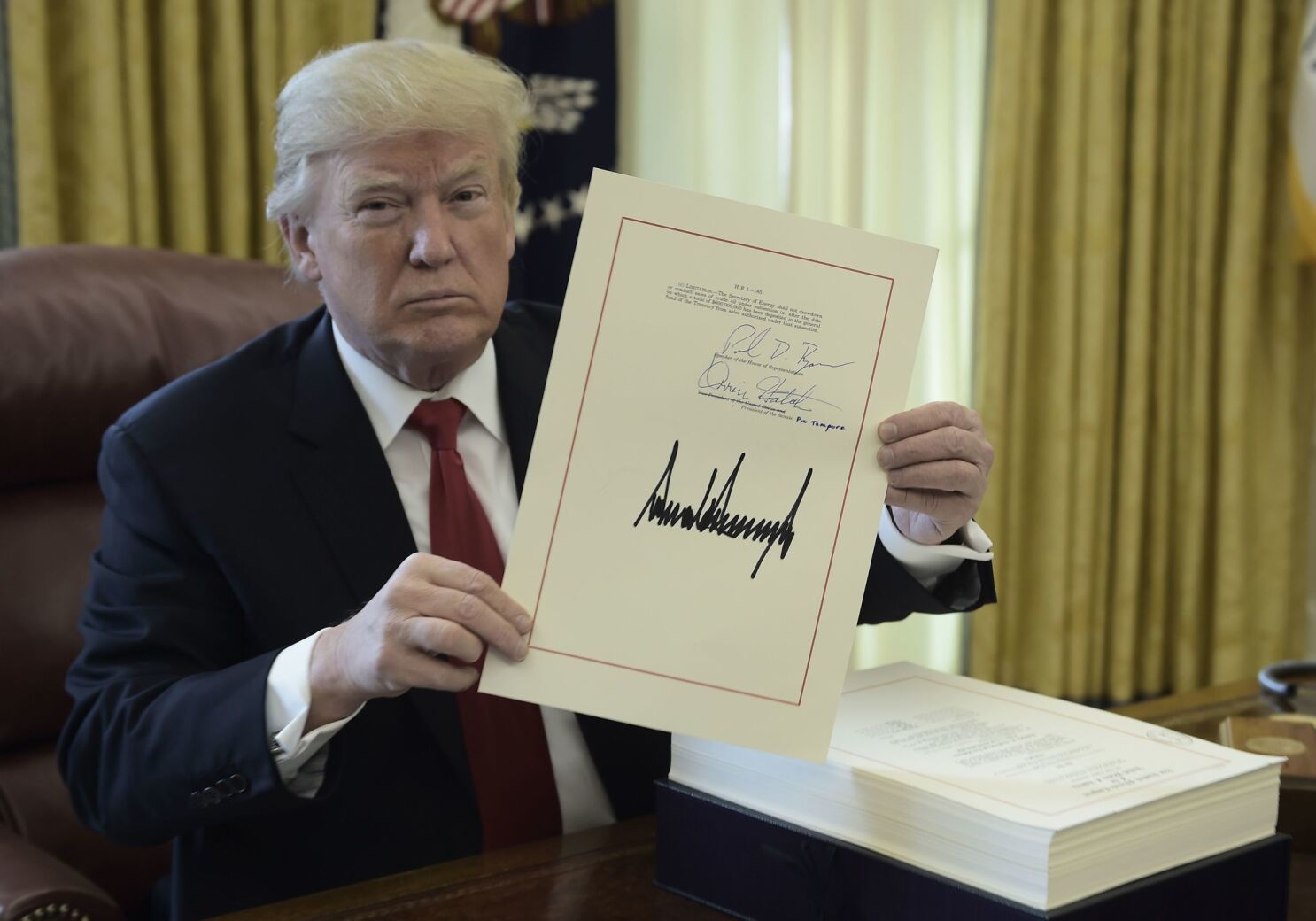

President Donald Trump marked the Tax Cuts and Jobs Act (TCJA) on Dec. 22, 2017. It quit raising individual annual duty rates, multiplied the standard allowance, and killed individual exceptions from the expense code. The top individual duty rate dropped from 39.6% to 37%, and various organized derivations were disposed of or impacted as well.12 The TCJA additionally quit raising the corporate government expenditure rate from 35% to 21% viable in 2018. The corporate cuts are highly durable. The only changes lapse toward the finish of 2025 except if Congress acts to recharge some or each of the arrangements of the TCJA.

