If you qualify for both, you should put as much money into retirement savings.

Opening either a traditional or a Roth individual retirement account (IRA) - opening either account is available as an option to you. Both the Roth IRA and the traditional IRA are excellent vehicles for saving money for retirement. You can open both within the same calendar year. However, the qualifying requirements and the contribution caps will determine how much money you can put into each account each year.

Key Takeaways

- Contributions to traditional Individual Retirement Accounts (IRAs) are generally made with money that has not yet been taxed. You can make contributions to either form of IRA.

- After-tax dollars are used to contribute to Roth IRAs instead of pre-tax dollars.

- In 2022, the maximum amount you can contribute to your IRA will be cut off at $6,000. However, in case you are 50 years of age or older, you are eligible to make catch-up contributions of an additional $1,000.

Traditional IRA vs. Roth IRA

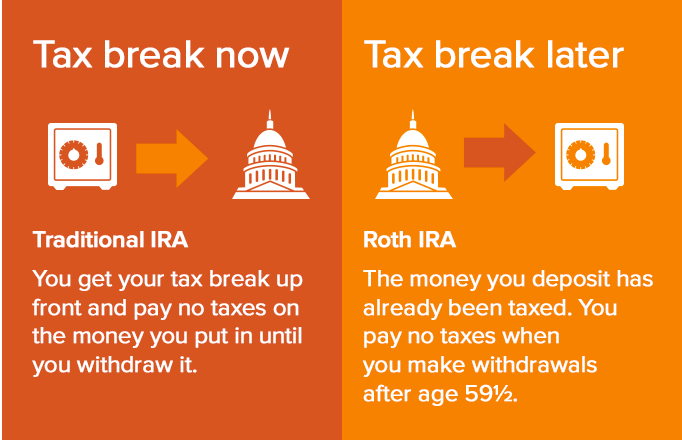

How money is classified when contributed to a Roth IRA instead of a traditional IRA is the primary factor that differentiates the two types of retirement accounts.

Traditional IRAs

|

Roth IRAs

|

| Tax-deductible contributions |

Not tax-deductible contributions |

| Savings taxed at withdrawal. |

Savings tax-free at withdrawal. |

| Growth and earnings taxable upon withdrawal. |

Growth and earnings tax-free if withdrawals are "qualified." |

| By a certain year, you must start taking required minimum distributions. |

You are not required to take required minimum distributions. |

Maximum allowable contributions to an IRA

Starting off in 2022, the maximum amount you may contribute to your IRAs each year is restricted to $6,000. However, if you are above the age of 50, you are eligible for catch-up payments that allow you to increase your total contribution amount to $7,000.

This limit on contributions is applicable to all of your IRA accounts taken together.

Contributions to an IRA are open to anybody who had taxable income in the previous tax year. However, income from dividends interest, or gains on investments do not count. You are only allowed to donate up to the amount you made in the previous year from your IRA.

The role that your income plays in determining your IRA contribution limits

There are restrictions on the amount of the IRA contribution deduction that taxpayers can claim with very high incomes. Still, contributing to a traditional IRA is unaffected by your income. Your ability to deduct that amount of money from your taxes is the only thing impacted by this.

The contributions to a Roth IRA work differently. Due to the limits associated with Roth accounts, certain taxpayers with higher incomes are unable to make contributions to these accounts.

Traditional IRA vs. Roth IRA - Which Individual Retirement Account is right for you?

If you put money into a traditional individual retirement account, you can immediately take advantage of the tax breaks that come with those contributions. In case you make contributions to a Roth IRA, you will have the opportunity to reap the potential long-term benefits of tax-free retirement income.

Your eligibility for making contributions to a Roth IRA may be affected if there are fluctuations in your income over time.

Frequently Asked Questions (FAQs)

What number of individual retirement accounts (IRAs) may one keep?

You are permitted to open any number of traditional IRAs and Roth IRAs. You may only be able to have one account of each type with a particular brokerage, but you are free to open as many accounts as you like with a different brokerage. However, opening several Roth IRAs or traditional IRAs isn't a good strategy for eliminating contribution caps. They continue to function as a cumulative cap across all of your accounts.

When are the declarations regarding limits to the IRA contributions for the following year made?

The Internal Revenue Service (IRS) will typically provide updated adjustment figures for inflation in the latter part of the calendar year. However, the maximum amounts contributed to an IRA aren't necessarily increased or altered annually. Since 2019, the maximum allowable contributions have been capped at $6,000 and $7,000.