Peer-to-peer lending has come on strong since the financial meltdown – and not by coincidence. That was about the time that banks decided they weren’t lending to anybody. The choice opened a chance for the free market to supply differently for people to borrow money. And that’s when the peer-to-peer phenomenon started getting popular. There are tons of reasons why P2P lending has grown so quickly. But is it a legitimate loan source for you? Learn more about getting a loan as a part of your decision-making process.

The complete guide to peer-to-peer lending:

What is peer-to-peer lending?

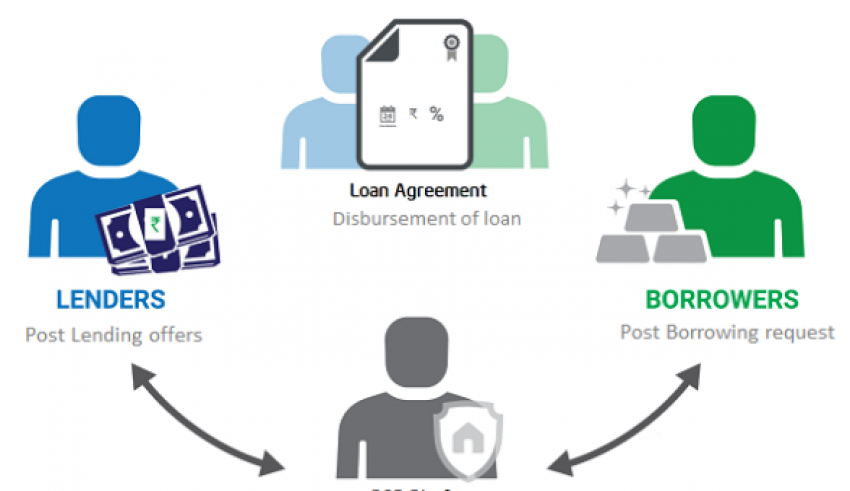

Peer-to-peer lending can loosely be thought of as non-bank banking. That is, it’s a process of lending and borrowing that takes place without the utilization of traditional banks. And for that reason, it's entirely different from conventional banking. Peer-to-peer lending is usually a web activity. Borrowers come to the varied peer-to-peer lending websites trying to find loans – and better terms than what they will get through their local bank – while investors come looking to lend money at much higher rates of return than what they will get at a bank. On the surface, it will seem as if the upper rates paid to peer-to-peer lending investors would end in higher loan rates for borrowers, but that’s not generally the case. Commonly referred to as “P2P”, It’s an appointment that “cuts out the middleman,” more commonly referred to as the banker. Peer-to-peer lending brings borrowers and investors together on an equivalent website. Commonly referred to as “P2P”, it’s an appointment that “cuts out the middleman,” more commonly referred to as the banker. Here’s the thing, it costs money to work at a bank. You would like a physical bank branch that has got to be purchased and maintained. Furthermore, you may need to staff the operation with employees, which requires paying multiple salaries and related employee benefits. Then there’s the acquisition and maintenance of costly equipment, like in-house computer systems and software, also as sophisticated security equipment. Now multiply the prices of that single bank branch by multiple branches, and you begin to urge a thought why you would possibly pay 15% for a loan at an equivalent bank where you'll earn, but the tenth return on funds persisted deposit there. It’s not exactly an equitable – or democratic – financial arrangement. P2P lending doesn’t have all that bank branch land, hundreds or thousands of employees, or expensive equipment. And for that reason, you would possibly see an appointment that appears more like 10% loan rates and eight returns on your investment money.Lending sites within the U.S.

