The majority or maybe all of the items listed on this website are provided by our business partners, who in turn reimburse us. This might have an impact on the items we choose to write about, as well as where and how they are displayed on a page. Despite this, it does not affect how we evaluate the situation. Our opinions are entirely our own.

Purchasing long-term care insurance is one method to prepare financially for a day when you may need to pay for assistance to take care of yourself. This kind of insurance covers medical and non-medical costs associated with long-term care. However, this is not the sole method for financing nursing home care, adult day care, assisted living, or care provided in the comfort of one's own home.

Furthermore, there is a minimum age limit for obtaining insurance. The majority of long-term care insurance firms will not approve you for coverage if you are beyond the age of 75. Investigating your options thoroughly before purchasing a plan is highly recommended.

A short review as a refresher

Long-term care refers to a range of services that help with "activities of daily living," such as taking a shower, eating, and remembering when to take medication. Both traditional health insurance and Medicare contribute to the payment of medical bills. However, they do not contribute to the cost of custodial care, which refers to assistance with non-medical tasks and activities of daily living.

Because of the high cost of long-term care, it is essential to start planning when you reach your 50s and 60s. According to statistics from the Administration for Community Living, which is part of the United States Department of Health and Human Services, in the year 2020, about seventy percent of people who are 65 years old will need the assistance of long-term care services. For those individuals who need long-term care, the average number of years that males will be in need of services is 2.2, but the average number of years that women will be in need of services is 3.7.

A long-term care insurance coverage will pay for your care if you have a major cognitive impairment, such as dementia, or if you are unable to perform two out of six activities of daily living. These include:

- Take a bath.

- Taking care of someone with incontinence.

- Dressing.

- Eating.

- Using the toilet

- TransferringHowever, there are purchasers who are hesitant to spend a significant amount of money on coverage that they may never make use of. In addition, there is no assurance that the amount you pay annually for your coverage won't go up in the years to come. Many people who have policies for long-term care insurance have been subjected to significant premium increases during the previous decade.Here are several options for purchasing coverage that covers long-term care costs:

Put some of your money aside for long-term care

You might make plans to pay for your own long-term care out of pocket if you have a sizable emergency fund and savings.

- Pro: You don't run the danger of shelling out money for insurance that you may never need to use.

- Con: Even just a few years of care might make a significant hole in your savings, reducing the amount of money that will be left for your heirs. Another possibility is that you may run out of money. In such an instance, you could be eligible for coverage via Medicaid, which would pay for the care you get in a nursing home. In such cases, however, your choices would be restricted to hospitals and clinics that serve patients who are covered by Medicaid. In addition, the program does not provide financial assistance for assisted living in all states.

Use your life insurance policy's "living benefits" to your advantage

This provision, which is also available on most permanent life insurance plans such as whole life insurance, is also referred to as an "accelerated death benefit." You are permitted to withdraw a part of the payoff from the life insurance policy while you are still living in order to pay for medical bills, which may include the cost of long-term care. The money that was utilized for long-term care comes out of the beneficiary's death benefit.

- Pros: On certain life insurance plans, the cost is already included in your premiums, and on others, you may add it for an additional fee when you purchase the policy.

- Con: The triggers for when you may receive the benefits of care differ from business to company; thus, you should carefully read the tiny print. A diagnosis of a life-threatening disease could be a catalyst. Additionally, if you use the policy to pay for long-term care, the amount that your heirs get from your life insurance policy will be reduced.

Sell your life insurance policy

You have the ability to cash out your permanent life insurance policy and spend the money for any purpose you see fit, including paying for long-term care costs.

- Pro: The payments you get by selling your policy, which may be done via a transaction known as a life settlement or a viatical settlement, are often more than what you would receive if you relinquished the policy in exchange for the cash value.

- Con: The earnings may be subject to taxes, and your beneficiaries may not get a death benefit if you cash in the policy. (When you pass away, the new owner of your insurance will be entitled to receive the death benefit.) It is not always easy to determine whether the price you are being offered is reasonable. In most cases, term life insurance plans are not eligible for life settlements because of their shorter duration.

Invest in an annuity.

Paying for long-term care may be done via the purchase of an instant annuity, which guarantees a certain amount of money each month. You create a specific payment into an immediate annuity, and in return, the insurance company promises to provide you with a constant stream of income for a certain time period or for the rest of your life. The amount you will get is based on the total amount you contributed, as well as your age, gender, and maybe other characteristics.

- Pro: Even if your health isn't great, you may still get an instant annuity for yourself.

