Acquire the knowledge necessary to fill out a check correctly

There are no instructions included with checks, and if you end up making a mistake, it could have a negative impact on your finances. However, after you gain an understanding of the various components on a check, you will feel comfortable.

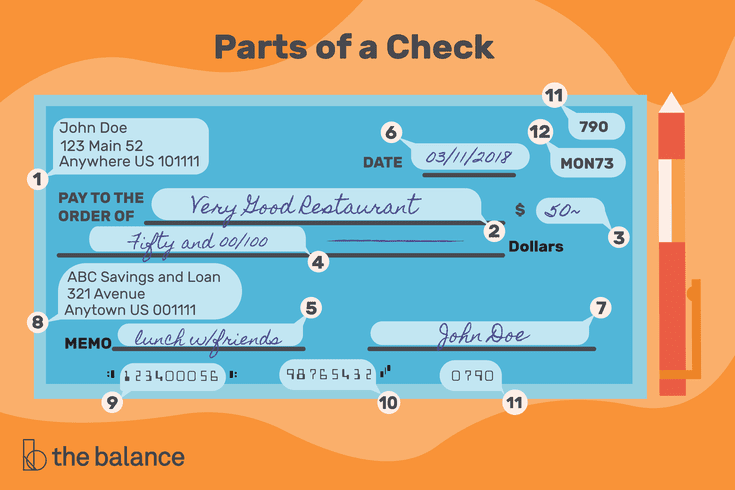

When you write a check, there will be information which has already been printed that you need to be aware of, in addition to blank sections which you will need to fill in with the utmost care and precision.

Understanding the components of a check is beneficial for a number of reasons, including the fact that you need to be able to write checks on your own.

- Order brand new checks

- Be certain that the check orders are printed accurately.

- Set up instructions for direct deposit

- Check to see that whatever checks you that receive have been completed in the appropriate manner.

An Explanation of the Various Components of a Check

The contents of the sections that follow correspond to an essential component. Keep scrolling to find out what each one is called as well as its function.

- Details regarding the account's owner are contained in the "personal information" section.

- Payee line: This line specifies who is eligible to receive the funds on the check.

- The dollar box is where the check's value will be displayed in a numerical format.

- The amount of money that the bank will deduct from your check is detailed in the section that uses words rather than numbers.

- The memo line is a place for any remarks regarding the purpose.

- The date line is shown below.

- Signature line: account holder has given their permission for the payment to be processed.

- Information regarding how to contact your bank and/or its logo: Typically, this information is printed already.

- The routing number assigned to your bank by the American Bankers Association (ABA): This number tells financial institutions where to look for the money to cover the check.

- The number of your account: The recipient of the check will use this identifier to determine the origin of the funds that will be used to pay.

- The check number: security measure that helps prevent fraud. It is printed in two different places on the check.

- Your bank's fractional ABA number: Contains the exact same details as the ABA in section 9. Typically presented in a different format.

Personal Information –– details about an individual

It is common practice for identifying details about the owner of the account to be pre-printed in the upper-left-hand corner of a check.

This section will typically include the following:

- Your given name

- An address for your home

- Your number for the phone

Suppose you have reservations and concerns regarding your privacy. In that case, you can reduce how much information is printed, or undertake other precautions.

It is not unusual for a retailer to demand precise information before accepting a check as payment. On the check, for instance, your phone number might be handwritten by the cashier. They will have an easier time protecting themselves in the event of fraud as a result of this.

Payee Line

Identify the individuals who will be the beneficiaries of funds transferred. In the space designated for "Payee," put down the individual or organization's name that will be receiving payment from you.

Dollar Box

In the space on the check designated for the dollar amount, please write out your amount in numerical format.

It is sometimes referred to as the "courtesy box." The number that you enter here will not be factored into the calculation to come up with the maximum allowable amount for your check.

In principle, the two sums ought to coincide, but this is not always the case in practice. When something like this occurs, the written words have a higher importance over the numerical values.

Check Amount Written Down With Words

Please use words to indicate the amount and write it here (as opposed to using digits).

In case there is any empty space, you might want to cross it out to make sure no one goes around changing the amount written on your check.

Instead of being written as whole cents, the value of a cent is represented here as a fraction of a dollar. There are one hundred cents in a dollar. As such, the total amount of cents should come after the number one hundred.

Memo Line

On your check, you can write a small note on the memo line. This is not required in any way, shape, or form and can be worded in a casual manner. Utilize this section in order to:

- Include specifics for the purpose of your own record-keeping.

- When paying bills, include a number corresponding to the invoice, account, or transaction.

- When you write checks to family or friends, including a note is a nice touch.

Date Line

Please provide the date in the space provided. You can put down a date in the future and let the bank know if you wish to postpone the transaction.

If you give your bank or credit union timely notice regarding a check that is post-dated, that notice will typically remain in effect for a period of six months from the date it was given.

Signature Line

The line located in the right-hand lower corner of the check is where the payer signs. This is done as a safety measure, and the bank can validate the signature by comparing it to the signature of the account holder that is already on file.

The final step is signing the check, and you shouldn't complete this step until after you have double-checked everything. If you go ahead and sign a check that is blank in other respects and then lose track of the check, whoever finds it will be able to fill in the blanks with whatever they choose.

Bank Contact Information –– how to contact your bank

Every check you write will have the name of your bank printed on it. On the other hand, this section does not contain any vital information. If someone has given you a check, this portion of the document will inform you of their banking information as well as the origin of the funds.

ABA Routing Number (MICR Format)

One can find the address of your bank in the left-hand bottom corner, and it is known as the routing number. When you write a check, other banks will be able to contact your bank and then collect the funds directly if they have that number.

Account Number –– the number of your account

MICR is also used for the account number which is also located on the bottom.

There are typically three numbers printed at the bottom. It is important to double-check the format because different checks use different formats. Looking for a symbol that resembles a "?" is a good way to locate the account number you need right in front of that symbol is where your account number is displayed.

Check Number

This is a reference number on the check that can assist you in the following situations:

- Bring your checkbook ledger up to date.

- Keep an eye on the checks that have been cleared through your bank.

- It is important to be aware of which checks have not yet been cashed.

Some checks print this in MICR as an additional layer of security against fraud.

This number is typically found in two locations, the lower-right and the upper-right corners of the page.

ABA Routing Number (Fractional Format)

The ABA routing number of the bank is typically printed in fractional format on the right top corner, in addition to the MICR line located along the bottom.

The bank, the location of the bank, and the branch of the Federal Reserve that services it are all represented by this number, just like they are by the MICR line.

Frequently Asked Questions (FAQs)

Do the numbers on the check matter?

The check numbers provided for you in order to assist you in accurately recording transactions. Check numbers are not considered by the bank, and it is possible to cash multiple checks using the exact same number.

Name the kinds of information which are expected to be written down on personal check?

There is a possibility that service providers and sellers will have varying requirements concerning the personal details that you must include in a check. In most cases, all that is needed to cash a check is to have your name and address printed on it. If you print too much information, identity thieves will have an easier time stealing it and using it to steal your identity.

Is it possible to make use of a check with an old address?

If the account number and routing number that are printed are up to date, then the check is valid. This means that your bank will be able to process it.