The regularly scheduled installment equations work out how much a credit installment will be and incorporate the credit's head and interest.

Definition and Examples of Monthly Loan Payments

When you get a credit from a moneylender, you get a sum called the head, and the bank attaches revenue. You repay the credit over a set number of months or years, and the premium brings in the aggregate sum of cash you owe bigger.

Your month-to-month credit installments will commonly be broken into equivalent installments over the advance term.

How you compute your installments relies upon the sort of credit. The following are three sorts of advances you'll run into the most, every one of which is determined unexpectedly:

Interest-just advances:

You pay down no vital in the early years — just interest.

Amortizing credits:

You're paying toward both head and interest over a set period. For example, a five-year vehicle credit could start with 75% of your regularly scheduled installments zeroed in on taking care of interest and 25% paying toward the principal sum.

The sum you pay on interest and chief changes over the advance term. However, your regularly scheduled installment sum does not.

Mastercard advances:

A charge card provides you with a credit extension that goes about as a reusable advance as long as you take care of it in time.

You'll probably be charged interest if you're late making regularly scheduled installments and conveying your equilibrium to the following month.

How Do You Calculate Monthly Loan Payments?

Since the installments on various kinds of credits center around various equilibriums, there are discrete ways of ascertaining your regularly scheduled installments. This is the way to work out the three kinds talked about beforehand.