- Con: Investing requires a significant amount of capital, often at least fifty thousanddollars. There is still a possibility that the income from the annuity will not be sufficient to cover the cost of your care. Because of the complexity of the tax consequences of annuities, you should consult with a tax expert in order to have a better understanding of the potential tax burdens in the future.

Invest in a policy that combines life insurance and long-term care protection

As a result, these plans are also known as asset-based or hybrid life and long-term care insurance policies, which offer either an amount of money to be used for long-term care if necessary, or a death benefit to your beneficiary if you do not use up all of the long-term care benefits. If you need long-term care, you can choose which option you want to use. In most cases, you either make a single high premium payment all at once, such as $75,000, or many large payments spread out over a few years. Many health insurance plans provide money-back guarantees if you change your mind about the coverage later on. Lincoln Financials’ MoneyGuard II is an example of this kind of plan.

- Pro: Even if you never make use of the long-term care component of the insurance, you will still get some return on your investment. Your beneficiary will get a payment from the life insurance policy if you do not need it for long-term care or if you do not use all of it when you pass away.

- Con: You may only consider this choice if you have a significant amount of money available for expenditure.

Purchase coverage for care that is only needed temporarily

The coverage provided by short-term care insurance is comparable to that of long-term care plans; however, the duration of the policy ranges from three months to three hundred sixty days. When you make the purchase, you get to choose the time period. Because there is often no "elimination period" or waiting time associated with short-term care insurance, benefits under the policy will begin to be paid out as soon as you begin receiving care. The elimination period on insurance for long-term care acts similarly to a deductible in that it: Is the number of days that you are responsible for paying for treatment before the insurance company starts making payments. The elimination phase typically lasts for ninety days.

- Pro: When compared to long-term care insurance, short-term care insurance policies are not only more affordable but also simpler to qualify for. Even if the duration of coverage is shorter than a year, it may be sufficient for your needs. There is also the option of purchasing a policy for short-term care insurance in order to cover the cost of care during the elimination phase of a long-term care insurance plan.

- Con: If you need medical assistance for more than a year, you won't get enough coverage from a short-term care insurance policy. Saving money for several months of care rather than paying for short-term care insurance every year makes more sense. In addition, states do not impose the same consumer protection criteria on short-term care insurance as they do on long-term care policies since the states do not regulate the former as stringently as they regulate the latter. This indicates that you need to shop with an increased level of caution. For instance, long-term care insurance contracts have to be "guaranteed renewable," which implies that the policy will continue to be in effect so long as the premiums are paid on time each year. Even though it is common for short- term care insurance contracts to have a guaranteed renewal provision, providers are not compelled to provide this safeguard. Consumer activists conducted an analysis of the available insurance plans and discovered at least one of them did not guarantee the policy's renewal. According to the terms of that policy, the insurance company had the right to decline to renew your coverage even if you had been a loyal customer for many years and had never filed a claim.

Obtain assistance in determining the best way to proceed

It might be difficult to properly prepare financially for long-term care. Talk to a reliable financial counselor who can assist you in planning for the costs of long-term care prior to purchasing any kind of insurance.

Purchasing a Package Deal Consisting of Life Insurance and Benefits for Long-Term Care

The majority or maybe all of the items listed on this website are provided by our business partners, who in turn reimburse us. This might have an impact on the items we choose to write about, as well as where and how they are displayed on a page. Despite this, it does not affect how we evaluate the situation. Our opinions are entirely our own.

Because long-term care insurance is so expensive, you run the risk of paying tens of thousands of dollars on a service you won't need. The cost of nursing homes, assisted living facilities, or home health care is covered by policies, but what happens if you never use these services? New kinds of plans combine permanent life insurance, such as whole life or universal life, with long- term care insurance in one convenient package.

How the various combination policies are implemented

Long-term care expenses that aren't covered by standard medical insurance or Medicare are taken care of by plans that combine life and long-term care insurance. And if you don't use up all of the long-term care benefits, the insurance company will still make a payment to the beneficiary of your policy after you pass away.

Combination products, which may also be referred to as linked or asset-based plans, function as follows:

Depending on the policy, you may pay a single high premium all at once or a few significant yearly premiums. The average cost of long-term care insurance with a single premium is $75,000, according to the American Association for Long-Term Care Insurance.

Your coverage will set aside a sum of money for long-term care that is multiple the amount that you pay each month for the premium.

Depending on how much of the long-term care benefit you tap into, the policy's death benefit will be lowered, which means that the beneficiary of your life insurance will get less money when you pass away. Even if you use all the money that was set aside for long-term care, many plans will still guarantee a small portion of the total death benefit, such as 10 percent of the whole amount.

