Debt management is a necessity for anyone who carries even a modest amount of financial obligation. If you only have a small amount of debt, you still need to make sure that you keep up with your payments so that it doesn't spiral out of control. When you have a large amount of debt, on the other hand, you have to put in more effort to pay off your debt while simultaneously juggling payments on debts that you are not currently paying. This can be difficult to accomplish.

Know How Much You Owe

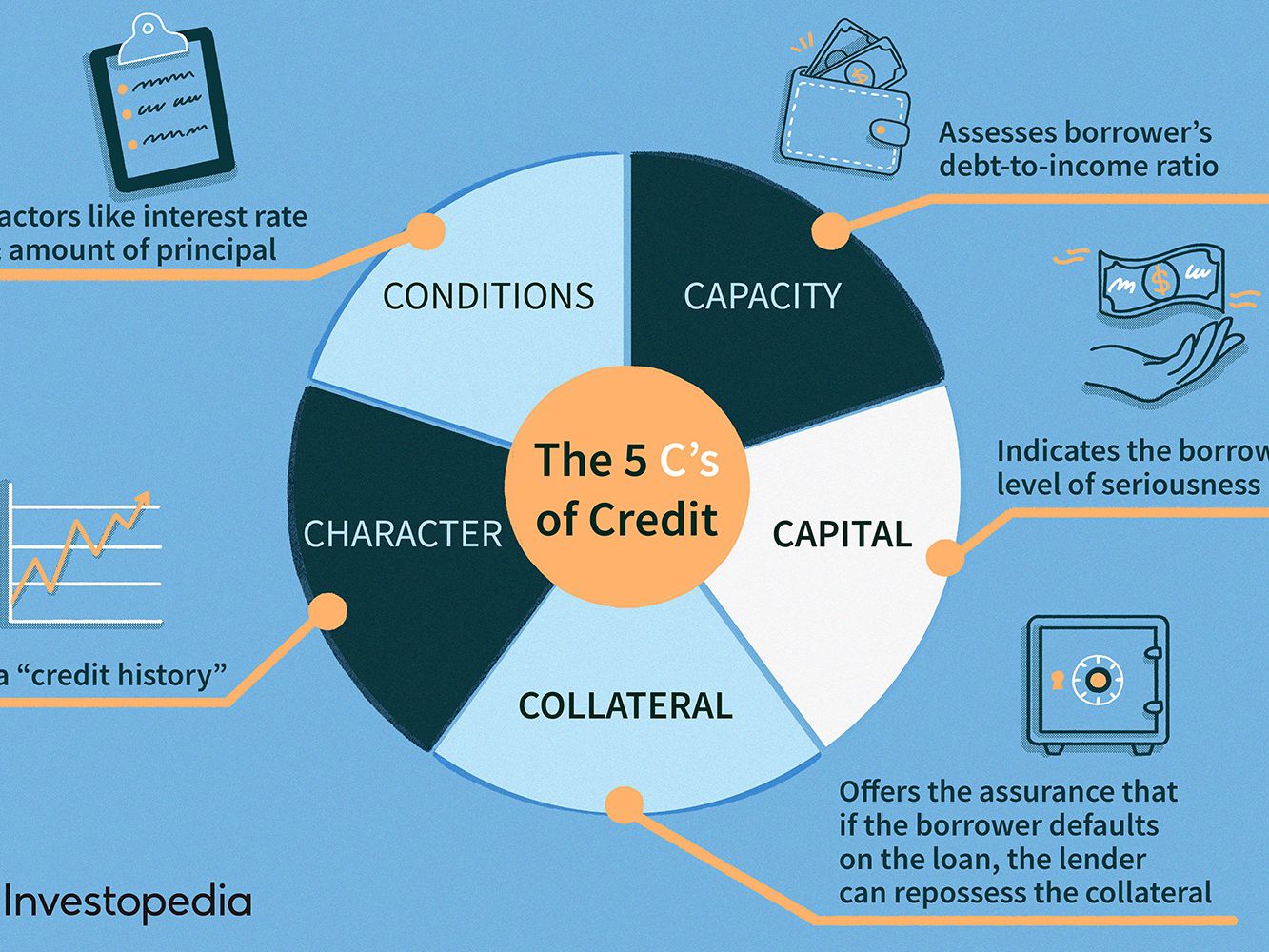

Create a list of all of your obligations, noting the name of each creditor, the total amount of your debt, the payment you make each month, the interest rate, and the due date. You can verify the debts that are listed on your list by consulting your credit report. You will be able to see the bigger picture and remain aware of your entire debt situation if you write down all of your obligations and keep them in front of you at all times. This process can be simplified with the help of debt reduction software. When you have a firm grasp on your financial obligations and earnings, you will be able to compute your debt-to-income ratio (DTI). This ratio will tell you what percentage of your income is being used to make payments on your debt. To determine it, divide the amount you pay toward your debts by your income and then multiply the result by 100. For instance, the monthly debt payment of $1,200 divided by the monthly income of $3,000 results in 0.4 multiplied by 100, which equals 40 percent. The lower this number is, the better, and keeping track of it can assist you in gaining a better understanding of your financial situation. Don't just make your list and then ignore it after you've done it. Make sure you check your debt list on a regular basis, especially when you are making payments on your bills. Keep your list up to date at least once every few months, especially if the total amount of your debt is fluctuating.Make Prompt Payment of Your Bills Every One Month

It will be more difficult to pay off your debt if you make late payments because you will have to pay a late fee for each payment you miss. If you are late with two payments in a row, the interest rate on your loan and the finance charges will go up. If you use a calendaring system on your computer or smartphone, enter your payments there and then set an alert to remind you of the payment's due date several days before it actually is due. If you are late on a payment, you should send it as soon as possible rather than waiting until the next due date because by then, the late payment may have been reported to a credit bureau. Instead, you should send your payment as soon as you realize that you forgot to send it the first time. Creating and sticking to a budget can both help you avoid falling into debt and assist you in climbing out of it. It gives you the ability to track not only how much money you earn but also where that money goes. Make sure you have enough money in your budget to cover the essentials, such as your rent or mortgage payment and utility bills. Put everything else on hold and concentrate on paying off your debt as quickly as you can.Make a schedule for the monthly payment of your bills

To assist you in determining which bills should be paid with which paycheck, you should make use of a bill payment calendar. Put the total amount that must be paid for each bill in the column corresponding to the due date on your calendar. After that, fill in the date that corresponds to each paycheck. If you get paid on the same day each month, for example, the first or the fifteenth, you can use the same calendar from one month to the next without changing it. If, on the other hand, you receive payment on a variety of days throughout the month, you will need to make a calendar for each new month.Make Sure You Meet the Bare Minimum Requirement