Though the whole concept of peer-to-peer lending started within the Third World decades ago, there are now dozens of P2P platforms operating within the US. Most people have heard of Prosper and Lending Club (which does not offer P2P lending), but there are several other lenders within the U.S. Market. Although Lending Club does not offer peer-to-peer lending, it has become one of the most important names in this field. Starting in 2007, Lending Club has since grown to become the most crucial peer-to-peer lending platform online. By the top of 2015, the location funded nearly $16 billion worth of loans, including quite $2.5 billion within the half-moon of the year. Lending Club was doing a bunch of things right. With the acquisition of Radius Bank, they announced that they might be retiring their P2P lending service in situ of a more traditional banking model.Other Peer-to-Peer Lending platforms:

SoFi: student loans and refinances

SoFi, which is brief for Social Finance, has become one of the leading sources for student loan refinances available anywhere. This site is virtually synonymous with student loans, though they also provide mortgages and private loans. The platform was founded by people that are on the brink of the school scene and well familiar with the nuances of student loan refinances. That’s a neighborhood of finance that's not adequately served by the banking system. There are just a couple of significant lenders who will provide student loan refinances, and SoFi is one of them. SoFi may be a lending platform where student loan refinances are mainly granted on the idea of non-traditional criteria, like sort of occupation, the school or university you graduated from, your GPA, and your major – also as your income and credit profile. But this suggests that authorization isn't strictly supported by income or credit. The education-related criteria weigh heavily within the decision. This is important because while student loans are granted on a virtually automatic basis, student loan refinances require that you qualify to support your ability to repay. SoFi considers your educational background as a part of the evidence that you can repay. Also, SoFi is out there seven days every week, and you'll complete the whole application process online. The site claims that the standard member can save a mean of $14,000 due to refinancing a student loan with them. SoFi currently has rates on student loan refinances ranging from 3.50% APR to 7.49% APR on fixed-rate loans and between 2.13% APR and 5.68% APR on variable rate loans. You’ll also refinance the whole amount of student loan debt that you currently have because the platform doesn't indicate any maximum loan amount. You can refinance both private student loans and federal student loans, though the location recommends that you take care in refinancing federal loans. This is often because federal loans accompany certain protections that aren't available with private source loans or a SoFi refinance. You’ve got to understand that sort of openness and honesty during a lender of any stripe!Prosper: first P2P lending platform

Founded in 2005, Prosper is the first among the favored peer two peer lending sites. The location has 2 million members and has funded quite $5 billion in loans. The platform works in a fashion almost like Lending Club, but not identical. Prosper brings individual investors and borrowers together on an equivalent website. This institutional participation is vital in itself; as peer-to-peer lending is rapidly growing, large institutional investors are getting more actively involved within the funding side. Many of those investors are significant concerns, like Sequoia Capital, BlackRock, Institutional Venture Partners, and Credit Suisse NEXT Fund. Prosper makes personal loans for amounts of between $2,000 and $35,000. The loan proceeds are often used for almost any purpose, including debt consolidation, home improvement, business purposes, auto loans, and short-term and bridge loans. You can also borrow money to adopt a toddler, purchase a ring, or remove “green loans,” which enable you to finance systems that are supported renewable energy. Loan terms range from 36 months to 60 months, with interest rates between 5.99% APR and 36.00% APR. Your loan rate is calculated on the idea of your Prosper Rating and is predicated on your credit score and credit profile, loan term, and loan amount. Loans are fixed-rate installment loans, which suggests that the debt is going to be fully paid by the top of the loan term. There are no prepayment penalties, and no hidden fees, though Prosper does charge origination fees. Once again, the whole process takes place online, where you'll complete an application in minutes and obtain your Prosper Rating. From that time, your interest rate is going to be determined, and your loan profile will be made available to prospective investors who will plan to fund the loan. But that process could happen in as little together or two days. Since funding is completed in small increments from multiple investors, the loan won't be fully funded until enough investors have sufficient interest. Learn more about the oldest of the P2P companies within us in our full Prosper review.PeerStreet: land loans