In order to be eligible for certain combination plans, you will be required to provide medical records and undergo a medical exam for life insurance. Others provide "simplified underwriting," which indicates that you may just be required to respond to health-related questions over the phone. If you are in good health, purchasing insurance that involves both a medical exam and the submission of medical documents will result in lower premium costs for you.

The payments for long-term care might be paid out for a period of up to six years, at a maximum monthly rate of up to $6,303. If she never needed long-term care, the insurance would pay her beneficiary a death benefit of $151,261 if she never utilized it for that purpose. She could get her $100,000 investment returned if she decided she no longer wanted the insurance after the fifth year and had not used any of the long-term care benefits.

The demand for insurance plans that cover both long-term care and life insurance has increased. According to LIMRA, in 2021, more than one-fourth of Americans said they were very likely to consider purchasing a combination policy if they were shopping for life insurance. As of 2019, just 17% of Americans stated they would be very interested in such a policy.

The benefit of using combination strategies

The most significant benefits of combination plans are not limited to the fact that you will always get some benefit in exchange for the payment of your premium.

If you would have spent the money or hold it in an account that yielded a poor rate of return otherwise, purchasing the insurance may prove to be a profitable alternative.

The insurer may even ensure that your prices won't rise if you get a plan with a specific number of installments and pay for it all at once, so you didn't have to worry about your premiums going up. As a result of the fact that actual medical expenditures have been far higher than anticipated by insurance firms, the premiums paid by certain policyholders of standard long-term care insurance have more than doubled in the previous few years. In addition, since interest rates are at all-time low levels, insurance companies have not been able to generate sufficient investment income from premiums to pay out claims.

A money-back guarantee is included in many combination insurance contracts. If you decide that you do not want the insurance coverage after a certain amount of time, such as five years, the insurance company will refund the sum that you paid. Before that time, you are eligible to get a refund on a portion of the premium.

The negative aspects

If you are solely interested in purchasing life insurance, you do not need a policy that includes coverage for long-term care and vice versa. If this is the case, you should look into purchasing a standard life insurance policy, either one with a term or one that is permanent. The majority of individuals do not need anything more than term life insurance, which is intended to cover the years during which your family is dependent on your income. You are protected by your permanent life insurance policy for the whole of your life.

You do not want to have life insurance that is permanent. Shop around for term life insurance, which is far more affordable if you just want coverage for a certain time.

You do not have $75,000 or more readily available in your possession at this time. The American Association for Long-Term Care Insurance advises those with "lazy money" in money market or certificate of deposit accounts to acquire combination plans since these policies provide the best value.

Get counsel before you decide

Prior to making a final selection, be sure to compare quotes from a variety of insurance companies if you decide that combination coverage is the best fit for your requirements. It won't take you more than a few minutes to check them up on the websites of independent rating organizations such as A.M. Best, Fitch Ratings, Moody's Investors Service, or Standard & Poor's Ratings Services, among others. (On certain websites, you will be required to register before you can see ratings; however, registration is completely free.) The insurance businesses are given grades by the rating agencies, and each agency uses its own scale to assess the companies.

Combination policies are complicated financial solutions with a wide range of associated costs and advantages. Before making a purchase, you should have a conversation with a financial adviser who is familiar with these products and is able to evaluate them in relation to the alternatives available for stand-alone life insurance and long-term care policies.

5 Insider Secrets to Help You Find Long-Term Care Insurance at an Affordable Price

The majority or maybe all of the items listed on this website are provided by our business partners, who in turn reimburse us. This might have an impact on the items we choose to write about, as well as where and how they are displayed on a page. Despite this, it does not affect how we evaluate the situation. Our opinions are entirely our own.

In the future, many baby boomers may need assistance with the activities of daily living, such as getting dressed, taking a bath, eating, or remembering to take their prescriptions.

In almost all cases, traditional medical insurance, including Medicare, will not pay for assistance with "custodial care" activities (i.e., chores related to personal care and hygiene of the patient). That's what long-term care insurance is for.

However, when confronted with the price of coverage, many people who are shopping for long- term care insurance experience sticker shock and abandon up. This is how we can maintain the price at a reasonable level.

1. Start making purchases sooner rather than later

According to Kevin M. Lynch, an insurance lecturer at the American College of Financial Services in King of Prussia, Pennsylvania, "the key to long-term care insurance is to apply early while it's affordable." This advice was given by Kevin M. Lynch.

Long-term care insurance is available from most firms up to the age of 75; however, premiums increase with increasing age and if the policyholder has preexisting medical issues.

