It's helpful for a financial backer to calculate a monetary proportion known as "return on resources" (ROA). This is an administration execution proportion that is by and large used to look at changed organizations and the purposes of their resources. ROA is best utilized as a general reference throughout various periods. It can notify the board's utilization of the resources inside a business to create pay. Knowing how to find the ROA will help you look at an organization's financial record and pay explanations. You can involve the ROA as a mark of significant worth.

Return on Assets Formulas

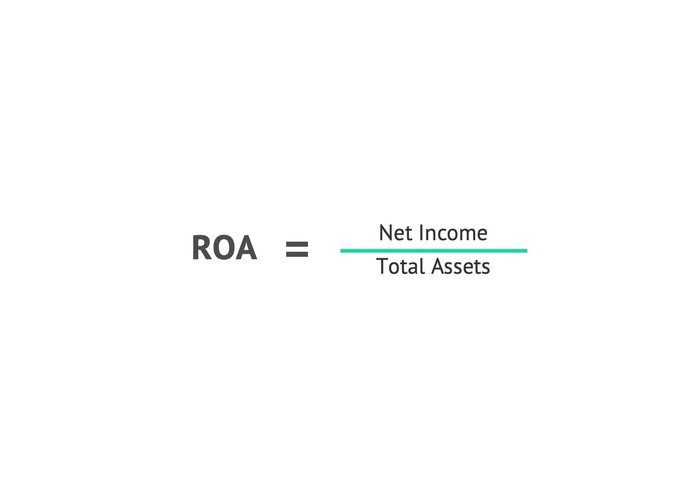

The standard strategy for finding the ROA is to contrast the net benefits with the all-out resources of an organization at one point in time: ROA = Net Profits ÷ Total Assets The principal equation expects you to enter an organization's net benefits and all out resources before you can track down ROA. Often, these are details on the pay explanation and accounting report. With 2019 Best Buy Co. filings, we can use this recipe to track down the organization's ROA. Page 109 of its yearly report has the ROA determined for the earlier seven years. ROA = $1.464 billion ÷ $12.994 billion ROA = .113, or 11.3% For the most part, public organizations report their net benefits, or profit, on their pay explanation and their complete resources on their financial record a couple of times every year: every year, quarterly, and month to month. On the off chance that you are searching for numbers throughout a period rather than yearly detailing the time, utilize the typical resource technique to work out the ROA. Essentially take the normal of the resources over the timeframe being referred to as opposed to at one point in time. ROA = Net Profit ÷ Average Assets Remember that an organization's resources can fluctuate unexpectedly. For example, this could occur assuming the organization chooses to sell a few enormous bits of hardware. Hence, utilizing the typical resources to work out ROA is often a superior measure.Return on Operating Assets

One standard estimation of resources and the profits they produce is known as the "return on working resources' ' (ROOA). It is like ROA in that it estimates the profit from resources. Yet, ROOF estimates the profit from resources that are in use. You work out the ROOF by deducting the worth of the resources not being used from the worth of the complete resources and afterward isolating the overall gain by the outcome. ROOA = Net Income ÷ ( Total Assets ? Assets Not being used ) Organizations that get through will generally follow the vertical and descending swings of the business cycle, where market interest vacillates trying to settle. At the point when the request is rising, organizations will build the number of resources they use to create their labor and products. When the request is decreased, most organizations will offer resources to recover some cash. Yet, they will frequently hold resources for possible later use to lessen spending during the following vertical swing popular. ROPA considers that all resources are not regularly being utilized at some random time. Because of this, ROOA is a significantly more precise proportion of how resources are being utilized to create pay.The Importance of Return on Assets

ROA lets you perceive how much after-cost benefit an organization created for every dollar in resources. ROA estimates an organization's net profit compared to every one of the assets available to it. ROOF estimates the productivity of resources that are being utilized. These estimations are signs of the executives' proficiency with resource use. This is a key productivity metric. Giving financial backers' experiences in investor income generation is implied. A higher ROA is, in many cases, remembered to be preferable over a lower ROA. Nonetheless, you ought to be cautious while utilizing this proportion. ROAs couldn't measure up across ventures. At times, they couldn't be utilized to look at organizations in a similar industry because every business works and unexpectedly deals with its resources. Organizations should be the same in design and practice for ROA and ROA to be viable examination devices. It's likewise really smart to glance back at these proportions frequently. They can change much over the long haul regarding business execution and resource use.Now and again, Asked Questions (FAQs)

- What is a decent profit from resources?

- How would you track down an organization's profit from resources?