The majority of people have the goal of keeping their credit card costs at $0, and this particularly holds for the ones who use rewards credit cards and want to make the most of their credit card privileges. To get a head start on lowering the costs associated with credit cards, consider getting one that does not charge an annual fee. If you continue to carry debt, you will still be subject to additional expenses in interest charges. The most effective strategy to prevent paying the interest and keeping your credit card balance free is to become familiar with the process and the timing of when interest is charged on credit cards.

If you still have a balance past the grace period ending, the issuer of your credit card will charge you interest. The interest you have to pay on your credit card is not something you pay only once.

If a promotional rate of 0% is applied to your balance, you will not be subject to any interest charges.

When are you being charged the interest on a credit card?

The bank will subject you to interest charges if you do not pay the total balance owed from the prior billing cycle. If you do not pay the balance in full by the due date, an interest charge will be added to the remaining balance on your credit card statement.

If you pay off your balance completely every month, you won't have to pay interest, and you'll get a grace period during which you can send in your payment. However, even if you have paid all your bills in the preceding months, some transactions do not provide you with an automatic grace period.

When are you not being charged the interest on a credit card?

If you began with zero balance in the billing cycle or paid the balance on your most recent statement in full, you will not be subject to interest charges on any of your purchases made during that period. There will be no need to stress about paying interest either on balances that have zero percent promotional APR.

After getting a brand new credit card, the first billing statement will not have a financing charge. Any month in which you start the billing cycle at a balance of zero dollars is a good month. The grace period begins on the day that the billing cycle comes to an end.

How much are you supposed to pay for the interest on a credit card?

The amount of interest that you have to pay on your credit card every month may change depending on the balance of the credit card along with any adjustments that are made to your interest rate.

Credit card statements will provide more information regarding how your costs are determined.

Frequently Asked Questions (FAQs)

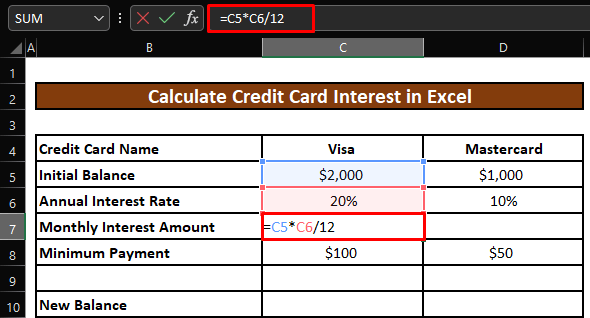

Computing credit card interest –– how does one do it?

To get the amount of interest you will be charged, multiply the remaining balance on your account by the interest rate on your credit card. Keep in mind that you must put in the interest rate only to the balance shown on the statement. To convert the interest rate to a numerical value, you must shift the decimal point left by two spaces.

What kind of interest rate would you recommend for credit cards?

Typical interest rate on credit cards is approximately 20 percent. Credit cards issued to businesses and students usually have lower interest rates, although the rates on shop credit cards are frequently higher than the average rate.

What steps can you take to bring down the interest rate on your credit card?

You could request your credit card business to lower your interest rate. However, whether or not the firm complies with your request is completely up to them. You should send these inquiries to a representative of the customer service department.