What is the optimal age to begin shopping? Deb Newman, the founder of Newman Long Term Care, an independent insurance business located in Richfield, Minnesota, had this to say about the age of 50: "I believe 50 is the golden number."

If you've already reached the half-century mark, you shouldn't give up hope. Jesse Slome, executive director of the American Association for Long-Term Care Insurance, recommends submitting your application at least sixty days before your subsequent birthday in order to get a premium that is based on your present age.

2. Collaborate with an unaffiliated agent

There is a disparity in cost amongst insurers for the same level of protection. Some recommend working with an agent that is able to sell insurance from many carriers rather than merely providing quotes for them. If you have a competent agent, they will be able to tell you which companies will most likely accept you for coverage depending on the condition of your health and provide you the best rate possible.

Even if you are given a chance to get long-term care insurance via a group, such as through your job, you should still shop about and compare prices. If you are in good health, doing it alone can allow you to locate a better rate.

3. Create a spending plan first

According to Brian Gordon, president of Maga Ltd., an independent long-term care insurance agency located in Bannockburn, Illinois, one piece of advice is to determine how much you are comfortable spending on coverage and then ask the insurance agent for estimates that are within your price range. If someone is going to have trouble paying the payment, Gordon strongly recommends that they should not get an insurance policy.

If you are unable to meet the requirements for long-term care insurance or pay the premiums, you should discuss your alternative choices with a financial expert. Nursing home care is covered by Medicaid, a joint federal and state insurance program for persons with low incomes. However, in order to be eligible for Medicaid benefits, you are required to spend down the majority of your assets first.

4. Make reasonable preparations

According to statistics from the Administration for Community Living, which is part of the United States Department of Health and Human Services, in the year 2020, about seventy percent of people who are 65 years old will need the assistance of long-term care services. According to findings published by the auditing and consulting company PwC, often known as

PricewaterhouseCoopers, in 2017, the typical cost of long-term care over the course of a person's lifetime is $172,000.

But very few people want to contemplate it at all.

According to Newman, the first thing that comes to people's thoughts is the terrible idea of living in a nursing home. Despite this, the HHS reports that the majority of long-term care is delivered at the patient's own home.

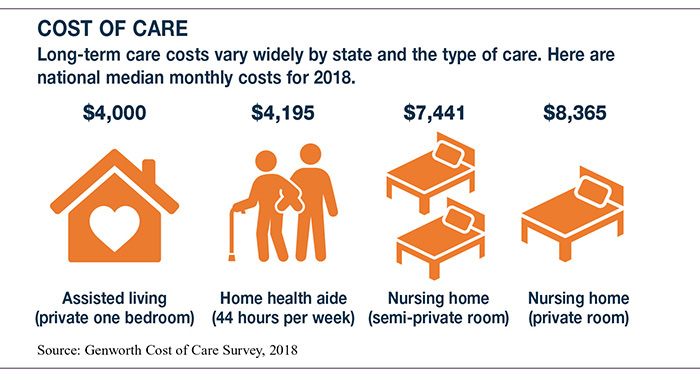

In Newman's opinion, clients should purchase enough insurance to cover the costs of in-home medical care for many years. Facility health aides cost $54,912 per year, while semiprivate nursing home rooms cost $93,072 per year, according to the Genworth 2020 Cost of Care Survey. The insurance will cover some of the costs of a nursing home if you buy enough to pay for home health care but end up there instead.

Lynch recommends taking a look at the expenses of care in your region in order to get an approximation of how much coverage to purchase.

5. Opt for a straightforward approach rather than a complicated one

According to Slome, you should inquire about quotations for excellent, better, and best coverage from each provider to get an idea of the prices associated with each level.

You should avoid introducing extra components, often known as riders, if at all possible. According to Gordon, "Keep it a nice, uncomplicated long-term care coverage without all the bells and whistles" is the best approach.

Reinstatement advantages" rider is an instance of this: If you require long-term care but recover, the benefits you used will be returned to your account for future use. But according to Gordon, if a person begins to need long-term care, it is often the case that they will continue to require it.

Your benefits might increase according to the rate of inflation if you have an inflation protection rider. The price of the insurance policy will go down if the inflation protection is decreased from, say, 3 percent to 1 percent. According to Lynch, if you are older, for example, 70 instead of 55, you may be able to get away with purchasing less inflation protection.

One more thing to consider

When purchasing long-term care insurance, you should steer clear of taking an all-or-nothing strategy.

According to Gordon, "There are occasions when consumers turn to insure one hundred percent of the expense of the treatment." Consider, as an alternative, the charges you are able to bear as well as the things you want to be insured against. "Do not make purchases that are in excess of what you need."