Key Takeaways

- Business tax reductions are long-lasting, while the precise cuts terminate in 2025.

- Individual expense rates were brought down, the standard allowance raised, and individual exceptions killed.

- Many organized derivations were eliminated.

- The most extreme corporate duty rate was brought from 35% down to 21%.

- Passthrough organizations got a 20% derivation on qualified pay.

- The arrangement urged enterprises to localize unfamiliar profit.

- The demonstration will cost $1-$2 trillion over the 10 years it's active.

What It Means for You

The TCJA is mind-boggling, and its different terms influence every family diversely, relying upon their circumstances:Top-level salary Earners

When the TCJA was proposed, the free duty strategy philanthropic Tax Foundation found that the people who procure over 95% of the populace would partake in a 2.2% increment in after-charge pay. Those in the 20% to 80% territory would get a 1.7% increase.4 The Tax Foundation expressed that those in the base 20% would get a 0.8% increase.Those With Valuable Estates

A more considerable exclusion for the domain duty will help you assume that you leave a bequest worth very much cash. The TCJA multiplied the home assessment exclusion from $5.6 million in 2017 to $11.2 million in 2018. For the charge year 2021, the exception is $11.7 million, and for 2022 it is $12.06 million.Citizens Who Claim the Standard Deduction

You'll win on two levels on the off chance that you guarantee the expanded standard derivation since it's presently greater than your old organized allowances were. To start with, it will lessen your available pay more than in previous years. Second, you can skirt the confounded course of organizing your allowances. That saves you time; however, it will likewise set aside your cash if you never again need to pay an expense counsel.Enormous Families

You may be wounded by the end of individual exclusions under the particulars of the TCJA. The expanded tax reductions for kids and grown-up wards and the multiplied standard allowances probably won't be sufficient to counterbalance this misfortune for families with different children.The Self-Employed

You could have profited from the 20% qualified business pay derivation assuming that you're a self-employed entity, own your own business, or are self-employed.Individual Income Tax Rates

The TCJA brought down charge rates, yet it kept seven personal duty sections. The sections relate with other great ranges of pay under the TCJA, be that as it may than under past regulation. Each section obliges more pay. The most special assessment section begins at available pay more prominent than $523,600 for single filers and $6128,300 for wedded couples recording mutually in the charge year 2021, and $539,900 and $647,850 for 2022. These citizens depend on a 37% salary rate over these limits after exclusions and deductions.89 2017 Income Tax Rate (Pre-TCJA) 2022 Income Tax Rate 2022 Income for Those Filing As Single 2022 Income for Those Filing Jointly 10% 10% $0-$10,275 $0-$20,550 15% 12% $10,276-$41,775 $20,551-$83,550 25% 22% $41,776-$89,075 $83,551-$178,150 28% 24% $89,076-$170,050 $178,151-$340,100 33% 32% $170,051-$215,950 $340,101-$431,900 33%/35% 35% $215,951-$539,990 $431,901-$647,850 39.6% 37% More than $539,990 More than $647,850 These pay levels are changed every year to stay up with the expansion.The Standard Deduction versus Organized Deductions