PeerStreet takes what Lending Club and Prosper did for private loans and applies it to land. Founded in 2013, Peerstreet has expanded rapidly, and its private marketplace is extremely easy to use. Unlike other companies that are funneling their investors into REITs, PeerStreet allows investors to take a position directly in land loans. The loans aren't your typical 30-year mortgages but short-term loans (6-24 months). The loans are for special situations, like the rehabilitation of a property that a landlord wishes to hire out. The annual returns for the typical investor compute to be between 6-12%, and you'll start investing with as little as $1,000. PeerStreet also does its underwriting on the properties and evaluates all their loan originators. The one downside to PeerStreet is that you must be an accredited investor to participate in their marketplace. This beautiful much eliminates most small investors from having an attempt at this unique P2P lender.Fundrise: property investment

Another crowdfunding source that only deals in the land are Fundrise. If you’re trying to find how to take a position in properties without trying to do the day-to-day duties of a landlord, investing with Fundrise is often superb, thanks to getting your foot within the door. One of the benefits of investing with Fundrise is you'll start with as little as $1,000. Fundrise uses all smaller contributions to take a position in larger loans. Fundrise is essentially a REIT, which may be a company that owns income-producing land. According to Fundrise’s website performance page, they had a return of 8.76% back in 2016. When you’re watching fees, Fundrise features a 1.0% annual fee. This includes all of the advisor fees and asset management. While 1.0% might sound like a lot compared to other investment routes, Fundrise has lower fees than other REITs. There are several benefits to picking Fundrise. If their returns stay the course, you'd possibly make quiet you would with a standard REIT or with other P2P sites. On the other hand, these investments are getting a touch riskier than other options. Getting started and investing with Fundrise is straightforward. You’ll create an account and begin investing in no time. Although you don’t have any experience investing in land, fundrise makes it incredibly easy. In fact, they now have Fundrise 2.0, which can handle all of the investing for you. Fundrise 2.0 will select the eFunds and eREITS and diversify your investments to support your goals.Funding Circle: business loans

Funding Circle may be a peer-to-peer lending site for people trying to find a commercial loan. This is often important because the banking system underserved the small business market. Not only do banks typically have extensive requirements before they're going to make a loan to little businesses, but they even have a preference for lending to larger businesses that are better established. The small, one-person, or woman shop is usually overlooked in the cold when it involves getting business financing. The platform has made quite $2 billion in loans to quite 12,000 small businesses worldwide. Loan terms are fixed-rate and range from one year to 5 years. With Funding Circle, you'll borrow as little as $25,000 to the maximum amount of $500,000 on a commercial loan at rates that start as low as 5.49% (the range is between 5.49% and 20.99%). And in fact, Funding Circle also has a fee, which is usually 4.99% of the loan amount you're borrowing. You can borrow money for a spread of business purposes, including refinancing existing debt, buying inventory or equipment, moving or expanding your operating space, or hiring more employees. One of the simplest features of Funding Circle is that you only got to be in business for as little as six months to 3 years. The appliance process takes as little as 10 minutes, and you'll receive funding within ten days. The entire process takes place online, and you'll be assigned your account manager to assist and guide you thru the method.Upstart: the non-traditional newcomer

A recent newcomer to the list of peer-to-see sites, Upstart began operations in 2014 but has already funded quite $300 million in loans. Among the leading peer-to-peer lenders, Upstart has the foremost in common with SoFi. Like SoFi, Upstart takes a better check out non-traditional underwriting criteria, preferring to look at a borrower’s potential, which incorporates consideration of the varsity you attended, the world of study, your academic performance, and your work history. The first focus is on looking to spot what they ask as “future prime” borrowers. Those are borrowers who are early in life but show signs of getting future solid potential. For this reason, the platform carefully evaluates factors that contribute to future financial stability and makes loans accordingly. They do take more traditional lending criteria like credit and income into consideration. For example, Upstart reports that the typical borrower on the platform features a FICO score of 691, a mean income of $106,182, is 91% likely to be a university graduate, and 76% likely to be refinancing credit cards. The last point is vital – borrowers who refinance credit cards are typically improving their financial standing soon due to lowering their interest rates, reducing their monthly payments, and converting revolving debt into an installment credit. Loan amounts range from $3,000-to $35,000, with terms of from three years to 5 years, and haven't any prepayment penalty. The location claims that its rates are 30% less than those of other lenders. Upstart reports that rates average 15% on a three-year loan, though they will range from 4.00% to 26.06% for three-year loans and between 6.00% and 27.32% for five-year loans. Like the other peer-to-peer lenders, Upstart also charges a fee, which may range between 1% and 6% of the loan. See the complete details in our Upstart Loans Review.PeerForm: individual and little business loans

