It might be hard to imagine now, but the likelihood is that you'll need some help taking care of yourself later in life. The big question is: How will you buy it?

Buying long-term care insurance is a method to organize. Long-term care refers to several services that aren't covered by regular insurance. This includes help with daily tasks such as showering, dressing, and getting into and out of bed.

A long-term care policy helps cover the prices of that care once you have a chronic medical condition, a disability, or a disorder like Alzheimer's disease. Most policies will reimburse you for the care given during a sort of place, such as

- Your home.

- A home.

- An assisted living facility.

- An adult daycare center.

Considering long-term care costs is a crucial part of any long-range budget, especially in your 50s and beyond. If you already have a crippling condition, you won't be eligible for long-term care insurance, and most long-term care insurance carriers won't approve most applicants beyond 75 years old—the majority of people with long-term care insurance are in their mid-50s to mid-60s. Waiting until you would like care to shop for coverage isn't an option.

Depending on your circumstances and preferences, long-term care insurance may or may not be the best option for you.

Before you buy coverage, it's essential to find out more about the subsequent topics:

- Why buy long-term care insurance?

- How popular is long-term care insurance?

- How long-term care insurance works

- Cost of long-term care insurance

- Tax advantages of shopping for long-term care insurance

- Where can I get long-term care insurance?

- Knowing how state "partnership" plans work

Why buy long-term care insurance?

According to 2020 figures from the Administration for Community Living, a US Department of Health and Human Services division, about 70% of 65-year-olds will require long-term care services or support. Women typically need to look after a mean of three .7 years, while men require it for two .2 years.

Regular insurance doesn't cover long-term care. It doesn't buy custodial care, which incorporates supervision and help with day-to-day tasks. And Medicare won't come to the rescue, either; it covers short home stays or limited amounts of home health care once you require skilled nursing or rehab only.

