Annual vs. Annualized returns –– comparing the average returns of mutual funds

The answer to what constitutes a satisfactory annual return for a mutual fund will be contingent on several fundamental considerations. A respectable annual return for an equity mutual fund, for instance, is anticipated to be quite a bit higher than the return on a bond fund investment.

Key Takeaways

- When it comes to mutual funds, what constitutes a "good" yearly return relies on several criteria.

- You will have a better understanding of a fund's performance if you are familiar with the distinction of "annual return" from "annualized return."

- You also need to educate yourself on the difference between "return of investment" and "return on investment."

Annual return vs. annualized return

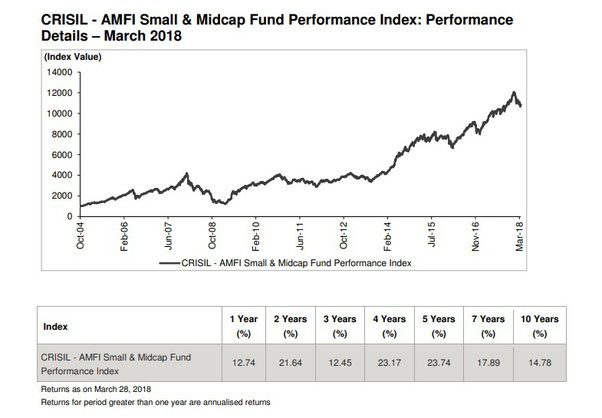

When researching the returns of mutual funds, it is essential to remember that there is a difference between the annual return and the annualized return. The loss or gain of an initial investment measured over the course of one year is the annual return. The annualized return is the same as the average rate of return calculated over more than one year.

How to calculate the annual return of mutual funds and their annualized returns

It is a good idea to know how to compute both the annual and annualized returns of a mutual fund to understand both measures better. It is essential to remember that the price is not used to determine the value of a mutual fund.

The total value of a mutual fund's holdings, less the value of the fund's obligations, is referred to as the fund's net asset value (NAV). At the close of trade each day, it is determined by the market price for each security held by the fund after the trading day.

Calculating mutual fund annual returns –– how to do it

To calculate the annual return of a mutual fund by the calendar year, you must first determine change over the year in the fund's NAV. Take the NAV on January 1 and subtract it from the NAV on December 31 of the same year. This gives you the beginning NAV. After that, you take the difference in NAV and divide it by the NAV at the beginning. One can find the annual return by using this calculation, which looks like this:

(ending NAV - beginning NAV) / beginning NAV = annual return

For instance, if the NAV you had on January 1 of a given year was 100 and the NAV you had on December 31 of that year was 110, your annual return would be 10%, and the computation would be as follows:

110 - 100 = 10

10/100 = 0.10 or 10%

Calculating mutual fund annualized returns –– how to do it

To calculate the annualized return of a mutual fund, you must first combine the returns for each year that falls within a particular time period, and then divide the total return by the number of years. This will give you an annualized return.

For instance, imagine a scenario in which you are computing the annualized return of your mutual fund over a period of three years. The annual returns over the time period ranged from 6 percent in the first year, 8 percent in the second year, and 10 percent in the third year. In this scenario, the annualized return on your investment over the past three years would be 8%. The calculation for it would look something like this:

(6 + 8 + 10) / 3

36 / 3 = 8

Return on investment vs. return of investment –– what is the difference between the two?

The difference between the return of the investment and the return on the investment is another critical distinction when examining the performance of mutual fund returns and other investment securities. The actual return that an investor realizes on their investment is referred to as return on investment (ROI). The return on investment refers to the amount of money first put in.

Making regular investments, such as buying mutual funds every month, is known as a systematic investment plan (SIP). This is utilized by a significant number of investors. This investing, also known as dollar-cost averaging (DCA), will typically result in a return on investment (ROI) distinct from the annual return advertised for the mutual fund.

Mutual funds –– what is a decent average annual return?

The sort of mutual fund you invest in and the period of time over which you look at its historical performance are the critical determinants of the mutual fund's average yearly return. When doing research on mutual funds, it is good to look at long-term returns to gain an expectation of how the funds will perform in the future.

One of the factors determining a fund's long-term success is whether or not it can outperform a benchmark index.

Frequently Asked Questions (FAQs)

What are the steps involved in mutual fund investment?

To purchase shares in a mutual fund, you will need a specific financial account, a brokerage account or a retirement account. Although starting one of these accounts is similar to opening a conventional checking or savings account, there are some key differences. When you have finished opening the account, all that is left is to put in a mutual fund buy order.

How are taxes applied to mutual funds?

The two types are capital gains taxes, which are levied when fund shares are sold, and dividend distribution taxes. The sale of equities from the fund's portfolio may result in capital gains for the fund. However, the taxes associated with these gains will be deducted from your dividends, so you won't need to take any further measures to determine how much this will have on your overall tax burden.

How exactly do mutual funds generate revenue?

Annual management fees are charged to shareholders of mutual funds to cover the expeditures of running the funds. You may find out how much an investment in a mutual fund will cost you. This ratio will tell you what percentage of each dollar you invest toward paying the fund managers.