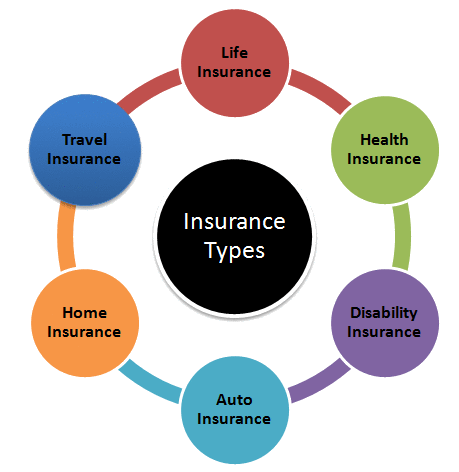

Insurance provides protection against the unexpected. Almost anything may be covered by a policy, although some are more significant than others. It all depends on your requirements. These four forms of insurance should be on your radar as you plan your future.

1. Auto Insurance

If you drive, you must have auto insurance. It is not only compulsory in most jurisdictions, but it is also costly to compensate for damages caused by automobile accidents. According to 2019 data, an automobile accident can cost more than $12,000 even if no one is injured; it can cost more than $1.7 million if the event is deadly. Medical bills, car damage, pay and productivity losses, and other factors all contribute to these costs. Most states require that you have basic auto liability insurance to cover legal fees, injury or death, and property damage to others when you are legally responsible. Some states also require you to carry personal injury protection (PIP) and/or uninsured motorist coverage. These coverages pay for medical expenses related to the incident for you and your passengers, no matter who is at fault. This also helps cover hit-and-run accidents and collisions with drivers who don’t have insurance. Suppose you’re buying a car with a loan. In that scenario, you may need to supplement your policy with comprehensive collision coverage to cover damage to your vehicle caused by automobile accidents, theft, vandalism, and other risks. They're especially important if fixing or replacing your automobile will put you in a financial bind.2. Home Insurance

For many people, their most valuable possession is their house. Home insurance protects you by providing a financial safety net in the event of loss. If you have a mortgage, your lender will most likely demand a policy, but if you don't buy one, your lender can buy one for you and bill you. It may be more expensive and provide less coverage. Home insurance is a good investment even after you've paid off your mortgage since it protects you from property damage costs. It also protects you against liability for injuries and property damage caused by you, your family, or your pets to guests. It may also cover you if your house becomes uninhabitable as a result of a covered claim, and it may pay to repair or replace detached buildings destroyed by a covered claim, such as your fence or shed. If you rent your house, a renter's coverage is just as necessary. Renter's insurance is just as important if you rent your home. It may even be necessary. The structure is covered by your landlord's insurance, but the value of your personal belongings can quickly pile up. Your renter's insurance should cover the majority of the expenditures in the case of a burglary, fire, or other calamity. It may also help you pay if you have to stay somewhere else while your house is being repaired, and renter's insurance, like home insurance, provides liability protection.3. Health Insurance

One of the most significant sorts is health insurance. Your excellent health is what permits you to work, earn money, and live life to the fullest. What if you got a terrible sickness or were in an accident and weren't insured? You may be unable to obtain treatment or be compelled to pay huge medical expenditures. According to a research published in the American Journal of Public Health, over 67 percent of participants said that medical bills were a contributing factor to their bankruptcy. “Purchasing health insurance is an integral part of managing key personal financial risks,” said Harry Stout, a personal finance author, and former president and CEO of an insurance company. “Not having coverage can be financially devastating to households because of the high cost of care.” Health plans bought through the Marketplace can even cover preventive services such as vaccines, screenings, and some checkups. That way, you can maintain your health and well-being to meet life’s demands. If you’re self-employed or a freelancer, you can deduct health plan premiums you pay out of pocket when you file your tax return. You can deduct expenses that exceed 7.5% of your adjusted gross income.4. Life Insurance

Many experts believe that life insurance should be at the heart of your financial strategy. But how important is it really? It is all up to you. "The demand for life insurance fluctuates and develops with time," Neponset Valley Financial Partners financial advisor Stephen Caplan, CSLP,TM stated. "A young and single person's requirement is modest. If they are responsible for providing for a family, appropriate protection is critical." What can life insurance do if you are married with children and die? It may be used to replace lost income, pay off debts, or fund your children's college education. If you're single, it might cover your funeral expenses as well as any debts you leave behind. The cost is primarily determined by your age and health. The lesser the cost is expected to be, the younger and healthier you are. You may be required to have a medical test, although other businesses provide no-exam life insurance plans, which may be more expensive. If you're wondering if a life insurance coverage will be beneficial to you, Caplan advises considering the following questions:- What urgent financial obligations would your family face if you died? Consider outstanding bills, burial expenses, and other possibilities.

- How long would your dependents require financial assistance if you died today?

- Would you like to leave money for vital but less urgent bills in addition to meeting your family's most pressing needs? Consider your children's education, inheritance, and philanthropic contributions.