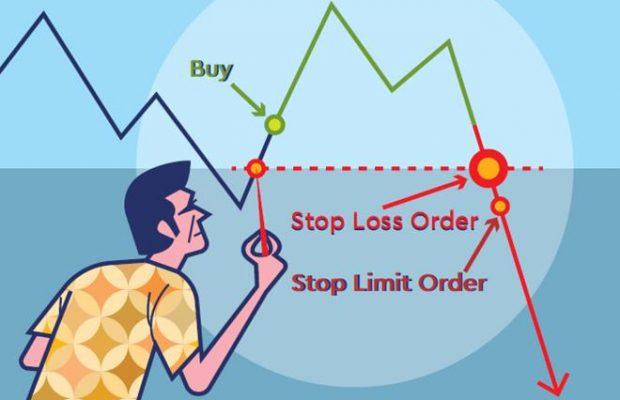

A stop market order is a buy or sells order placed when the market price of a stock, asset, or commodity reaches a certain level. It is a stop-loss order that limits the amount of money you can lose on a single trade. A stop market order is a standing order to sell a security or commodity if the price falls below a specific threshold. Its purpose is to shield you from loss if the market moves too far in the wrong direction. These can be bought or sell orders, but no trade occurs unless the price meets the trigger. The stop order is converted into a market order when the price is met. Alternate names: stop-market order, stop order, stop-loss order, a stop-loss market order. Successful trading is all about keeping a healthy risk/reward ratio or reducing losses while increasing gains. Every expert trader has a price in mind for when a trade has gone too far south, and they need to exit. Stop-market orders make that threshold official and automatic. This relieves you of the need to constantly monitor the market to limit your losses. A sell-stop order is set below the current market level to prevent a large loss on a sale, and a buy-stop order is placed above the current market level to purchase stock before it becomes too expensive. Stop-loss market orders have the same underlying order type as stop-market orders. If the market price hits the specified stop-order price, the order becomes "active" and executes like a market order. If the price hits the required level, market orders are always filled. A market order will always get a trader out of a losing transaction because the order will not execute until that point is achieved. On the other hand, market orders are filled at best available current price. The stop-loss could be filled at any price, not only the one you specify. In a fast-moving market, a stop-loss market order may fill or execute at a significantly lower price than you expect.

How a Stop-Market Order Works

Let's say you buy a stock at $30 and sell it at $29.90 using a stop-market order. All of the purchasers place their offers in the $30 range. No one is eager to buy, except at $29.60, where someone has placed an order. Major news about the stock is eventually released. Your stop-loss market order will be filled at $29.60 because that is the nearest buyer. When the price falls below $29.90, your stop-loss market order will look for someone ready to buy at that price or below. In this situation, you only expected to lose 10 cents per share, but you lost 40 cents. This is referred to as "slippage." With any form of market order, this is a common problem. If you avoid day trading volatile assets or those with low volume, slippage is less likely to occur. It's also a good idea to avoid holding positions during essential news releases affecting the asset you're trading, as these occurrences can generate severe slippage. Even though slippage can result in larger losses than anticipated, the market order nevertheless takes you out of your position and protects you from future losses. Slippage isn't something that happens all of the time. A stop-loss market order will, in most cases, get the trader out at the expected price.Stop-Market Orders vs. Stop Limit Orders

| Stop-Market Order | Stop-Limit Order |

| Only executes if the market reaches the stop price or worse | Only executes when the market reaches the stop price while remaining above the limit price. |

| Will always execute if the market hits that price or worse | Will not execute if either condition is not met |

| Good for stopping further losses on a trade | May not prevent major losses on a trade |

| Losses can be larger than you expect | If you expect the price to rise again, this is a good approach, but it's also risky. |

Do I Need a Stop-Market Order?

Stop-loss orders should, in general, be market orders. A stop-loss order's sole purpose is to exit a trade. The only form of order that will always make this happen is a stop-market order. 4 Slippage causes minimal additional losses compared to the possible loss resulting from an unfilled stop-limit order. Trading high-volume assets and not holding positions during important news events can help you avoid slippage. On the other hand, stop-limit orders can be helpful if you have patience and believe that a stock's price will rise again. Some traders would prefer to wait it out than accept a huge price reduction while prices change swiftly. This can be a good tactic if you're willing to take risks.Key Takeaways

- A stop-market order, often known as a "stop order," is a sort of stop-loss order used to limit a trader's losses.

- When the stop price is met, stop-market orders become market orders, and they will execute at whatever the current market price is.

- Although these orders will always get you out of a bad trade, your losses may be greater than anticipated.

- The stop-limit order is a more complex and hazardous type of stop-loss order that can restrict losses if the market price recovers.