Learn about the components of EBITDA and the formula and limitations. EBITDA (earnings before interest, taxes, depreciation, and amortization) is a common metric for determining a company's profitability. This metric is one of several financial calculations that provide a picture of a company's financial health and value to both owners and potential investors. This article will go over EBITDA, how it's calculated, and what it means to you as a business owner.

Important Points to Remember

- The term "earnings before interest, taxes, depreciation, and amortization" (EBITDA) refers to earnings before interest, taxes, depreciation, and amortization.

- It's a measure of a company's operating income that excludes all other sources of earnings and deductions.

- EBITDA can be used by both business owners and investors to evaluate a company's profitability and overall financial health.

- EBITDA is not a cash flow metric, and it is not subject to Generally Accepted Accounting Principles (GAAP).

EBITDA Definition

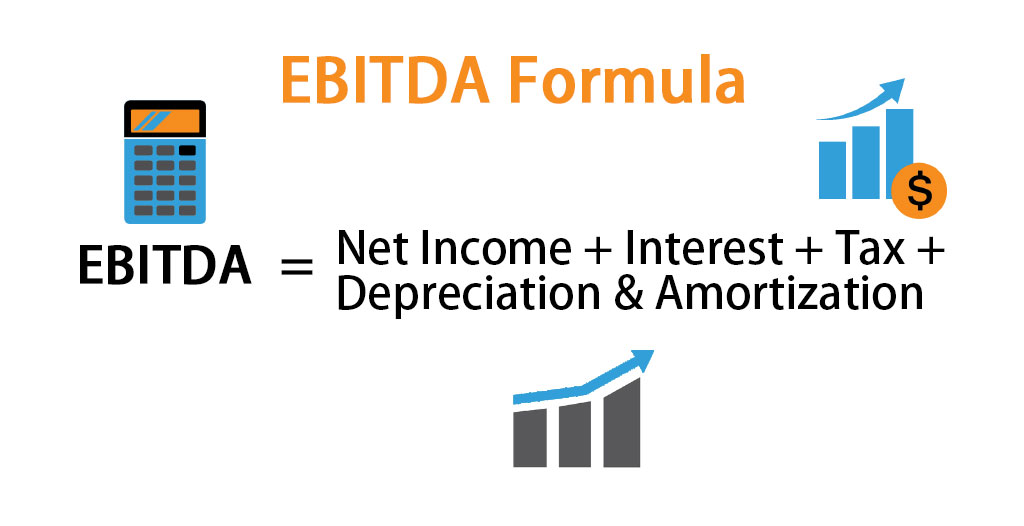

EBITDA stands for "earnings before interest, taxes, depreciation, and amortization," and it is a calculation that separates income from non-operational variables to find the income from a business's operations. Examine each component of the acronym in greater detail to understand better this metric, which can better reflect a company's operating profitability and financial health.Profits from a Company

A company's net profit or net income is the same thing as earnings. It's net income minus outgoings, and it includes all types of earnings. Operating income is the revenue generated by a company's primary activities of selling goods and services. The income after gross profits is shown as "net income" on a company's income statement (profit and loss statement) (profits from operating activities).The EBITDA Variables

The four variables are usually split into two sections on a financial statement: interest expense and taxes, followed by depreciation and amortization. Interest: Interest expense refers to the cost of borrowing money for business purposes. It could be the interest on a business loan or an investment in a business. Taxes: Taxes paid by businesses, such as income taxes, excise taxes, and employment taxes, are included in EBITDA (Social Security and Medicare taxes and unemployment taxes). Depreciation and amortisation are terms used to describe the process of a business deducting costs associated with purchasing and using long-term assets in order to generate profit. A business may deduct these costs over time depending on the type of asset. Depreciation is a method of calculating the cost of tangible assets such as cars, buildings, machinery, and equipment. Amortization is a method of deducting the costs of intangible assets, such as copyrights, trademarks, and patents, that have no physical form. Tip: A public company's EBITDA can be found in either its annual report to shareholders or its 10-K form, which is an annual report filed with the Securities and Exchange Commission (SEC). These filings can be found in the SEC's EDGAR database.What Is EBITDA and How Does It Work?

The following is the EBITDA formula: EBITDA = Net Income + Interest Expense + Taxes + Depreciation + Amortization = Net Income from An example of EBITDA calculation is provided in the table below. $200,000 in net profit 15,000 dollars set aside for income taxes 5,000 dollars in interest costs 8,000 dollars for depreciation and amortization $228,000 in EBITDAFor Individual Investors, What Does EBITDA Mean?

As part of their investment analysis, investors can compare the EBITDA information for several businesses. It allows them to examine companies solely based on their operations, excluding the effects of taxes, debt, and the cost of capital investments. It provides a solution to the question, "Which company generates the most revenue?" If investors consider several different types of businesses, they can rank them according to their EBITDA to see which one is best able to convert sales into profits. One of several methods for determining profitability is EBITDA. EBIT, or income before interest and taxes, is a similar analysis. Note: that EBIT includes interest and potential tax expenses but excludes depreciation and amortization, which are costs associated with investing in capital assets.EBITDA's Limitations

While EBITDA is a useful metric for determining profitability, it has some drawbacks. EBITDA, for example, does not account for cash flow, which is another important metric for businesses. A cash flow statement depicts the inflow and outflow of funds into and out of a company. EBITDA is also not used as a net income metric, as is required by generally accepted accounting principles (GAAP). The term "non-GAAP" may appear on an EBITDA calculation, indicating that it does not follow the standards.Most Commonly Asked Questions (FAQs)

What is adjusted EBITDA, and what does it mean?

Some businesses make an adjustment to EBITDA to account for:- Charges that are unusual

- Executive compensation based on stock options

- Expenses incurred in repaying debt

- Profit or loss from ceased operations (closing locations, for example)

- These particular circumstances could have an immediate or short-term effect on the profits of a business.

What exactly is the EBITDA margin?

In accounting, the margin, also known as the margin of safety, is used to compare a company's sales to its profit. Margin is used by investors to assess potential investments for risk and to determine the best price for a stock that is trading below its intrinsic value. Investors evaluate the margin of safety in various ways, including EBITDA margin.What does a good EBITDA multiple look like?

Multiples are a type of ratio that investors use to compare potential investments. The following are some examples of EBITDA multiples:- EBITDA as a percentage of sales

- Sales, general, and administrative (SG&A) expenses vs. EBITDA

- When comparing EBITDA to research and development (R&D) costs,