Overdraft protection is a loan that is linked to your bank account. If you run out of cash and your bank has authorized you for this sort of add-on, the line of credit can cover your costs, so you don't bounce checks, skip payments, or have your debit card banned. Some banks also enable you to use your credit line as an emergency fund. Any money you use is issued by your bank as a conventional loan, so you will pay interest on the amount borrowed. Overdraft lines of credit, on the other hand, are frequently less expensive than regular overdraft protection products, which can charge up to $35 for each rejected transaction that hits your account. Nonetheless, some banks levy a fee for each transfer from your checking line of credit or for each day that a transfer from your line of credit is made to your checking account. Understanding how a checking line of credit works and your options helps you to pay unexpected costs while avoiding the fees associated with a traditional overdraft protection program.

How a Checking Line of Credit Works

Assume you have no money in your bank account and numerous tiny charges of $5, $6, and $7 arrive. You're currently out of money by a total of $18. Assume your bank charges three $35 overdraft coverage costs, one for each item. That works up to $105 in fees to pay $18 in costs. Instead, with a checking line of credit, you would borrow the $18 from the overdraft line of credit. The bank would charge you interest on the loan at a rate equivalent to credit cards, as well as a transfer fee, maybe as much as $5 per item covered. If you repay the loan within a few weeks of receiving your salary, the interest rates may range from less than $1 to a few dollars. Thus, instead of $105 in fees and interest for paying the overdraft line of credit expenditure, you'll spend no more than $20 in fees and interest—a significant difference of $85. This benefit increases if you do this several times a year while tracking your transaction activity and cash in and cash out timing. An overdraft line of credit differs from and is often less expensive than a traditional overdraft protection package.Penalties Without a Checking Line of Credit

It's usually a good idea to retain some cash in your checking account, but sitting on your cash has a cost if you might be investing and increasing it instead. You may avoid this by limiting the quantity of cash in your account. However, if blunders or unexpected expenses catch you off guard and you don't have a significant financial cushion on hand, an overdraft line of credit might serve as a backup plan. Assume your bank account runs out of funds and you do not have a line of credit tied to it. In such instances, the penalties will be determined by the sorts of changes that impact your account, as well as if you have alternative overdraft protection set up for your account, such as normal overdraft protection.- One-time debit card transactions: If you use your debit card for everyday purchases or ATM withdrawals, your bank may simply refuse the transaction if your account does not have enough cash to cover it and you have not opted into any type of overdraft protection, such as an overdraft line of credit. In such a situation, your bank may not even charge you a non-sufficient funds (NSF) fee, as banks normally do not impose NSF costs for denied debt-based transactions. You have the option of using a different payment method or just canceling the transaction. You will, however, employ overdraft protection if you have signed up for it.

- Preauthorized payments: Even if your checking account is empty, your bank may still handle regular monthly invoices that arrive via ACH. Even if you did not specifically opt-in to overdraft protection, you would almost certainly be charged overdraft fees in those circumstances. If the ACH transaction is returned unpaid, you will be charged NSF costs of up to $35 per transaction.

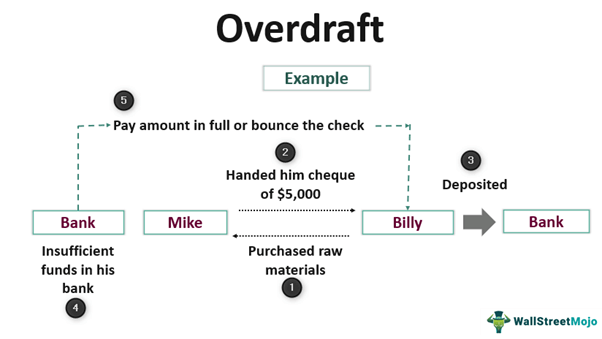

- Checks: If you write a check for more money than you have in your account, your bank may or may not allow it to be processed. Again, if you have regular overdraft protection, the check will be covered as long as the amount is within the restrictions. If not, your bank may pay the check and charge you overdraft fees, or it may allow the check to bounce, resulting in NSF fines and additional penalties and inconveniences.

Pitfalls of an Overdraft Line of Credit

A loan to your checking account is less expensive than traditional overdraft protection, and it allows you to continue spending in an emergency. However, relying too much on this type of overdraft protection is risky for several reasons:- Interest charges: Overdraft credit lines, while affordable, are not free. You must pay interest on the money you borrow. If you merely borrow for a day or two, the interest rate should be quite cheap.

- Transfer fees: You may also be charged a small fee each time you use the overdraft line of credit, so the more you use it, the more it will cost you.

- Annual fees: Some banks charge a small annual fee to keep the service active on your account. If you utilize your checking line of credit for several years, you will spend more on fees than you should.

- Limits: There are normally no precise limitations on how many times you may use an overdraft line of credit, but your bank may charge you penalties if you exceed the permitted credit limit and may even disconnect you if you use your overdraft line of credit too frequently. Furthermore, the line of credit normally has a monetary restriction to protect you from borrowing too much. 6 Depending on your history and possible need, you may get a $500 or $1,000 overdraft line of credit; however, some banks provide lines with credit limits of up to $10,000. However, if your permitted line of credit is inadequate to fund a transaction, it may fail.

- Encourages overspending: A checking line of credit linked to your checking account is similar to having a credit card in that it might encourage you to spend money that you don't necessarily have in your checking account. If you rely too much on it, you may end yourself with an overdraft debt and interest costs that you cannot afford to repay.