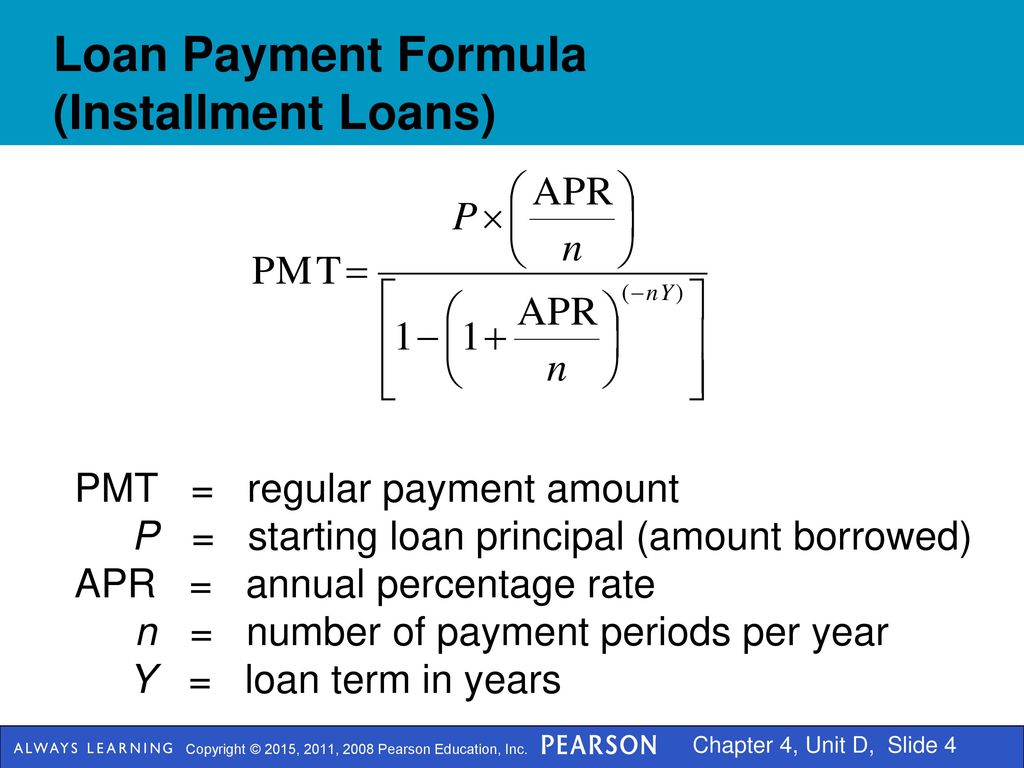

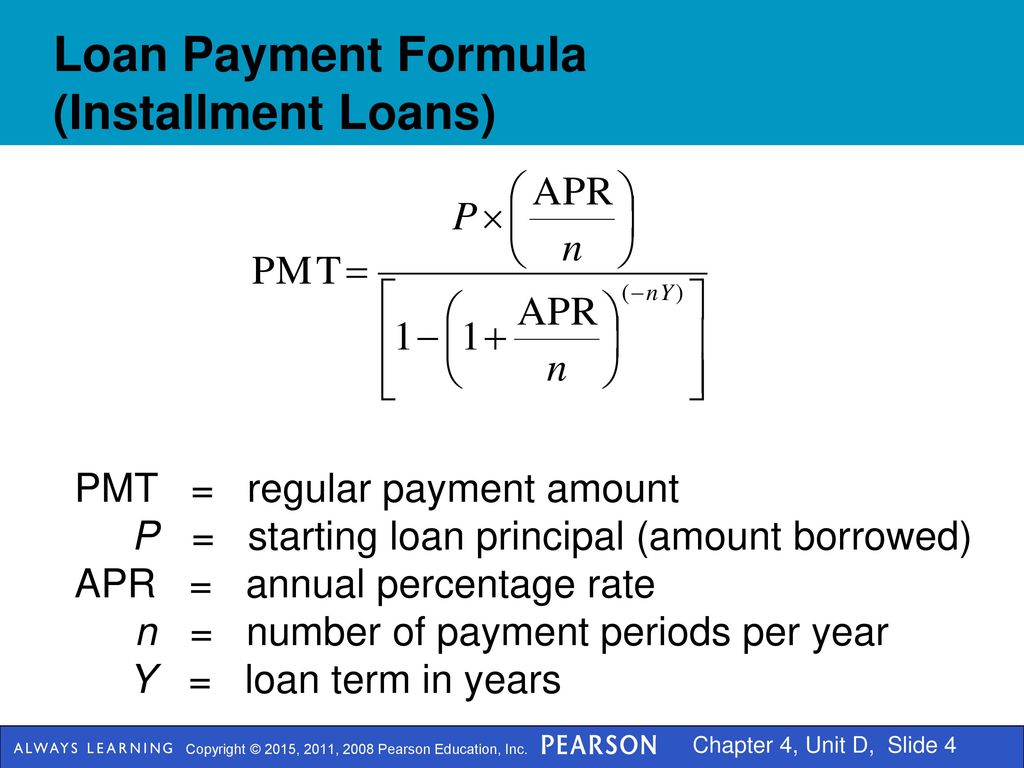

Amortized Loan Payment Formula

Compute your regularly scheduled installment (P) utilizing your chief equilibrium or all out credit sum (a), intermittent loan cost (r), which is your yearly rate separated by the number of installment periods, and your complete number of installment periods (n):

Interest-Only Loan Payment Formula

Ascertaining installments for an interest-just advance is simpler. In the first place, partition the yearly loan cost (r) by the number of installments each year (n), then, at that point, duplicate it by the sum you get (a):

Visa Payment Calculations

Mastercards likewise utilize genuinely basic math. However, deciding your equilibrium requires more exertion since it continually varies, and banks charge various rates.

They ordinarily utilize a recipe to compute your base regularly scheduled installment given your complete equilibrium. For instance, your card backer could expect that you pay somewhere around $25 or 1% of your unique equilibrium every month, whichever is greater.

The recipe you'd utilize would be:

How Do the Loan Payment Calculations Work?

To exhibit the distinction in regularly scheduled installments, here are a few working guides to assist you with a beginning.

Amortization Payments

Assume you were to get $100,000 at 6% for quite a long time, to be reimbursed month to month.