A solitary filer's standard derivation expanded from $6,350 in 2017 to $12,550 in 2021 and $12,950 in 2022. The allowance for wedded joint filers increments from $12,700 in 2017 to $25,100 in 2021 and $25,900 in 2022.8109 The Tax Foundation assessed in September 2019 that just around 13.7% of citizens would organize on their 2018 returns because of these changes. That is not precisely 50% of the 31.1% who might have organized before the TCJA. That would save them time in setting up their expenses. Likewise, it could hurt the expense planning industry and reduce altruistic commitments and organized deductions. Individual Exemptions Before the TCJA, citizens could take away $4,050 from their available wages each for them and their dependents.12 That works out to $20,250 for a wedded couple with three kids. Joined with the standard allowance for wedded citizens recording joint returns ($12,700 around then) and the complete derivation would be $32,950. Presently quick forward to a post-TCJA world. There are not any more private exceptions, yet the TCJA accommodated a to some degree refundable credit of up to $2,000 per youngster so that that couple could guarantee $31,100 (the standard derivation in addition to as much as $6,000 for their kids) in 2022. That is $1,850 more pay that they'll be paying assessments on, expecting in the two situations that they're not guaranteeing some other duty derivations or credits.Less Itemized Deductions

The TCJA killed most various organized allowances. That incorporates charge planning charges, work costs, and venture expenses: The derivations for charge arrangement charges and most unreimbursed representative costs are gone under the TCJA.13 The TCJA restricted the derivation on contract interest to the first $750,000 of qualifying advances. Contract holders who took out their advance before Dec. 16, 2017, weren't impacted. Also, interest on home value advances or credit extensions can never again be deducted, except if the returns were utilized to purchase, construct, or considerably work on the home.1415 The state and nearby assessment (SALT) derivation stays set up; however, it's been covered at $10,000 for all filers except hitched documenting independently. Citizens can deduct local charges, and either state payor deals taxes.1617 The allowance limit for most magnanimous commitments improved. For the most part, you can now guarantee a derivation for up to 60% of your changed gross pay (AGI) instead of 50%.18 Allowances for setback misfortunes are, for the most part, restricted under the TCJA to those that happen in governmentally pronounced catastrophe areas. The edge for the clinical cost derivation dropped from 10% to 7.5% of AGI. This change was set to terminate toward the finish of 2019, yet the Further Consolidated Appropriations Act of 2020 restored it.2021 Another significant change is that the TCJA removed the Pease constraint on organized derivations. This expense arrangement recently expected that citizens needed to lessen their organized derivations by 3% for every dollar of available pay over specific limits, up to 80%. This is not true anymore while the TCJA is in effect.22Over the-Line Adjustments to Income

The over-the-line derivation for moving costs has been dispensed with, aside from deployment-ready individuals from the military. Those paying provisions can no more, as a rule, deduct it as an acclimation to pay. This change is successful for divorces allowed on or after Jan. 1, 2018. The TCJA saves the allowance for retirement investment funds. It likewise permits those age 70½ or more seasoned to move up to $100,000 every year to qualified causes from their singular retirement accounts.Changes to Tax Credits

The TCJA expanded the youngster tax reduction from $1,000 to $2,000. Indeed, even guardians who don't make it to the point of paying duties can guarantee a discount of the credit up to $1,400.26 The TCJA likewise presented a $500 credit for different wards, which helps families whose reliant youngsters do not meet the strict rules of kid wards since they've matured out and families focusing on older parents. These tax breaks are accessible to citizens with altered AGIs of up to $200,000 for single filers and $400,000 for wedded citizens who record joint returns. They were gradually eliminated and killed at $75,000 and $110,000 separately before the TCJA.The Obamacare Tax

The TCJA canceled the Obamacare charge punishment that was charged to those without medical coverage, compelling 2019.29The Alternative Minimum Tax

The arrangement keeps the elective least assessment (AMT). The 2021 exception is $73,600 for single filers and $114,600for joint filers. The exceptions gradually transition away from $523,600 for singles and $1,047,200 for joints.Business Tax Rates

The duty plan brings down the most extreme corporate assessment rate from 35% to 21%, the least since 1939.Business Deductions

Go through organizations to get a 20% standard derivation on qualified pay. This derivation closes after 2025. Go through organizations include:- Sole ownerships

- Associations

- Restricted risk organizations

- S companies

- Certain trusts and assets

- The allowances transition away from administration experts once their pay comes to $157,500 for singles and $315,000 for joint filers.32