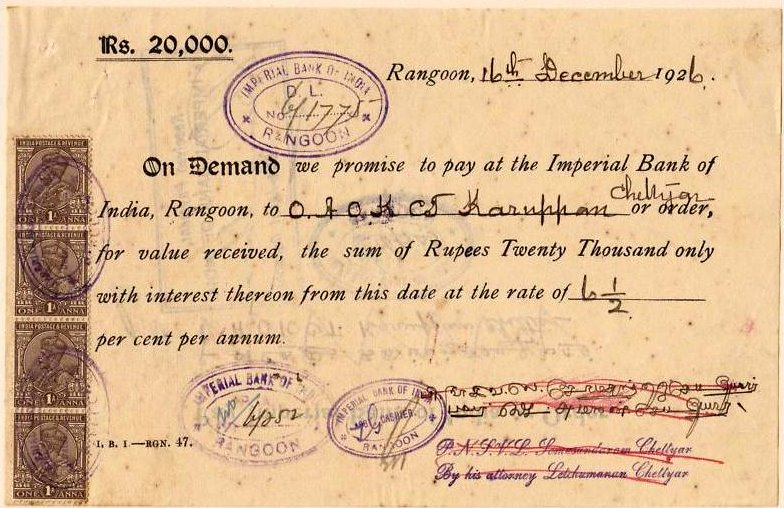

Definition and Example of a Promissory Note

A promissory record distinguishes the conditions of a credit understanding, the bank, and the borrower. It refers to how much cash is being acquired and the recurrence and measure of required installments. A promissory note should likewise demonstrate the financing cost being charged and the security if any. It ought to incorporate the date and spot where the note was given. It ought to likewise incorporate the mark of the borrower.

How a Promissory Note Works

A promissory note can be either gotten or unstable. An unstable promissory note relates to a credit founded exclusively on the creator's capacity to reimburse. A promissory note implies the credit is gotten by a thing of significant worth, like a house.

Promissory notes are enforceable authoritative reports. A borrower can be sued if they default on the understanding and the credit's terms.

Sorts of Promissory Notes

There are a few sorts of promissory notes. The distinctions depend on the sort of advance included and the data the note contains:

- Casual or individual: This significant kind could be starting with one companion or relative and then onto the next.

- Business: These notes are more formal. They explain the particular states of credit.

- Land: This promissory note goes with a home loan or other land buy game plan.

- Speculation: An organization can give a promissory note to raise capital. These notes can likewise be offered to different financial backers. Just sharp financial backers with the necessary assets should expect the dangers of purchasing these notes.1

Promissory notes can likewise shift contingent upon how the credit is to be reimbursed:

- Single amount: The whole credit sum must be reimbursed in one installment.

- Due on request: The borrower should reimburse the credit when the moneylender requests reimbursement.

- Portion: A predetermined timetable of installments decides how the credit is to be repaid.

- With (or without) premium: The arrangement should explain the pace of interest if any.

Promissory Notes versus Contracts

A credit and a promissory note are comparative. However, credit is significantly more definite. It portrays what will work out on the off chance that the borrower defaults on installments. The moneylender holds the promissory note while the advance is being reimbursed. Then the note is set apart as paid. It's gotten back to the borrower when the advance is fulfilled.

Promissory notes aren't equivalent to contracts, yet the two frequently remain inseparable when somebody is purchasing a home.

The promissory note records a guarantee to pay. The home loan, otherwise called a "trust deed" or "deed of trust," records what occurs if the borrower defaults. The moneylender would likely have the response of foreclosure.

The home loan protects the promissory note with the title to the house. It's likewise kept in the freely available reports. Promissory notes are by and large unrecorded.

Promissory Note

- Is a guarantee to pay

- Kept by the bank until the credit is paid off

- It is by and large not recorded

Mortgage or Loan

- Details a moneylender's response if the credit isn't paid, like dispossession

- Returned to the borrower when the advance is paid off

- It is kept in freely available reports

Prerequisites for Promissory Notes

Each state has its regulations in regards to the fundamental components of a promissory note, yet they frequently incorporate comparative components:

- The payor: This is the individual who vows to reimburse the obligation.

- The payee is the loan specialist, the individual or element that is loaning the cash.

- The date: This is the date the guarantee to reimburse is successful.

- The sum or head: This distinguishes the face measure of the cash acquired by the payor.

- The financing cost: The loan fee being charged is frequently expressed. It tends to be short interest or accumulated interest, or it could detail another computation of interest.

- The date the main installment is expected: The principal installment date may be the primary day of the month and each ensuing first day of the next month until the advance is paid off.

- The date the promissory note closes: This date could be the last installment of an amortized credit, a sort that is taken care of in a progression of even and equivalent installments on a specific date. Or, on the other hand, it very well may be an inflatable installment. This would make the neglected funds receivable on a particular date in one single amount.

Numerous promissory notes exclude a prepayment punishment, yet a few loan specialists need to be guaranteed a specific pace of return. This could be diminished or disposed of if the payor takes care of the promissory note before its development date so that a prepayment punishment may be incorporated. A typical punishment could rise to the amount of a half year's unmerited interest.

Promissory notes restrict archives, so there are ramifications for not following their terms. You could lose your home to dispossession, assuming that you neglect to reimburse a credit that the property gets. The loan specialist would reserve the option to indict you, send the obligation to an obligation assortment office, or answer to the credit organizations.

Could I, at any point, Write My Note?

Composing a limiting, enforceable promissory note can assist with staying away from conflicts, disarray, and even duty inconveniences while you're getting from a person. It may be a straightforward agreement between the borrower and the moneylender. Ponder employing a legal counselor to make one for you if you have any desire to be certain beyond a shadow of a doubt that all pieces of your promissory note are right.

Having an expert draw up your promissory understanding is particularly beneficial if a lot of cash is involved.

State usury regulations could influence a promissory note. They set the greatest pace of interest that can be charged. Banks should charge a financing cost that reflects honest assessment. Be certain you know about your state's regulations on the off chance that you will compose your note.

The IRS looks into advances also so that understanding assessment law can be useful. Premiums procured by a bank are viewed as available pay. The IRS can force its own pace of revenue on beneath market credits. It can compel the loan specialist to pay charges on that sum when no interest is being charged. A borrower could be burdened on the excused sum as pay if the bank pardons the credit and defers reimbursement.

A certified expense proficient can help if these duty suggestions appear too confounded to even think about taking care of them alone.

Key Takeaways

- A promissory note is a composed and marked vow to repay acquired cash.

- The record recognizes the conditions of credit. It names the gatherings to the advance, yet it doesn't detail what will work out assuming the borrower defaults.

- A promissory note can be either gotten or unstable, contingent upon the particulars of the credit.

- Promissory notes are restricting, authoritative archives, even though they're seldom kept in the freely available reports.