Do you find it challenging to manage your finances? It's easy to let things slip through the cracks when you've got a lot going on. Sadly, one of the first things to lose is financial progress.

It can sometimes make all the difference to have a plan in place. Americans report feeling more financially secure when they have a written financial plan. And, let's face it, putting things on the calendar increases their likelihood of being completed.

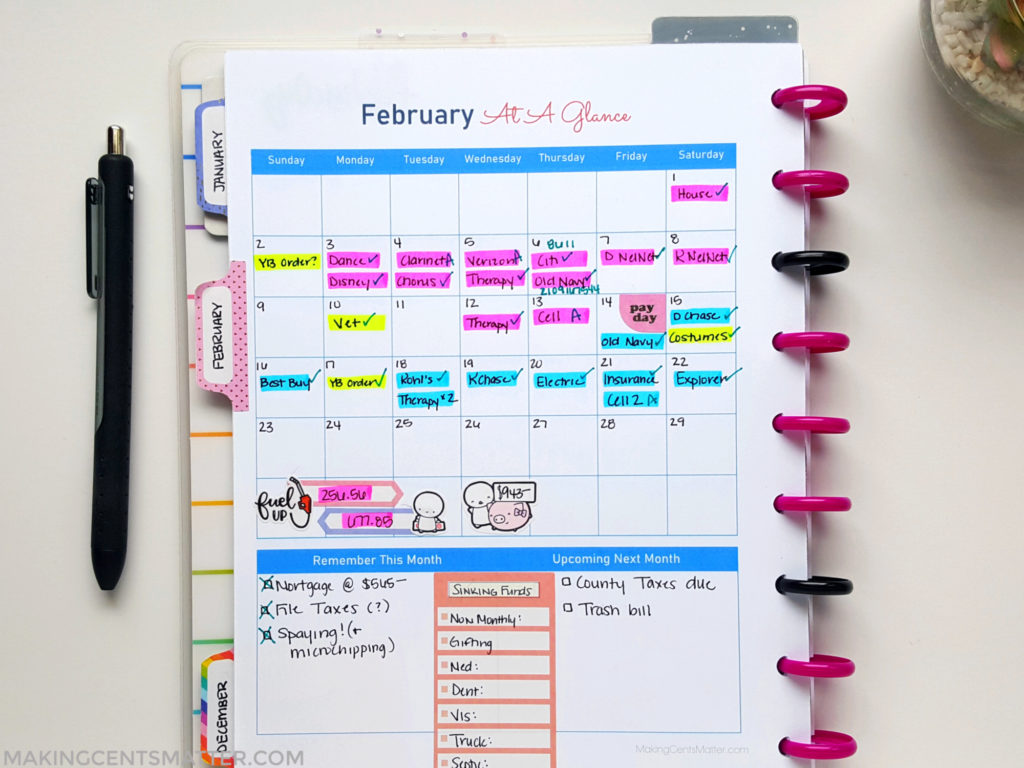

A budget calendar can help you with this. This one tool can assist you in getting back on track with your bills, breaking the paycheck cycle, and achieving your financial objectives. To begin, let's define a budget calendar.

What exactly is a budget planner?

A budget calendar (also known as a calendar budget) is a tool that can help you keep track of financial tasks, similar to how a standard calendar can help you keep track of impending activities and appointments. In other words, it's similar to making a budget on a calendar.

A budget calendar will help you recall due dates for all of your expenses and stay on track with your budget. It can also help you set and achieve financial objectives.

You can plan each transfer to your savings account until you've accumulated enough money to fulfill your goal. You may also make it work as a cash calendar to keep track of your current cash flow.

What are the benefits of using a budget calendar?

Although a budget calendar may not be for everyone, there are numerous reasons to give it a try. Here are three significant reasons:

1. A financial calendar serves as a visual reminder of your upcoming bills

It might not be easy to keep track of every bill that is due each month when you have a lot on your plate.

Missed payments have a variety of consequences, including late penalties and negative entries on your credit record. Even one late bill can lower your credit score by 150 points!

While measures like automating your payments might help you prevent missing payments, knowing when money is leaving your account is still important. A budget calendar serves as a visual reminder of your monthly expenses.

You can immediately understand how much money you're paying out and when by looking at the month ahead. If you want to budget per paycheck, this is an excellent tool to use.

2. A budget calendar makes it easier to plan ahead

Most people consider what they will do with their money this week or next month, but rarely plan further forward. However, preparing ahead is the key to making significant financial improvements.

Have you ever been caught off guard by yearly or biannual bills, such as vehicle insurance or property taxes? They come every year, so you know they're coming. They skipped your mind, though. To begin, a financial calendar can assist you in planning for large annual spending.

These charges might throw our budget off if we don't plan ahead for them. When we consider the year as a whole, though, we can begin preparing and saving for them sooner.

A budget calendar can also assist in saving for primary financial objectives. You and your friends have planned a girls' getaway for the coming year. However, unless you begin planning ahead of time, it may not be financially feasible when the time comes. You may start putting money down each month if you now put it on the calendar.

3. A budget calendar might help you break the cycle of living paycheck to paycheck

Many of us have experienced living paycheck to paycheck at some point in our lives. According to a Charles Schwab report from 2019, around 59 percent of Americans live paycheck to paycheck. And everyone who has been there knowing how difficult it is to stop the cycle.

