Personal finance software and apps can assist you in understanding fundamentals, becoming more effective with your money management, and even discovering new ways to reach your long-term financial goals. Some personal finance tools can assist you in mastering budgeting and expense tracking, while others can assist you in managing your investment strategy. Additionally, your finance software budget is equally important. Your current financial position influences your decision on the finest personal finance software. Our best personal finance software selection includes both free and paid options.

Best Overall: The 8 Best Personal Finance Software Options for 2022 Mint is the best budgeting app after Quicken.

- YNAB is the best habit-building app.

- Mvelopes are the best option for zero-based budgeting.

- TurboTax is the best tax software.

- FutureAdvisor is the best investment platform.

- Personal Capital is the best option for investment advice.

- Tiller Money is the best spreadsheet management software.

Quicken

Quicken has been around for several decades and is one of the most well-known personal finance software programs. The software can help you manage all aspects of your financial life, from budgeting to debt tracking, savings goals, and even investment coaching. Excel exporting is included in the software, allowing you to alter and conduct extra computations on your data. Bill paying is one of the more advanced capabilities, allowing you to set up payments for your bills directly from the software. You may also use it to correctly calculate your total net worth by tracking the value of your assets.

The program is powerful enough to handle both personal and company costs and property management features such as tenant rental payments. Quicken offers a 30-day money-back guarantee. The software is available for Windows, macOS, iOS, and Android and costs $35.99 per year.

Mint

Mint is a well-known budgeting and cost tracking app. You can have the software bring in your bank and credit card information to evaluate your expenditure and identify where you can save money.

Mint will provide you with real-time information about how much you can spend on things like food and gas if you've set up budget categories. Mint lets you set up alerts for payment dates and low balances to help you stay on track. These tools assist you in avoiding costly fees for late-payments and overdrafts on your bank account. Mint may be downloaded and used for free on iOS, Android, and desktop PCs.

YNAB

You Need a Budget, or YNAB is a personal finance software designed to help you manage your monthly budget while improving your financial literacy. As you establish your budget and manage your daily expenses, the software will present tutorials to assist you in tackling some of the more complicated financial problems. If you've been battling unhealthy money habits, YNAB can help you break them by teaching you a few simple financial management rules.

The app instantly connects to your bank account, merging your expenditure data for analysis and budget tracking. You may monitor your progress toward your monthly budget and take action if you're overpaying. It does not have investment tracking features. YNAB provides a 34-day free trial period during which you can use the software to determine whether it is appropriate for your personal finance goals. The full software costs $14.99 per month or $98.99 per year.

Mvelopes

By utilizing envelopes to handle your money, the traditional envelope budgeting approach helps you keep to a budget. After you've broken down your budget, you divide the money into several envelopes. So, if you budget $100 for petrol this week, you put it in a "gas" envelope. That's it. You've spent your $100. Mvelopes take a similar technique to budget, but it's done digitally on your phone and computer rather than with cash.

Choose the most critical financial goals, then input your bank accounts and income. Mvelopes can help you create a budget and organize your "envelopes." To keep you on track during the month, the software tracks your spending and shows you how much you've spent from each envelope.

The basic edition costs $5.97 per month, and you may test Mvelopes for free for 30 days when you sign up for the premier plan, which costs $9.97 per month.

TurboTax

You may not require TurboTax to handle your money throughout the year, but the software can be helpful during tax season. While it is one of the more expensive tax preparation programs, it is user-friendly, guiding you through your tax preparation to help you file your tax return correctly. You can import your W-2 information from your company or take a picture of it, and the software will transfer the information into the form.

If you've previously used TurboTax, the software will recall your personal information and inquire if there have been any significant changes. The most basic option allows you to file your federal and state returns for free if you only utilize form 1040 without attachments.

TurboTax paid versions contain a tool that helps you discover deductions you may not have known were available to you. On the other hand, TurboTax Live links you with a tax professional who can provide individualized guidance and answer questions regarding your tax return. While TurboTax may be used online, you can also download the software on your device for added security.

FutureAdvisor

FutureAdvisor is a fantastic addition for DIY investors looking for low-cost access to a financial counselor. The investment software generates personalized recommendations to help you diversify your portfolio, which you can follow or disregard as you see fit. You can sign up for the software if you have at least $5,000 in investable assets. FutureAdvisor administers the assets you deposit in the account for a flat yearly charge of 0.5 percent of the managed assets, invoiced quarterly at 0.125 percent. When you deposit funds into your account, FutureAdvisor attempts to combine them into accounts with its partners, Fidelity or TD Ameritrade.

