Most people do not appreciate the mortgage underwriting procedure. It frequently seems like a lengthy appointment to the dentist. You collect the papers needed to obtain a mortgage. You give the information to your loan officer. The underwriters will then go over your paperwork to ensure they are comprehensive and accurate.

You hope you've covered everything, yet practically everyone makes a mistake. Perhaps they fail to check a box or leave out a sentence. They could even forget to sign. Don't be concerned. Your lender will seek any missing papers or signatures, and you will be asked to resolve any concerns that arise.

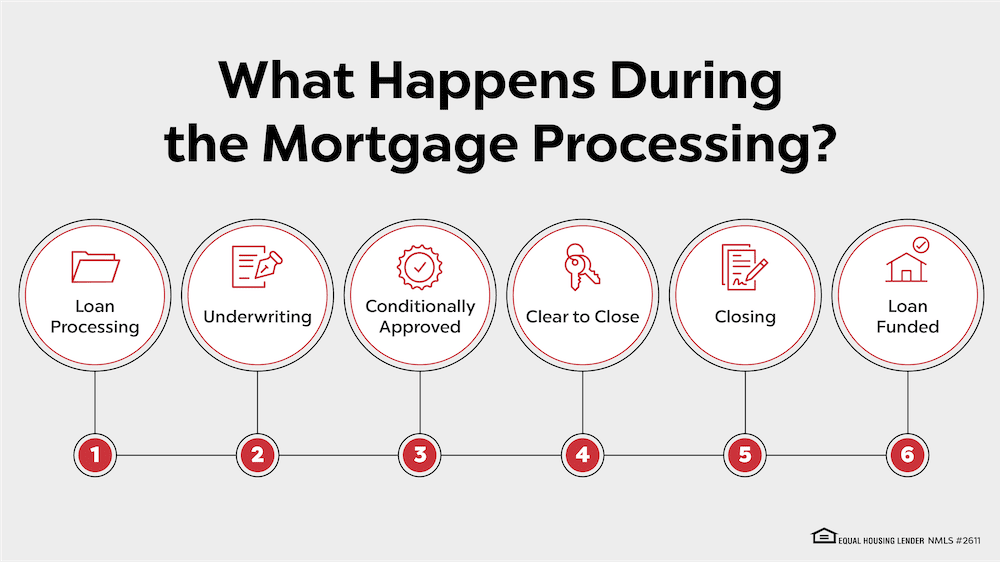

It might be a pain, but knowing what's coming and how to prepare for it can help. Here's what to expect from the financing.

What Is Mortgage Underwriting?

Underwriting is the process through which your lender determines your risk level as a borrower. It entails a thorough examination of your financial condition and history. They examine your income, bank accounts, investment assets, and previous loan repayment dependability. They accomplish this by evaluating the paperwork you submit, inspecting your credit record, and following up with inquiries.

In this evaluation, your debt-to-income (DTI) ratio is critical. It is the proportion of your monthly debt payments to your total monthly revenue. To calculate your DTI, estimate your monthly mortgage payment using a mortgage calculator and then add your other monthly debt payments to it.

Getting Started With Underwriting

When you start the underwriting process, you'll probably be asked right away whether you have any substantial deposits in your bank or savings accounts or how much of your 401(k) plan is vested, especially if you want to put down less than 20%. This is standard, therefore there is no need to be alarmed. Be as prompt as possible with your responses and any other information. It will speed up the procedure.

Your Choice of a Lender

The following phase in the underwriting process will differ greatly based on your loan officer and lender. The mortgage lender you select, the sort of loan you require, and the quantity of data you've included in your documentation will all play a role in deciding your level of underwriting discomfort.

If you work with a major bank or lender, your file will be routed to a corporate mortgage processor at a central location that is typically far away from you. Expect a lengthier time frame because these processors may be overworked and underpaid. Lenders strive to increase the amount of loan files that everyone must handle and underwrite. It's a quantity-over-quality strategy.

Smaller lenders and independent mortgage brokers typically staff in-house teams, which results in more efficient operations because everything is under one roof.

Nonetheless, there are several benefits to choosing a large bank. The titans can afford to take more risks than the little man, which is wonderful if you're in the approval gray zone. They also frequently provide a broader range of specialist mortgage solutions for things like refurbishment, but you'll have to give up a little efficiency in exchange.

The Effect of Turn Time

Every mortgage lender has a turn time, which is the amount of time it takes from submission for underwriter review to final lender decision. It can be influenced by a variety of things, both large and minor. The most important aspect is frequently internal regulation regarding how many loan operations the staff can handle at one time. Things as basic as the weather might easily disrupt loan turn times. For example, if you reside in an area where significant blizzards are typical in the winter, such as Rochester, New York, you should be aware that a major storm may cause the procedure to be delayed.

Inquire with your loan officer about the expected turn time for your loan, and weigh it into your lender selection. Always keep in mind that buy turn times should be less than refinancing turn times. Homebuyers must fulfill strict deadlines, so they are given first priority in the underwriting queue.

Typically, your purchase application should be underwritten (approved) within 72 hours of underwriting submission and one week after you submit your loan officer with all completed documents. This might take up to a month.

Approved, Denied, or Suspended

The underwriter's decision will be one of three: authorized, suspended, or refused.

If it is authorized, underwriting will set conditions that you must follow before receiving complete approval, such as clarification on a late payment or a high deposit. It might be as simple as a misplaced signature here and there.

If the procedure is halted, which is not uncommon, you will most likely need to explain anything.

These delays are frequently tied to employment or money. An asset verification query might sometimes result in a suspension. In such a situation, you will be given two conditions: one to lift the suspension and the regular criteria for full approval.

Finally, if you are refused, you will want to know why. Not all loans that begin as rejections finish up being such. Many times, a refusal just needs you to reconsider your loan product or down payment. You may need to correct an error in your application or on your credit report.

Approved With Conditions

Most loan applications are "accepted with conditions." The underwriter merely needs clarity and extra documentation in this scenario. This is largely to keep their employer safe. They want the loan to be as safe and risk-free as feasible when it is closed.

Frequently, the additional things are not added to persuade the underwriter, but rather to ensure that the mortgage fulfills all of the requirements necessary by possible investors who may end up purchasing the finished loan.

Your Role in the Underwriting Process

Your responsibility during the underwriting process is to respond rapidly to requests and queries. You must jump through each hoop as soon as can, no matter how ridiculous you believe the request is.

Take nothing personally. This is exactly what underwriting is for. Just take care of the final few details and submit them so you may hear the three finest words in real estate: "Clear to close!"

There will only be a few more hoops to jump through once you hear those words. Make your down payment, sign the dotted line, and prepare to move into your new home.

Frequently Asked Questions (FAQs)

What are underwriters looking at when they are approving a mortgage?

When you have completed all of your documentation, the underwriters will review your credit record, income, and existing debt commitments to evaluate whether you have the ability to repay the loan. They will also look through the house assessment and loan request, comparing the loan to the property's worth to confirm that the LTV ratio is appropriate. If your loan is worth more than 80% of the home's value, you'll almost certainly have to pay mortgage insurance. All of these criteria will have an impact on the final loan terms and interest rate.

What happens following underwriting approval in the home-buying process?

After receiving clearance from an underwriter, you should get notification that you are ready to close. Your lender will send you your final closing disclosure a few days before closing. You should carefully check this document and compare it to your initial loan estimate to confirm that everything seems correct. Bring everything you need for closing, including your ID and money for closing expenses, and be prepared to sign a lot of paperwork!