Instructions for free on how to use check registers

Keeping a personal record of your checking account transactions can be made easier with the assistance of a check register. This gives you the ability to view and keep track of your current account balance, any withdrawals from or deposits made to your account, and transactions that have not yet been processed through your account.

Even if you have complete faith in your financial institution, keeping your own records is still a good idea, as you may have more up-to-date information about impending transactions than your bank does.

Key Takeaways

- A check register can be presented in various formats, but at its core, it is always a ledger in which you physically record your financial transactions.

- There is a possibility that you may receive a check register when you open a checking account; however, you are also able to locate one online, download one in the form of an app, or make your own.

- Tracking your account balance, which includes transactions that may or may not have been posted to your account yet, is the primary objective of using a check register.

- If you routinely use a check register, it can assist you in monitoring your expenditures, preventing overdraft penalties, and spotting errors made by the bank.

What exactly is it that a Check Register is?

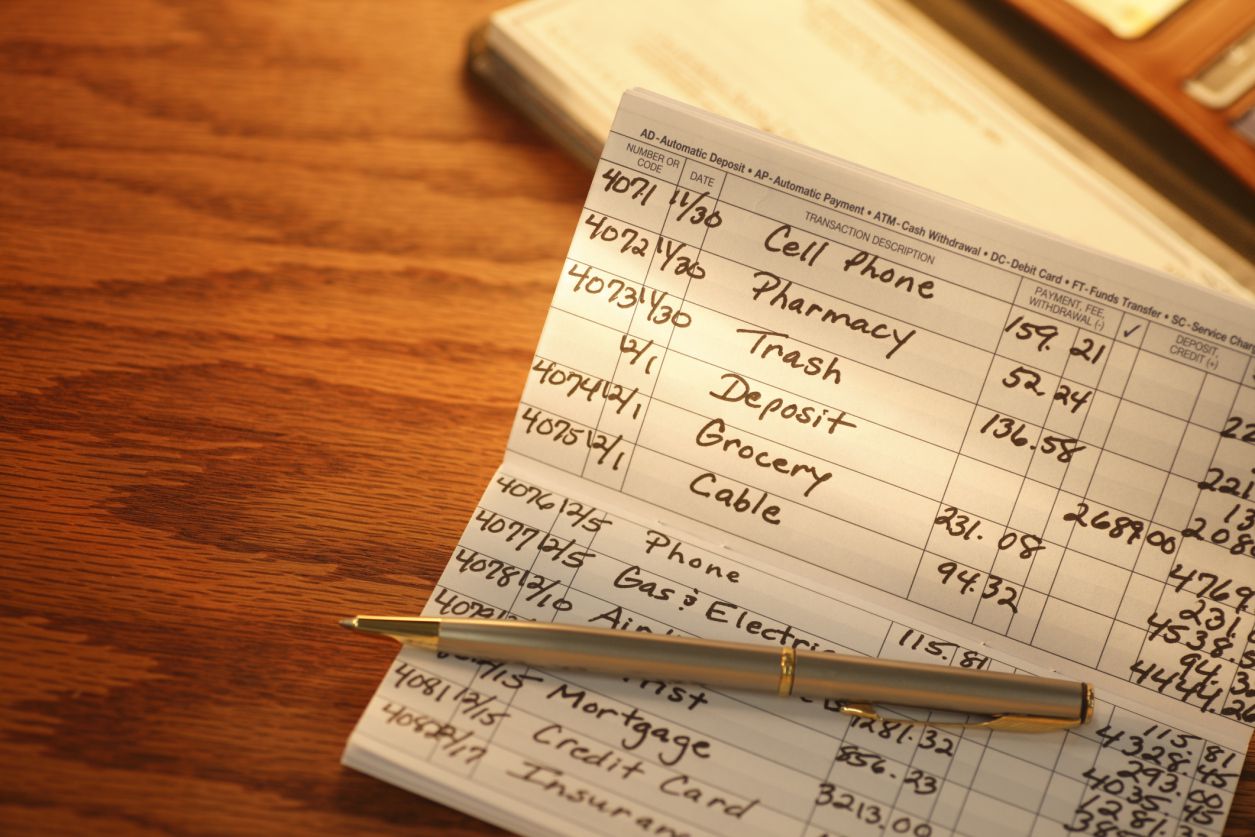

A check register is a list of transactions that have taken place in your bank account, together with a running balance that provides you with information regarding the amount of money that is available to be spent. You will need to update the list whenever you purchase or add money to your account. When it comes to keeping these documents, you can use paper, applications, or spreadsheets. It is also a good idea to make regular comparisons between your register and the records kept by your bank.