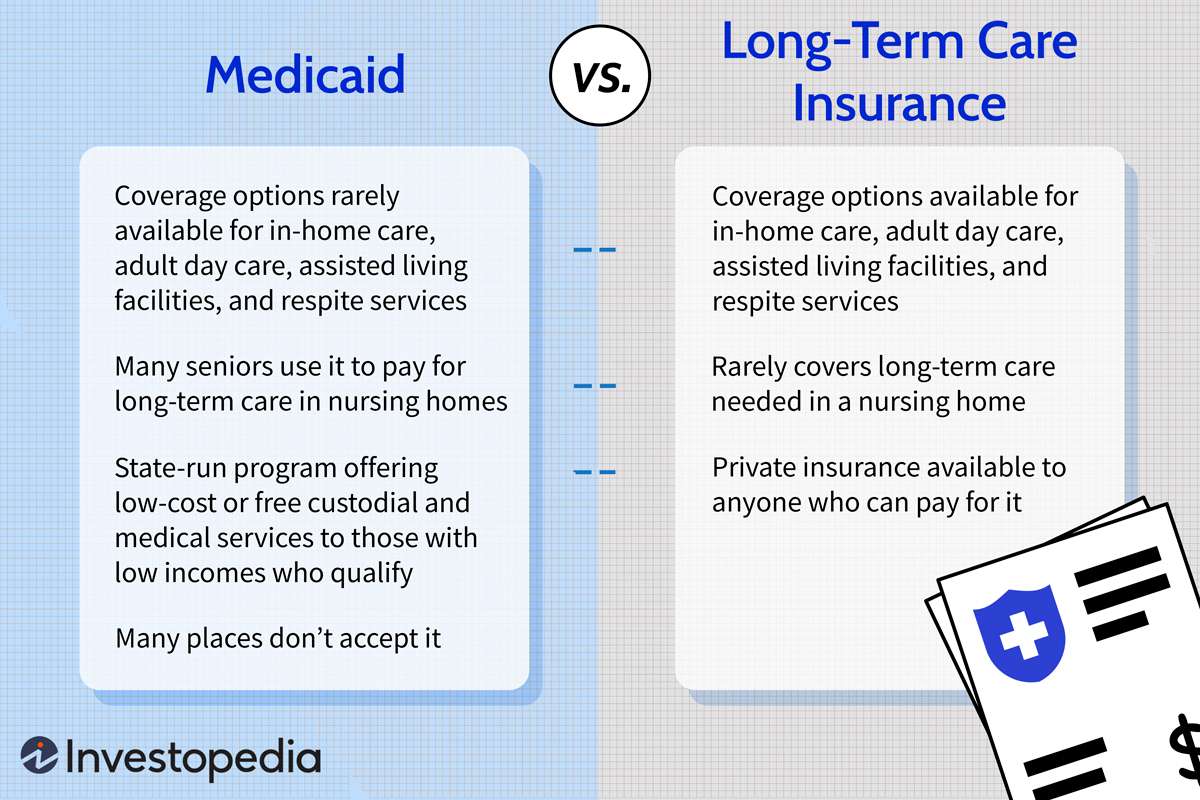

If you don't have insurance to hide long-term care, you'll need to buy it yourself in most states. You'll qualify for Medicaid, a federal and state-run insurance program for low-income people, but only after you've depleted your funds.

Nerdy Tip: In 2025, Washington state will provide long-term care insurance to eligible residents, funded by a payroll tax that begins in 2022. Washington workers may cop-out of the program if they buy a personal long-term care policy before All Saints' Day, 2021. For additional information, go to the WA Cares Fund website.

Long-term care insurance is purchased for two reasons:

To keep money safe. Long-term care bills can quickly empty a retirement fund. The median cost of care during a semiprivate home room is $93,072 a year, consistent with Genworth's 2020 Cost of Care Survey.

LONG-TERM CARE ANNUAL MEDIAN COSTS IN 2020

| Home health aide |

Homemaker services |

Adult day health care |

Assisted living facility |

Nursing home care |

| $54,912 |

$53,772 |

$19,236 |

$51,600 for a private one-bedroom |

$93,072 for a semiprivate room

$105,852 for a private room |

Source: Genworth 2020 Cost of Care Survey

To give you more choices for care. The extra money you'll spend, the higher the standard of care you'll get. If you've got to believe in Medicaid, your choices are going to be limited to the nursing homes that accept payments from the govt program. Medicaid doesn't buy assisted living in many nations.

Buying long-term care insurance won't be affordable if you've got a coffee income and small savings. Some experts advise spending less than 5% of your salary on a long-term care coverage, according to the National Association of Insurance Commissioners.

What is the popularity of long-term care insurance?

Since 2000, the number of insurance firms offering long-term care insurance has decreased dramatically. Slightly quite 100 insurers were selling policies in 2004, consistent with 2020 data from the National Association of Insurance Commissioners. a few dozen are selling policies today.

The uncertain cost of paying future claims and low-interest rates since the 2008 recession led to the mass exodus from the market. Low-interest rates hurt because insurers invest the premiums their customers pay and believe the returns to form money.

The market is constant to varies. One of the essential remaining carriers, Genworth, suspended individual long-term care insurance sales through agents and brokers in March 2019. the corporate sells policies to groups and on to individual consumers through its own sales division.

How long-term care insurance works

To buy a long-term care policy, you fill out an application and answer health questions. The insurer may ask to ascertain medical records and interview you by phone or face to face.

You choose the quantity of coverage you would like. The policies usually cap the quantity paid out per day and, therefore, the amount paid during your lifetime.

Therefore once you're approved for coverage, and the policy is issued, you start paying premiums.

You're qualified for coverage under most long-term care insurance if you can't accomplish two out of six "activities of daily living," or ADLs, on your own and have dementia or other cognitive impairment.

The activities of daily living are

- Bathing.

- Caring for incontinence.

- Dressing.

- Eating.

- Toileting (getting on or off the toilet).

- Transferring (getting in or out of a bed or a chair).

When you require assistance and need to form a claim, the insurance firm will review medical documents from your doctor and should send a nurse to try to do an evaluation. The insurer must first approve your care plan before approving a claim.

Under most policies, you'll need to buy long-term care services out of pocket for a particular amount of your time, like 30, 60, or 90 days, before the insurer starts reimbursing you for any care. this is often called the "elimination period."

The policy starts paying out after you're eligible for benefits and typically after you receive paid to look after that period. Most policies ante up to a daily limit for care until you reach the lifetime maximum.

