When you have many credit cards, it is more beneficial to pay off one at a time rather than spreading your payments over all of your credit cards. When you pay a flat sum to one credit card each month, you'll make greater progress.

Even if you are concentrating your efforts on paying off one credit card, you should continue to make minimum payments on all of your other credit cards in order to avoid late payment penalties and maintain your accounts in good standing. The difficult aspect is determining which credit card should be paid off first.

The Two Basic Ways to Pay Off Credit Cards

There are two fundamental methods for paying off credit cards: first, pay off the credit card with the highest interest rate first, or second, pay off the credit card with the lowest balance first. To determine which technique is best for you, consider if you want to save money on interest or fast pay off complete credit card bills.

Save Money on Interest

If you choose to save money on interest, pay off your credit cards in the order of the highest interest rate balance. Paying down the highest interest rate bill first may take less time and save you money on finance costs, especially if your other credit cards have greater balances.

Make a list of all of your credit cards and sort them by interest rate, from highest to lowest. Then, make significant monthly lump sum payments to the credit card with the highest interest rate first. After you have paid off the card with the highest interest rate, proceed to the card with the next highest interest rate. Repeat this step until all of the credit cards have been used.

To save even more money on interest, apply for a credit card with a 0% APR balance transfer offer for new cardholders. If you want to get started, check out our top selections for balance transfer cards.

Check with your present credit card providers as well, since one of them may offer a 0% or near-0% debt transfer from another credit card. If the card has a zero amount, you can transfer the high-interest credit card debt to the current card without opening new credit. If you haven't paid off the current card yet, you can do so first and then transfer the second high-interest debt to the existing card at the 0% rate.

Pay Off an Account Faster

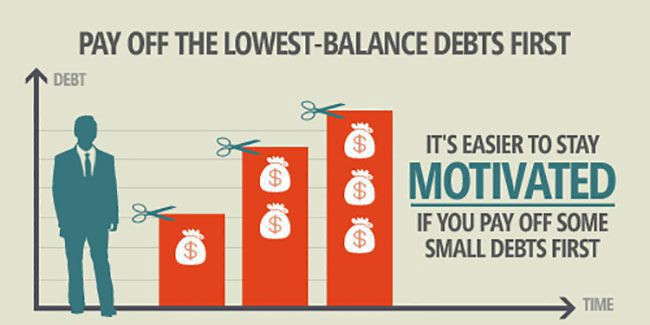

If you want to pay off your credit cards as soon as possible, start with the one with the lowest balance. When you pay off lower bills initially, you feel like you're making more progress since you're not accumulating a large credit card load. This progress might keep you motivated to continue paying off your debts. If you have a $500 credit card bill and $500 extra in a paycheck, bonus, or tax refund, you might pay off an entire credit card and have one less account to fret about.

Exceptions to the Rule

There may be certain exclusions depending on your credit card. For example, if you choose not to have your interest rate raised and shut or cancel your credit card account, you may be compelled to pay off the debt within five years. All else being equal, paying down the sum will keep your credit score from suffering. Pay off any amounts with deferred interest to avoid getting slapped with full interest charges at the conclusion of the promotional period.

Keep in mind that interest rates might fluctuate, especially if you have a variable APR or are subject to the penalty APR.

Is One Method Quicker?

When it comes to the period of time necessary to pay off your credit card bills, there isn't much of a difference between the two approaches. Paying in order of interest rate allows you to pay off your accounts a few months sooner than paying in order of balance, and you'll pay less in interest.

You are not required to use one of those two techniques. You may pay off your credit cards in whatever sequence pleases you. You can alphabetize them by credit card provider or pay off the sums on cards you no longer use. The ultimate aim is to pay off your credit card debt by making a monthly lump-sum payment to one credit card until that balance is paid off.

Frequently Asked Questions (FAQs)

Which of my credit cards should I pay off first in order to raise my credit score?

Your credit usage ratio, which compares how much credit you have to how much you use, has an influence on your credit score. If you have a credit card that is maxed out or above the limit and are concerned about your credit score, consider decreasing your balance on that card.

Is it possible that paying off a credit card can harm my credit score?

Paying down a credit card and canceling it may temporarily lower your credit score since terminating an account decreases the amount of credit you have been provided. Your credit score should improve if it is evident that you will not incur further debt.

When will I be able to pay off my credit cards?

The answer is determined by how much you owe and how much money you have available to pay them off. There are online calculators that may help you predict how long it will take, as well as beneficial tools for organizing your debts.