Breaking the cycle with a budget calendar can be surprisingly successful. For starters, it makes you acutely aware of when money enters and leaves your bank account. The first step to getting ahead is to understand where your money is going.

A budget calendar can also assist in the establishment and maintenance of a savings habit. Assume you've been promising yourself for years that you'll put any money you have leftover at the end of each month into savings. However, there is never anything left by the end of the month.

Instead of depending on excellent spending habits, a budget calendar allows you to plan and save money.

Make a recurring appointment on your calendar to transfer money to your savings account as soon as you get paid each month, even if it's a tiny sum.

Once you watch your savings account grow, you'll be inspired to keep going and set even more ambitious financial objectives.

What is the best way to make a financial calendar?

So you've made the decision to create a budget calendar in order to benefit your finances. So, where do you begin? There are several considerations to be taken, such as whether to use paper or digital calendars and what goals to include.

Whether you prefer to budget weekly, bimonthly, or monthly, you have a budget. A budget calendar is helpful regardless of your budgeting method. Let us begin.

Alternatives to the budget calendar

A budget calendar can be set up in a variety of ways. We also have a plethora of options, thanks to technological advancements. Let's have a look at some of the calendar options:

a planner made out of paper

Setting up your budget using a good old-fashioned paper planner is a terrific idea.

Templates and Printouts

Many budget templates and printables, both free and paid, are developed explicitly for budget calendars.

Calendar software

A digital calendar such as Google Calendar might be a helpful budget tool if you prefer digital tools.

Budgeting app

Budget calendars have become so popular that firms are even developing applications to help you keep track of yours.

What should be on your budget calendar?

It's time to pick what to include in your calendar once you've decided on a format. Depending on your financial circumstances and ambitions, the list may appear slightly different for each person. Here are a few items to put on your calendar

Income

Make sure your monthly budget calendar covers all of your paychecks.

Bills

Add up all of your bills, including monthly bills like rent and electricity, as well as annual subscriptions.

Payments on debts

If you're attempting to pay off debt quickly and making extra payments, including those on your calendar.

Goals for saving

It is critical to have money set aside for unexpected expenses. Make sure you arrange your transfers if you're still building up your emergency money. You may also use your calendar to schedule transfers to savings accounts for financial goals like a vacation or a downpayment on a home.

Put everything together.

It's time to put it all together once you've chosen the correct budget calendar format and what you want to include! It can take a long time to set up your calendar for the first time.

It will entail reviewing all of your monthly, biennial, and annual bills. You can also list any upcoming events for which you want to save money during the year. It's much easier to keep track of your calendar once you've set it up. Another option is to use your calendar in conjunction with digital cash envelopes!

A budget calendar with design elements

Incorporating the correct design elements into your calendar can be surprisingly helpful in ensuring that you keep to it. Visuals can be used to make your calendar more aesthetically appealing, but they can also be used as tools to make your calendar more successful.

Choose a suitable size.

Everyone's correct solution will be different! Make your budget calendar a size that will be easy to stick to. Assume you're someone who is constantly on the move. You might not need such a large budgeting binder. It'll be a nuisance to transport, and you might as well give up on it.

Color coding is a great way to keep track of things.

Color-coding your budget calendar will help you stay on track. Color-coding can be used to organize your calendar in a variety of ways visually:

For a variety of reasons. If you get paid several times a month, you can identify which bills will be handled by each check by using a different color.

Different forms of expenses should be classified. You may, for example, use one color to emphasize monthly bills and another to emphasize when you'll move money to savings.

Bills to be assigned If you share costs with a partner or roommate, make a joint budget calendar and color-code each bill to remind everyone who is accountable for it.

Examining your financial calendar

A fiscal calendar isn't something you can set and forget. It's something you'll want to explore and review on a frequent basis, just like other elements of your finances. So, let's discuss how frequently you should examine your budget schedule.

How frequently should you go over it?

As a general guideline, go over your calendar at least as often as you get paid. This method enables you to plan for your money as soon as it arrives. You can make tweaks and adapt your calendar by reviewing it with each paycheck.

Let's imagine you opted to make an additional student loan payment. Your extra payment was scheduled on your budget calendar, but your car broke down.

Instead of paying that extra debt payment, you used the money to fix your car.

You can change your plans to account for the money spent on car repairs when you sit down to plan out your financial actions for your next paycheck. Perhaps you'll opt to use this new paycheck to make those extra debt payments or build up your emergency fund, so that car repairs don't throw your budget off in the future.

Use a calendar to set reminders.

When it comes to sticking to a new habit, whether it's keeping track of your finances or starting a new gym program, we all have the best of intentions.

But, let's be honest, things do slip through the cracks from time to time. Setting calendar reminders for yourself is one of the most effective techniques to guarantee you stay on your financial calendar. You can utilize them in a variety of ways.

Any strategy is only as good as its execution. To begin, set calendar reminders for yourself to examine your budget calendar. Make a recurring calendar reminder for payday, so you don't forget. Calendar reminders can also help you stay on track with your budget.

Calendar reminders can assist you in completing each of your financial tasks after you've put them on the calendar. Is the first of the month when rent is due? Make a reminder on your calendar to make sure you pay it.

To sum up

Using a calendar to budget, stay on top of your finances, and reach your objectives can be a terrific way to get organized. Remember, the key to successful budgeting is to use the method that works best for you!