When both spouses acquire policies, some firms provide a shared care option. This enables you to distribute the total coverage amount, so you'll draw from your spouse's pool of advantages if you reach the limit on your policy.

Cost of long-term care insurance

The rates you pay depend upon a spread of things, including

Your age and health: The older you're and therefore, the more health problems you've got, the more you'll pay once you buy a policy.

Gender: Women generally pay quite men because they live longer and have a greater chance of creating long-term care insurance claims.

Marital status: Married folks pay less than single persons for their insurance.

Insurance company: Prices for an equivalent amount of coverage will vary among insurance companies. That is why comparing quotes from several carriers is crucial.

Amount of coverage: You'll pay more for richer coverage, like higher limits on the daily and lifelong benefits, cost-of-living adjustments to guard against inflation, shorter elimination periods, and fewer restrictions on the kinds of care covered.

A single 55-year-old man in healthiness buying new coverage can expect to pay a mean of $1,700 a year for a long-term care policy with an initial pool of advantages of $164,000, consistent with the 2020 price level from the American Association for Long-Term Care Insurance. At the age of 85, those benefits will have compounded at a rate of 3% per year, totaling $386,500. For an equivalent policy, one 55-year-old woman can expect to pay a mean of $2,675 a year. They typically combine premiums for a 55-year-old couple, each buying that quantity of coverage, which is $3,050 a year.

Many consumers have seen increases in their rates in recent years as insurance companies sought approval from state regulators to raise prices. Regulators approved the speed increases because they wanted to form sure the insurance companies would have enough money to continue paying claims. They were ready to justify rate increases because the value of claims was above what they had projected. A caveat: the worth could go up after you purchase a policy; prices aren't bound to stay an equivalent over your lifetime.

Tax advantages of shopping for long-term care insurance

Long-term care insurance might provide tax benefits if you itemize deductions, especially as you get older. Federal and a few state tax codes allow you to count part or all long-term care insurance premiums as medical expenses, which are tax-deductible if they meet a particular threshold. The bounds for the number of premiums you'll deduct increase together with your age.

Limits on long-term care insurance tax deductions in 2021

| Age at the end of the year |

Maximum deductible premium |

| 40 or under |

$450 |

| 41 to 50 |

$850 |

| 51 to 60 |

$1,690 |

| 61 to 70 |

$4,520 |

| 71 and over |

$5,640 |

Source: IRS Revenue Procedure 2020-45.

Medical expenses are limited to premiums for tax-qualified long-term care insurance policies. Such policies must meet specific federal standards and be labeled as tax-qualified. Ask your insurance firm whether a policy is tax-qualified if you're unsure.

How to buy long-term care insurance

You can buy directly from an insurance firm or through an agent.

You might even be ready to buy a long-term care policy at work. Some employers offer the chance to get coverage from their brokers at group rates. Usually, once you buy coverage in this manner, you'll need to answer some health questions, but it might be easier to qualify than if you purchase it on your own.

Get quotes from several companies for equivalent coverage to match prices. That holds true, albeit you're offered a deal at work; you would possibly find better rates elsewhere despite the group discount.

Working with a long-term care insurance broker who can sell policies from at least three carriers, according to the American Association for Long-Term Care Insurance, is a good idea.

The group discovered that rates varied substantially among insurers in its 2019 price comparison.

Understanding state 'partnership' plans

To encourage consumers to plan ahead for long-term care, most states have "partnership" programs with long-term care insurance firms.

Here's how it works: The insurers comply with offer policies that meet specific quality standards, like providing cost-of-living adjustments for benefits to guard against inflation. Reciprocally for purchasing a "partnership policy," you'll protect more of your assets if you employ up all the long-term care benefits they want help through Medicaid. Generally, in most states, as an example, one person would need to spend down assets to $2,000 to be eligible for Medicaid. If you've got a partnership long-term care plan, you'll qualify for Medicaid sooner. In most states, you'll keep a dollar that you would generally have had to spend to qualify for Medicaid for each dollar your long-term care insurance paid out.

Ask your state's insurance department to find out whether your state features a long-term care partnership program.

As you create a long-range budget, the potential cost of long-term care is one of the essential things you'll want to think about . ask a financial advisor about whether buying long-term care insurance is the best choice for you.