Working capital is the cash that remains assuming that you deduct an organization's ongoing liabilities from its ongoing resources. All else being equivalent, the seriously working capital an organization has close by, the less monetary strain it encounters. An organization that keeps a lot of working capital close by isn't utilizing its working capital proficiently. Realize what working capital is, how to compute it, and how to utilize it to decipher a stock backer's momentary liquidity.

Definition and Examples of Working Capital

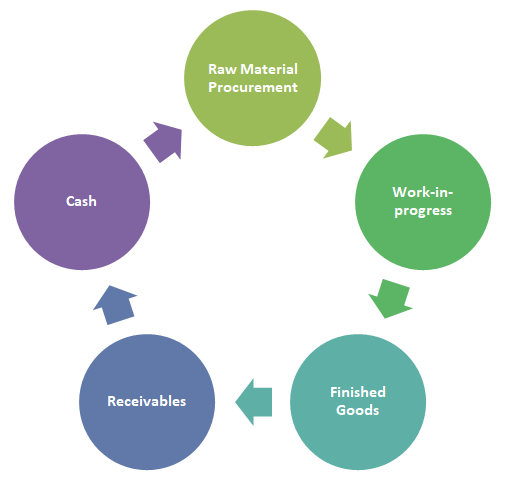

Working capital is the cash a business would have extra if it somehow managed to pay all its ongoing liabilities with its ongoing resources. Current liabilities are obligations that are expected in no less than one year or one working cycle. Current resources are resources that an organization intends to use over a similar period. Instances of current liabilities are creditor liabilities, momentary advances, finance charges payable, and annual duties payable. Any record that is payable in no less than a year or working cycle is an ongoing risk. Some ongoing resource models are cash, debit claims, ventures that can be sold, and stock. Comparative organizations in comparative enterprises don't necessarily represent both current resources and liabilities the equivalent inside or on their financial reports. While taking a gander at organization financials, becoming befuddled over resources and liabilities is simple. Search for "momentum" before the resource or obligation. Subsequently, working capital ought to be taken about the organization's business and monetary design. Comparable organizations might have various measures of working capital yet perform well overall. It's likewise conceivable to have negative working capital and perform well in an organization's business and monetary design.How Do You Calculate Working Capital?

Organizations account for records and total their financial information on economic reports. To find the data you want to compute working capital, you'll require the organization's accounting report. Current resources and liabilities are both regular financial record passages, so you probably won't have to do some other ascertaining or expecting. Working capital is direct. The equation is:Step by step instructions to Interpret Working Capital

An organization in great monetary shape ought to have adequate working capital to pay its bills for one year. You can determine whether an organization has the assets essential to extend inside or, on the other hand, on the off chance that it should go to a bank or financial backers to raise different assets by concentrating on its working capital. One of the principal benefits of taking a gander at an organization's functioning capital position is the capacity to predict any monetary troubles. Indeed, even a business with billions of dollars in fixed resources will rapidly wind up in liquidation court on the off chance that it can't cover its bills when they come due. Under the best conditions, lacking working capital levels can prompt monetary tensions in an organization, which will expand its getting and the number of late installments made to banks and sellers. This can prompt a lower corporate credit score and less financial backer interest. A lower FICO score implies banks and the security market will request higher loan fees, diminishing income as the expense of capital ascents.Negative Working Capital

Negative working capital on a financial record typically implies that an organization isn't adequately fluid enough to cover its bills for the following year and support development. Nonetheless, organizations that partake in a high stock turnover and carry on with work on a money premise require next to no functioning capital. Negative working capital can be beneficial for organizations with high stock turnover. Instances of these sorts of organizations are supermarkets and rebate retailers. As a rule, they fund-raise each time they open their entryways by selling stock. Then, they utilize that cash to buy more products. Since cash produces so rapidly, the executives can store the returns from their daily deals for a brief period. This makes it pointless to keep a lot of networking capital close by to manage a monetary emergency.Limits of Using Working Capital

While an excellent device for deciding how much wriggle room an organization has monetarily; working capital has restrictions. For example, a large equipment maker is a capital-serious firm and a phenomenal model. These organizations work in costly things that consume most of the day to gather and sell, so they can't raise cash rapidly from stock. They have many fixed resources that can't be sold and costly hardware that takes care of a particular market. Huge makers that have been in working for quite a while, by and large, have more working capital than more youthful ones. These organizations could experience issues keeping sufficient working capital available to traverse any unexpected issues. The stock on the financial record for this kind of organization is usually requested a long time ahead of time — it can seldom be bought and used to make hardware quickly enough to raise capital for a transient monetary emergency. It likely could be past the point of no return when sold. Similarly, as with all monetary examination proportions and equations, you ought to utilize them to fabricate a comprehensive image of the worth of speculation. One organization's functioning capital will be unique from another comparative organization, so looking at them may not be great for utilizing the idea. Industry midpoints are likewise great to utilize, yet they are not generally a solid sign of the financial capacities of a business. You ought to utilize the data acquired to assess an organization contrasted with your effective money management methodology and objectives.Key Takeaways

- Working capital is how much cash an organization has leftover after deducting current liabilities from current resources.

- Working capital tells you if an organization can pay its transient obligations and have cash for tasks and development.

- Working capital ought to be utilized related to other monetary investigation equations, not without help from anyone else.