PeerForm may be a peer-to-peer lending platform that was founded in 2010 and makes loans to both individuals and small businesses. The location is somewhat more tolerant of credit scores. They’re going to lend to borrowers with scores as low as 600 (most others require a score within the mid-600s or better). Much like the opposite peer-to-peer platforms, you begin by completing an easy online application that takes not quite a couple of minutes. You decide on the sort of loan you want; also, your request is put into a loan listing on the location because of the amount. That’s where investors plan to fund your loan (the process can take anywhere from some point up to 2 weeks). Once they are doing this, the knowledge you provided in your application is verified, and therefore the funding process begins. Interest rates range from a coffee of 6.44% to a high of 29.99% and need a fee of between 1% and 5% of the loan amount. However, there are not any application fees and no prepayment penalties. The loans are unsecured and need no collateral. You can borrow money for a good range of purposes, including debt consolidation, a marriage loan, home improvement, medical expenses, moving and relocation, car financing, and more. Loan amounts range between $1,000 and $25,000, and every loan is for a term of three years. Get all the small print on this great company in our Peerform reviews for investors and borrowers.Why would anyone invest through a P2P platform?

Higher returns on investment are a strong motivator. This is often very true since interest rates on completely safe, short-term instruments like market funds and certificates of deposit are commonly paying but 1% per annum. And albeit you would like to take a position in longer-term securities to urge higher returns, they’re not there either. For instance, the Ten Year US Treasury note currently pays just one .82% per annum. That’s an incredibly low return considering that you will need to tie your money up for an entire decade just to urge it. Your choices are 1. traffic jam your money with a coffee return or 2. lend your money with more risk and more reward. By contrast, an investor can quickly get a return within the neighborhood of 10% per annum on a portfolio of five-year loan notes, with blended credit profiles, by investing their money through a peer-to-peer platform. Yes, there’s more risk involved in investing/lending through a P2P platform – in any case, there’s no FDIC insurance on your money. But the speed is far above what it's on conventional fixed-income instruments. This is also because of the indisputable fact that a P2P investor can create his portfolio to match his risk tolerance. For this reason, peer-to-peer lending platforms tend to possess many investors’ money to lend out. And if you’re a borrower, that’s a win for you.Why would a borrower use P2P?

If investing through peer-to-peer sites makes common sense for investors, there are probably even more reasons why a borrower would want to urge a loan from one. Lower Interest rates – counting on the sort of loan taken, rates are often lower on P2P sites than what you'll get through a bank. This is often very true once you compare P2P rates with people for who you'll buy credit cards and business loans. It gets back to P2P platforms having a lower cost of doing business than the banks. They’re not lower altogether cases, but they’re always worth trying almost any loan type you would like to require. Bad credit, no problem – P2P platforms aren't subprime lenders, but they're going to make often loans that banks won’t. You’ll be charged higher interest if you've got credit blemishes, but which will be preferable to not having the ability to urge a loan in the least. Less restrictive – P2P platforms are tons less restrictive when it involves the aim of your loan. One example is business loans. A P2P lender might cause you to a private loan for business purposes, while a bank might not want to form a commercial loan in the least, under any guise. Ease of application – the whole loan process is handled online, so you never need to leave your house. Even third-party verification and document signing can usually be done online. All you would like to try to do is scan them, then either email them or download them to a portal on the P2P site. Speed – you'll often handle the whole loan process, from application to receipt of funds, in little as two or three days. Against this, certain bank loans can take weeks or months to tug out. No face-to-face meetings – Some people feel uncomfortable when applying for a loan requires a face-to-face meeting, particularly at a bank. Such meetings can often have the texture of a physical exam and include requests by bank personnel for information and documents that cause you to feel uncomfortable. There are not any face-to-face meetings once you apply for a loan through a peer-to-peer website. Anonymous processing – Investors will see your loan request, but you won’t be personally identified within the process. There’s little danger that a neighbor who works at a bank will have access to your loan information since a P2P isn't a bank.How it works