To ascertain the regularly scheduled installment, convert rates to a decimal organization, then follow the equation:

a: $100,000; how much the credit

r: 0.005 (6% yearly rate — communicated as 0.06 — partitioned by 12 regularly scheduled installments each year)

n: 360 (12 regularly scheduled installments each year times 30 years)

This is the way the number related works out:

100,000 ÷ { [ ( 1 + 0.005 ) 360 ] - 1 } ÷ [ 0.005 ( 1 + 0.005 ) 360 ] = 599.55

The regularly scheduled installment is $599.55. You can look at your math with a web-based credit mini-computer if you're uncertain.

Interest-Only Loan Payments

Utilizing the past credit illustration of $100,000 at 6%, your computation would seem to be this:

a: $100,000. How much the credit

r: 0.06 (6% communicated as 0.06)

n: 12 (given regularly scheduled installments)

Here is the math:

Utilizing the subsequent technique, it would seem to be this:

( 100,000 * 0.06 )/12 = 500

You can look at your math with an interest-just mini-computer if you don't know you got everything done as needs are.

Visa Payments

If you owe $7,000 on your Mastercard, and your base installment is determined as 1% of your equilibrium, this is the way it would look:

$7,000 * 0.01 = $70

This sum incorporates no late charges or different punishments you could owe. You can check your math with a charge card installment mini-computer if you're unsure.

Since your Mastercard charges interest month to month, your equilibrium changes consistently. That influences how much your base regularly scheduled installment will be.

The base regularly scheduled installment on a high equilibrium won't be sufficient to cover the gathered interest.

It's a great practice to pay more than the base due every month, except the base is the sum you should pay to avoid late charges and different punishments.

For instance, if the card in the past model with a $7,000 total has a 19.99% yearly rate (APR), you would work out your month to month premium charges utilizing this recipe, where (B) is month to month equilibrium and (I) is your new month to month balance:

This is the secret to your new Mastercard balance:

$7,000 ( 19.99% ÷ 12) = $,7000 ( .1999 ÷ 12) = $7,000 ( 0.0166 ) = $116.20

Then, add the interest to your equilibrium and ascertain your base installment:

$7,116.20 * .01 = $71.16

As may be obvious, the interest charges surpass the base regularly scheduled installment, so the equilibrium would keep on developing regardless of whether you make the base installment each month.

How It Affects Consumers

Computing your regularly scheduled installments can assist you with sorting out whether you can stand to utilize an advance or charge card to fund a buy.

It assists with requiring the investment to consider how the advance installments and premiums are put on your month-to-month tabs.

When you compute your installments, add them to your month-to-month costs and see whether it lessens your capacity to pay actual and everyday costs.

If you want the credit to fund an essential thing, focus on your obligations to attempt to pay the ones that cost you the most as soon as expected.

However long there's no prepayment punishment, you can set aside cash by paying extra every month or making enormous singular amount payments.

It assists with conversing with your loan specialist before you start making extra or singular amount installments.

Various loan specialists could increment or diminish your regularly scheduled installments, assuming you change your installment sum. Realizing ahead of time can save you a few cerebral pains not too far off.

Key Takeaways

You can sort out whether you can sensibly stand to acquire cash by utilizing advance installment computations.

Factors, such as your payment and month-to-month costs, will help you conclude whether taking credit is smart.

With interest-just credits and amortizing advances, you can address what your regularly scheduled installments would resemble.

Taking care of your credit as fast as conceivable can limit how much

the premium you'll pay on the acquired cash.

Frequently Asked Questions (FAQs)

What are semi-regularly scheduled installments?

Semi-regularly scheduled installments are those that happen two times every month.

How would you make regularly scheduled installments on Amazon?

Assuming that a thing is qualified for regularly scheduled installments on Amazon, you have to choose regularly scheduled installments at checkout. The installments will be consequently deducted from your record's essential charge card.

How would you make regularly scheduled installments to the IRS?

If you don't think you'll have the option to document your charges and pay your equilibrium on time, you can demand an installment plan with the Internal Revenue Service on the web.