Personal Capital

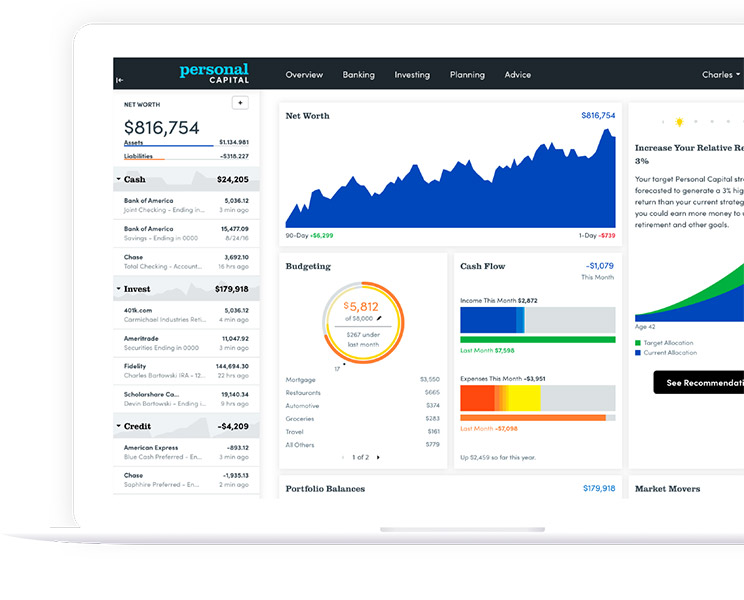

Personal Capital enables you to manage all of your financial accounts in one place. You can include your bank accounts, mortgage, other credit accounts, and investment accounts to see your entire financial picture. Personal Capital can spare you from going between various screens to grasp where you stand if you have multiple accounts, which most of us do these days.

You can obtain tailored financial advice based on your goals if you have a portfolio worth more than $100,000. While you will be charged a fee for this service, financial advisors are required to give you advice that is in your best interests.

Use the software to see whether you're on track to meet your retirement and other investing objectives. Even if you aren't quite ready to hire a financial counselor, Personal Capital can help you keep track of your finances and investments in one location. There are no monthly fees, and the annual management fee is scaled based on the amount invested.

Tiller Money

Tiller Money allows you to see all of your money in one place by automatically transferring data from your bank, credit card, loan, investment, and other accounts into a customizable Google Sheet or Excel template. Tiller Money allows you to customize your spreadsheet or choose from templates that organize your data. It will also send you daily emails summarising your most recent transactions and balances. The program costs $79 per year or $6.58 per month, but you can try it out for free for 30 days to see if it's suitable.

What Is Personal Finance Software?

Any program that assists you with all aspects of your finances is considered personal finance software. It is intended to make managing and tracking your finances more accessible and more efficient and assist you in developing methods that work for you. You can select different software for various purposes. Some software is perfect for budgeting, while others are suitable for investing and tracking debt and savings objectives.

How Does Personal Finance Software Work?

Personal finance software works typically by gathering data from you, connecting it to your financial institution, investment accounts, and credit cards, and then assisting you in setting financial objectives. It can monitor your credit, track your spending and savings habits, assist you in creating a budget, provide recommendations and investment guidance, and send you bill pay and savings goal reminders once it has access to your accounts.

How Much Does Personal Finance Software Cost?

The features, functions, and costs of personal finance software vary. Some software provides basic functionality in both free and paid editions. Other software, which charges monthly fees, assists you in meeting more complex financial goals. Personal finance software costs typically between $5.97 and $12 per month, but you can save money by paying annually. Other software charges an annual fee of $35 and investing software charges a flat rate of 0.5 percent of managed assets.

Is Personal Finance Software Worth the Cost?

Personal finance software is worthwhile if it assists you in meeting your financial objectives. It can help you keep to a budget and save money, or it might help you manage and track your investments and make money. If you utilize it and find it helpful, it's usually worth the inexpensive cost.

How We Chose the Best Personal Finance Software

We investigated and examined numerous personal finance programs before selecting our top eight personal finance software solutions based on price, feature diversity, the types of financial goals they assist you in a meeting, company reputation, and other factors.