Each peer-to-peer lender works a touch bit differently from the others, but there are some common steps to the application process.Loan application steps

Brief questionnaire: The platform does a “soft credit pull,” You’re assigned a loan grade (we’ll get deeper into these with individual P2P reviews). Loan grade: Your loan inquiry will be made available to investors, who will review the loan request and determine if they need to take a position at the assigned loan rate (which supported the loan grade). Investor Interest: When enough investor interest is shown in your loan, your loan will be eligible to be funded. Documentation: Providing proof of income and employment and an inventory of existing debts that you shall repay with the new loan (refinances and debt consolidation loans are pretty familiar with P2P platforms). Application Review: The loan is then underwritten to form sure that the documentation supports your claims within the initial questionnaire; the package will either be approved for funding, or there'll be an invitation for extra documentation. Funding Approval: the loan documents will be prepared and sent to you for signature. Funds are typically wired to your checking account within 24 to 48 hours of the receipt of your signed documents by the peer-to-peer platform. Though the method could seem as if it takes several weeks, it'll proceed very quickly if you're prepared to furnish any right away, and everyone requires documentation. Since you'll usually scan and email information, the whole application process is often compacted down to just a couple of days.Loan Characteristics

Loan amounts granted are typically between $2,000 and $35,000, though many platforms will lend higher amounts for various purposes – all the high to overflow $100,000 counting on the loan purpose. You’ll usually be required to possess a credit score within the mid-600s or higher to qualify, though loans for those with bad credit are getting more common. And loans typically run between three years and five years, but once more, there's significant flexibility for various loan types and from different lending platforms. P2P platforms usually don’t charge application fees or any of the varied fees that banks generally charge in reference to loans. But one fee with peer-to-peer loans that you will get to remember is that they typically charge origination fees. They will represent anywhere from 1% to five of the loan amount provided and are usually deducted from the loan proceeds. So if you're approved for a $10,000 loan with a 2% fee, $200 is going to be deducted from the quantity of the loan proceeds that you simply waive. The actual amount of the fee is closely tied to your loan grade, which is essentially (but not entirely) determined by your credit profile. Other factors include the term of the loan, the aim, the loan amount, and your income or employment.Types of peer-to-peer loans

As the number of peer-to-peer lenders has expanded, so have the kinds of loans that are available through them.- Common loan types available include:

- Personal Loans

- Auto Loans

- Business Loans

- Mortgages

- Student Loans (including student loan refinances)

- Bad Debt Loans

- Medical Loans (for uncovered medical expenses)

Investing Software Services

As interest in investing through peer-to-peer sites becomes more popular, there's a growing demand for software services that will help investors select specific loans – or notes – that they need to take a position in. These software services help with the development, management, custody, and reporting requirements for a portfolio of peer-to-peer loans. These software services help with the development, management, custody, and reporting requirements for a portfolio of peer-to-peer loans. An example of such a provider is NSR Invest, which entered the P2P investing software services market last year. NSR Invest is hardly alone, albeit the industry is new. A number of the more prominent peer-to-peer investing software services include:- Lending Robot

- BlueVestment

- Peer Trader

- PeerCube