Check registers are often included with each order of checks. These registers typically contain several columns or fields that enable you to keep track of your transactions and balances. Check registers can also be generated electronically or by hand, allowing you to personalize your system and keep tabs on your account without having to purchase additional registers.

Instructions on How to Acquire a Check Register

Several options are available to you, some of which are free if you want a check register but did not receive one along with your checkbooks and would like to have one.

- You can get a free template for either Google Sheets or Microsoft Excel if you click here.

- Place an order for a new register with your bank or through an online check printer.

- Purchase a register from a retailer that specializes in office supplies.

- Take out the check register hidden in the back of your previous checkbook.

- Create a basic register using the software of your choice, whether it be a design program or a spreadsheet.

You can either print your a check register or make your own

Paper checkbook registers have been functional for many years, and some individuals choose to record this information by hand rather than using a digital system. You also can print off an essential registration that is found online.

It is not difficult to create your own register using either paper or a spreadsheet. It is also possible to modify the register's size, format, and column headings to meet your specific requirements.

Create a document with the following columns running across the top of it to build a check register:

- Check box: Use it to verify that the funds have been removed from your account.

- Check number or category: A listing of the check numbers

- Date: The date on which a transaction took place

- Notes: Descriptions that give details about a transaction

- A payment/Debit (-): Transactions involving payments, fees, and withdrawals

- A deposit/credit (+): Deposits, along with interest earned

- Balance: How much money you currently have remaining in your account after you complete a transaction

Why should one make use of a check register?

There are occasions when banks make mistakes, and there are also times when you could forget about transactions. Even if you check your account balance online, the information given to you on your available amount could be false. Keeping track of the activities in your account is made more accessible by using a check register.

You will find that using your check register will help you:

- Identify any errors made by the bank. These errors seldom work to your advantage and should be reported as soon as feasible.

- If you come across something you weren't expecting, report it as soon as possible so you can enjoy the complete protection that the law in the United States provides.

- Avoid having your checks bounce by: These are costly and will have a domino impact on your whole financial situation.

- Determine how much money you have available to spend: You will know whether you need to move money from your savings account into your checking account to cover your costs. Transferring funds from your savings account to pay impending costs is one way to circumvent incurring fees for an overdrawn checking account, for instance.

- Be aware of what you've already paid for: In case you are asked to provide proof of payment, you should keep a record of all the debts you have paid off, the amounts, and the dates.

- See spending trends: When you manually enter your expenditures, you are compelled to pay attention to what you are spending and make adjustments, if necessary.

When you forget overdue checks or automatic withdrawals, the information displayed on your online account could be misleading. Using a check register, you can better estimate how much money you have available to spend.

When to use your check register

Maintaining a conscientious attitude toward updating your check register following each transaction is essential to ensure that it is a trustworthy source of information regarding your financial activity. You must ensure that every time you use your debit card or write a check, you promptly record the transaction in your check register.

Keep the receipts from your ATM and debit card transactions, and record those transactions once a week at the very least. The more issues you have with checks being returned because they do not have adequate funds, the more frequently you will need to update your check register.

Another crucial step is checking your check register against your most current bank accounts for inconsistencies. In addition, your bank statement may include items that are not yet reflected in your check register, such as the following:

- Charges that you made to the bank.

- Payments of interest coming from the bank

- Transactions that are carried out automatically through the Automated Clearing House (ACH), such as the direct deposit of your paycheck or the payment of bills directly from your bank account

Check registers are helpful tools for keeping track of your transactions to avoid incurring penalties like overdraft fees and late payment fines. They can provide a precise record of your current financial status, which can assist you in more effectively managing your money.

Frequently Asked Questions (FAQs)

What is the proper way to complete a check register?

To start filling out your check register, record the amount in your account at the top of the column to the right. You should record all of the checks, debits, credits, and deposits in the register. You need to write down the check number or transaction number, the date, a description, and the amount of the debit or credit for each transaction. Add credits where appropriate to bring your balance on each transaction line up to date and subtract debits. When the funds from a transaction clear your bank account, make a checkmark next to the transaction.

Where can I find a place to purchase a check register?

Check registers that are blank and generic can be purchased from a variety of businesses, both in-person and online, such as office supply stores, Walmart, and Amazon, amongst others. You can also place an order for them with the firm that handles restocking your check supplies.