Need help writing a present letter for a mortgage? You've come to the proper place. If you're within the market to get your first home, it isn't uncommon to urge some financial help from your relations or maybe close friends. This financial assistance is usually given as a present. For such monetary presents, most lenders typically want a written document certifying that the money is actually a gift and not a loan. Before you draft the letter, it is vital to know why one is required and what you would like to incorporate so your lender accepts it. At the top of this text, we've included a present letter template to assist you in drafting your gift letter for a mortgage.

What is a present letter for a mortgage?

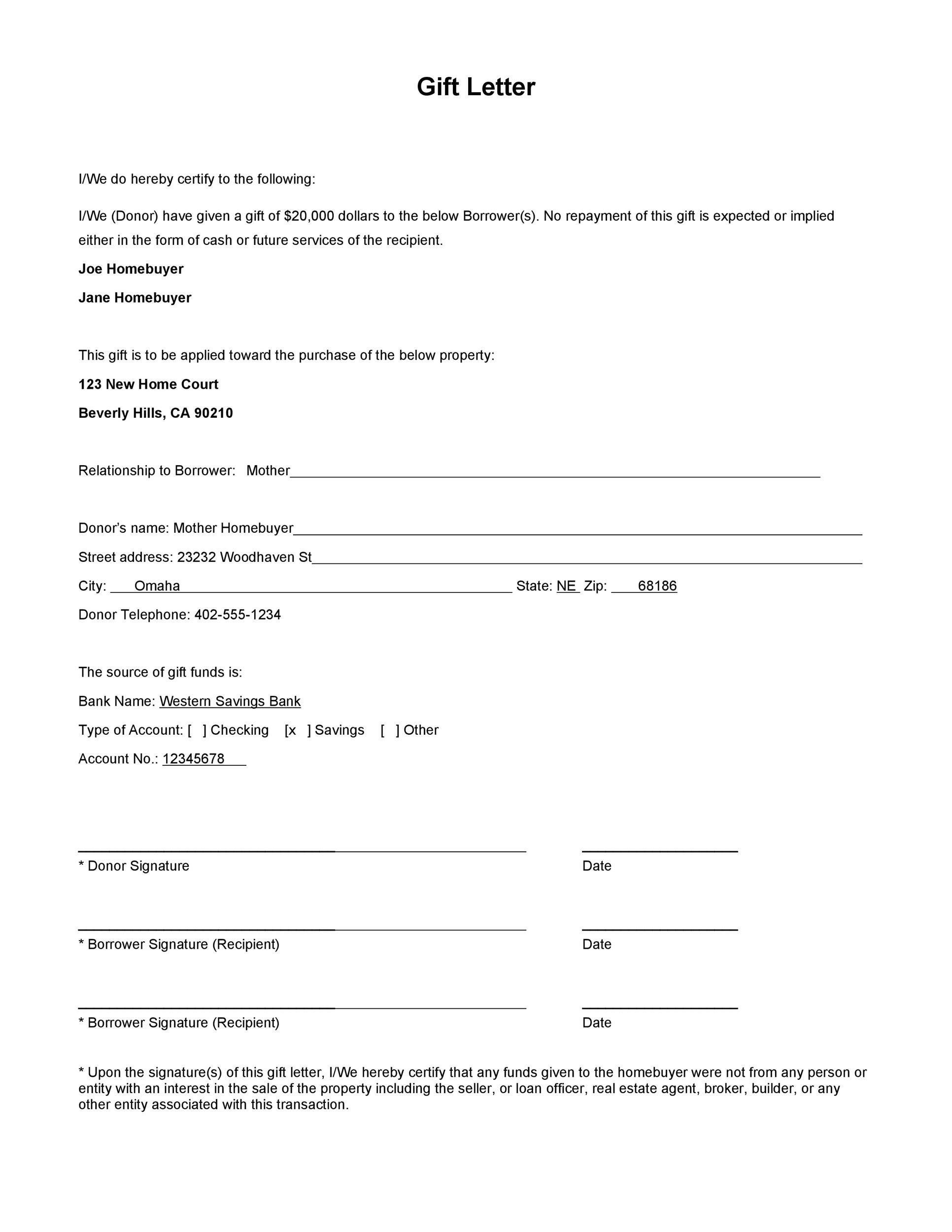

A present letter for a mortgage may be a formal letter stating that funds from a donor are a present that never has got to be repaid. A mortgage lender reviews this as a part of the appliance package. There is a variety of critical components a lender will look out for:- The Name of the donor, address, and telephone number

- Relationship to donor

- The precise gift dollar amount

- Funds transfer date

- A clear statement that this is often purely a present with no payback required

- Address of the property that the funds are going to be used for

- Payment method the donor is using for the transfer (bank account information, checks, etc.)

