Stock index futures are legal agreements to buy or sell stocks at a specified price on a specific date in the future.

Stock Index Futures: Definitions and Examples

Stock index futures are contracts between investors that effectively wager on the price changes of a stock index on settlement day (based on index points) (the day agreed upon in the contract).Equity index futures is another term for them

A Micro E-mini S & P 500 Futures (MES) contract, for example, is worth $5 per index point. Let's say Joe sells Ann one MES contract. The S & P 500 was trading at 4,100 on the contract date. The S & P 500 index closed at 4,101 on the settlement date. The S & P 500 may have moved more than one point between the contract and settlement dates, but Ann still owes Joe $5 on the settlement day.What are stock index futures and how do they work

Because stock index futures are derivatives, no actual stock is traded. Instead, the buyer and seller sign a contract with each other, each with its own set of terms. Stocks are typically purchased in lots, which can be costly, but these contracts do not include lots. Index futures are traded on the Chicago Mercantile Exchange Globex, and if your broker offers index futures trading, you can trade them there. Instead, each investor pays a broker a margin, which is the amount needed to keep the futures contracts active. Both parties agree to pay the difference in index movement between the day the contract is entered and the settlement date when the contract is entered. In the United States, index futures on the S & P 500, Nasdaq 100, Russell 2000, and Dow Jones Industrial Average are available. The contract parameters are listed in the table below. 1 Index E-Mini Contract Size Ticker Micro-E-Mini Contract Dimensions Nasdaq 100 MNQ $50 x S&P 500 MES S&P S & P 500 x $5 Russell 2000 x $50Russell 2000 M2K for $5M2K Russell 2000M2K Dow Jones MYM $.50 x Dow Jones International index futures, as well as index futures for individual sectors including utilities, healthcare, and communication services, are available through the Chicago Mercantile Exchange Group.Individual Investors: What Does It Mean

You can take short or long bets on hundreds of stocks for a lot less money and in a lot less time than you could if you did it one at a time. While index futures are leveraged, in the sense that you use a smaller amount of capital to control a larger quantity, you trade more effectively since you use less money. Because the futures market is open nearly 24 hours a day, six days a week, it's easy to get carried away and trade too much—you can also find yourself chasing the market rather than sticking to your strategy. Index futures include the same risks as any other futures trade: there's no way of knowing which way the markets and indexes will move when the contracts expire. If trading activity is low, you may not be able to close a trade, and your stop and market orders may not be executed. The Benefits and Drawbacks of Stock Index Futures Pros- The ability to bet on future prices without owning equities in the index covered by futures.

- It is possible to make a lot of money with a small amount of money.

- If the deal goes bad, leverage can force investors to lose their entire investment.

- To meet future margin calls, cash is necessary in margin accounts.

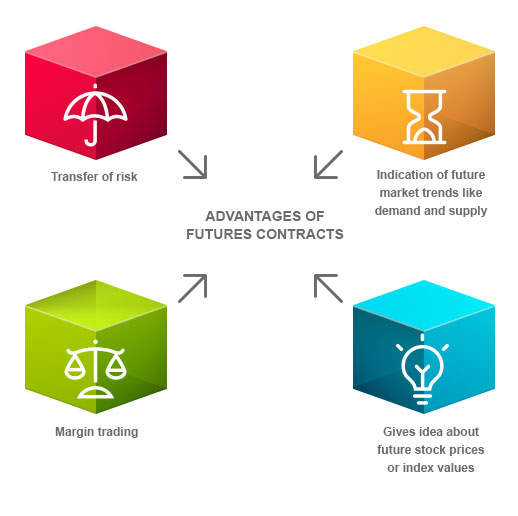

Advantages explained

The main advantages of futures are their low cost and the possibility for speculation. Possibilities for speculation: You might speculate on future stock prices to increase your leverage. You can trade assets in highly regulated markets 24 hours a day, seven days a week, and you don't have to hold the equities in the index that the futures contract covers. When you buy stock index futures contracts, you pay a fraction of the published price for the stocks in the index that the futures contract tracks. A $2,480 per-share investment in a fund that tracks the S & P 500 Index, for example, would cost $248,000 for 100 shares. You'd pay a lot less if you bought one S&P 500 futures contract (or 100 shares of the index).The drawbacks are explained

The downsides of trading futures revolve around high risk and the need to keep funds on hand: The high risk of buying and selling index futures contracts is one disadvantage of index futures investing. When market conditions go against you, it's simple to become heavily leveraged and lose your entire investment. When trading stock index futures, one important consideration is cash and margins. To participate in trades, you must have money in a brokerage firm's margin account. Your broker will contact you to replenish your margin account if you do not maintain it. A "margin call" is what this is called. If you don't have enough money to keep your margin account topped up, you risk quickly building up a large debt load to cover the account. Margin calls have caused many traders to lose their personal assets and become deeply in debt in the past.Is it Worth It to Invest in Stock Index Futures

When fees and maintaining a margin account are factored in, index futures trading may be rather pricey. Depending on the broker you pick, the margins could be pretty high. Stock index futures allow you to trade entire indexes' worth of stocks for much less, so if you enjoy trading and are willing to accept the risk of losses, it can be a profitable method to invest. If you're serious about investing in stock index futures, you should speak with an investment advisor or another qualified financial professional first. You'll gain access to independent investment advice that can help you make more informed and responsible financial decisions.Important Points to Remember

- Stock index futures are legal contracts that allow you to buy or sell contracts at a set price at a future date.

- Stock index futures provide investors with the opportunity to speculate on future prices, but they can also be hazardous if values shift too quickly.

- Stock index futures allow you to trade all of the stocks in an index for a fraction of the price.

- The major U.S. indexes, several overseas indexes, and industry-specific indexes all have stock index futures available.