A nine-digit identifier called an ABA number, commonly called a bank routing number, is used to identify banks in the United States. Banks can transfer funds to and from your accounts using that number for operations like wire transfers, direct deposits, and automatic bill payments.

ABA Origins

The American Bankers Association (ABA) developed ABA numbers in 1910 as a mechanism to provide each payment-issuing bank with a special identification number. Doing this made it simpler to process paper checks, which were widely used at the time as a payment method. The Federal Reserve's payment procedures have been included in ABA numbers throughout time to support current electronic payments.

How To Find and Use ABA Numbers

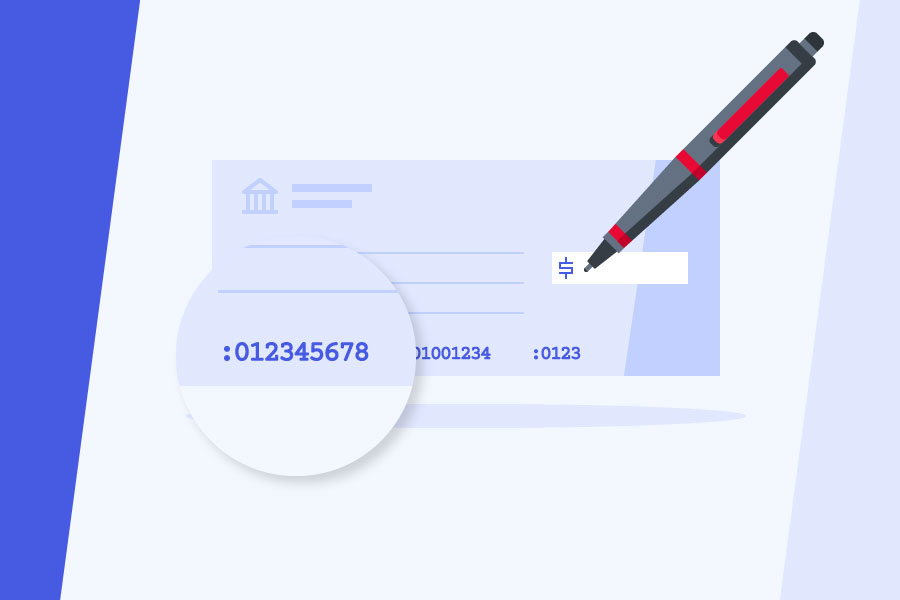

There are various places where you can find your account's ABA number. If you have a checkbook on hand, the simplest solution is to find the numbers at the bottom of one of your checks.

On Paper Checks

Every check has an ABA number printed on it. It is often the nine-digit number in the lower left-hand corner of personal checks. On computer-generated checks, the number can appear somewhere else (like online bill payment checks or business checks). Your ABA number is often located in the same spot on deposit slips as well.

Contact Your Bank

Although you might need to enter into your account to find the correct number, some banks offer this information online. Find direct deposit forms and information on the Automated Clearing House (ACH) on your bank's website. You could also inquire by calling customer care.

Use the Correct Number

Finding the ABA number that corresponds to your account is crucial because your bank may operate under multiple ABA numbers. Depending on where you created your account, your ABA number may differ, and bank mergers may provide various codes for the same bank. In addition, some financial institutions use different ABA numbers for ACH and wire payments.

You might need to use a different number for wire transfers or electronic bill payments, even if you know the right one to order checks with. When in doubt, ask a member of your bank's customer support team which number to use.

How ABA Numbers Work

Most of the time, you have to tell whoever is asking for your ABA number and account number. The logistics are then handled by banks, billers, and your employer (or whoever else is setting up automated transfers).

You might get new ABA numbers if your bank fails or mergers, but you aren't required to use them immediately.

Before ordering new checks or registering for new services, inquire with your bank if you may keep using your old numbers. You may be able to use obsolete route numbers indefinitely in some circumstances.

A complex mechanism governs ABA numbers:

Behind the Name

Financial companies can locate your account using your ABA number, which functions as an address. ABA numbers may sometimes be referred to as routing transit numbers (RTNs) or check routing numbers.

Computer-Readable

In order to make it easier for specialized machinery to read the code, routing numbers are generally put on checks using magnetic ink. Printers typically utilize MICR typeface, which makes it simple for computers to visually distinguish the numbers whether magnetic ink is present or not. That comes in handy, for instance, when photographing a check and depositing it using a mobile device.

The Federal Reserve Routing Symbol is

the first four digits of the number. Depending on their sequence, the first two numbers have various meanings. The ABA describes each series on its website.

The ABA institution identifying digits are

the next four digits.

The first eight digits of this mathematical equation are complex.

The ninth digit provides a checksum or checks digit. The transaction is detected and sent back for manual processing if the final result does not match the checksum number.

The ABA's Role in Check Processing

The ABA number has been crucial to considerably accelerate check processing since the 1960s. Additionally, checks that had to be delivered by truck and airplane to banks could now be lodged and cleared electronically thanks to the Check 21 Act, passed in 2003. As a result, money moves through the system faster, and customers can no longer "play the float" by writing checks a few days before the money shows up in their account.

Frequently Asked Questions (FAQs)

How do you distinguish between an account number and a routing number?

The account number is normally written after the routing number, which is often the first number on the bottom left of your check. Your account number might range in length from 10 to 12 digits, whereas the routing number is always nine digits long.

What distinguishes an ABA number from an IBAN number?

In most of Europe, international bank routing is done using IBAN or international bank account numbers. ABA numbers cover only the United States. IBAN numbers are not used in international banking in the United States. The United States employs SWIFT codes for international transfers.