Why does the bank invite a mortgage gift letter?

You may wonder why a lender requires a mortgage gift letter in the first place. Well, lenders want to make sure they know your existing debt obligations before you take on a mortgage. This is often because an individual who features a high debt burden presents a way higher risk to the lender. They primarily want to avoid situations in which someone receives funds for a downpayment on a home and then needs to pay it back in a shorter period of time. If this occurs, the borrower's ability to make mortgage payments may become more difficult. That being said, someone who receives some of or all of their home downpayment funds as gift money may be a completely different story. They might not owe anyone a payment which suggests a lower overall debt obligation. If banks didn't enforce a proper mortgage gift letter, they could encounter increased fraudulent activity. As a result, a politician's letter clears up any questions and concerns they could have. It is critical to call your lender and learn the specific information contained in the letter. To accept the contribution, certain lenders may want extra information.How much money are you able to receive as a gift?

There are a couple of rules that apply to deposit gifts. These boil down mainly to the tax implications involved. For starters, a present recipient doesn't face any tax consequences. A gift-giver, on the other hand, might. There are specific levels at which a gift-giver must pay taxes based on IRS guidelines. As of 2022, an individual can gift up to $16,000 tax-free. A marriage filing jointly can gift up to $30,000 free from any tax penalties. The IRS doesn't require additional filings if the standards above are met. On the flip side, there'll be tax implications if the gift exceeds the bounds above. The gift-giver must file a return. If you're giving a present, we encourage you to talk to your accountant or tax advisor to know the impact on your finances.Who can offer you a gift?

So you've nailed down what proportion you'll receive as a present. However, you continue to confirm another piece of data - who is supplying you with the gift. As you can see, there are varying restrictions for different lenders and mortgage programmes. Some people only accept gifts from blood relatives or a godparent. In contrast, others allow gifts from friends and non-profit organizations. Some recent samples of this include conventional loans through Federal National Mortgage Association or Federal Home Loan Mortgage Corporation. For these, relations are the sole eligible donors. This will include family by blood, marriage, or adoption. It also can include fiances. Another category is FHA loans. Under FHA loans, nieces, nephews, and cousins don't count. However, close friends do. Additionally, non-profits, employers, and labor unions do qualify. VA and USDA loans are the most permissive categories. Anyone can be a present donor under these loans. The sole restriction is that the person cannot hold any interest in purchasing your home. An example of this can be your housing agent or your lawyer. Do you have to use one?Getting a present of equity? Here's what you ought to know

Another alternative your donor may provide may be a gift of equity. This gift occurs once you purchase a property from a relative for less than the asking price. The asking price minus the worth that you pay is the gift of equity. You'll use your gift of equity towards your deposit, points, and shutting costs. Gifts during this category can only come from a loved one. Moreover, FHA loans allow the utilization of gifts of equity, supplying you with more options to pay down the loan. Jumbo and VA loans, on the other hand, do not allow the use of gifts of equity. Like the above, a borrower must submit a presentation of equity letter to urge the ball rolling. Minimum contribution amounts still apply.Mortgage gift letter template

Now that we've ironed out the fine details around a present letter for a mortgage, it's time to require a glance at a present letter template.Sample gift letter for mortgage

- Address: [Insert your address]

- To: [Insert bank name or lender name and address]

- Date:

- I/We [insert name(s) of gift-giver(s)] shall make a present of $[exact dollar amount of gift] to [name of recipient]. [Name of recipient] is my / our [insert relationship].

- This gift will go towards the acquisition of the house located at [insert the address of the property under consideration].

- [Name of recipient] isn't expected to repay this gift either in cash or services. I/we won't file a lien against the property.

- The gift source is from [insert name of the bank, description of the investment, or other accounts the gift is coming from].

- [Insert donor signature(s)]

- [Print name]

- [Donor address, telephone, and email]