Make at least the required minimum payment even if you are unable to pay any additional amount at this time. Of course, you won't make significant headway toward eliminating your debt if you only make the required minimum payment. On the other hand, it maintains a good standing for your account, which helps you avoid late fees. When you are behind on payments, it becomes increasingly difficult to get caught up, and eventually, your accounts may default. Put away the credit cards and focus on getting your debt under control while you do so. Start replacing your credit cards with cash. Maintain the budget you've created and restrict your spending to items that can be paid for in cash.Determine which of your debts will be paid off first.

Due to the fact that credit card interest rates are typically higher than those of other types of debt, it is typically advisable to pay off credit card debt first. The credit card that has the highest interest rate should typically be given priority when it comes to repayment because it is the card that is costing you the most money. Make use of your list of debts to create a priority list and rank your obligations in the order in which you intend to pay them off. You also can focus on paying off the debt that has the smallest balance first. In the long run, this could end up costing a little bit more money, but paying off smaller debts first can help build confidence.Reimburse all outstanding collections and charge-offs

You can only put toward your debt the amount you are able to pay each month. When you have limited funds for repaying debt, you should focus on maintaining a good standing with all of your other accounts. You shouldn't put your good accounts at risk in order to fix accounts that have already hurt your credit. Instead, pay those accounts that are past due as soon as you are able to afford to do so.Create a Contingency Savings Account

If you did not have access to savings, you would be forced to go into debt in order to pay for an unexpected expense. Even a modest amount put aside in an emergency fund will be sufficient to cover unexpectedly high costs when they arise. To begin, make it a priority to establish a modest fund for unexpected expenses; $1,000 is a good initial target amount. Once you have achieved that, set a new objective for yourself to build a larger fund, such as $2,000 in total. At some point in the future, you will want to have a savings cushion that can cover your living expenses for three to six months. It is not difficult to persuade oneself that they "need" to make a certain purchase, such as a new television or a vacation. The reality is that there aren't that many things that are absolutely necessary for life. You will require things such as food, a place to sleep, clothing, a means of transportation, and similar things. For instance, you want steak, a nice house in the suburbs, designer labels, and a luxury car.Recognize the Indications That You Do Need Assistance.

If you are having trouble paying your monthly bills, including your debt, you may need to look for assistance from an outside source, such as a credit counseling agency. Other options for relief from debt include the following:- Debt consolidation

- Debt settlement

- Bankruptcy