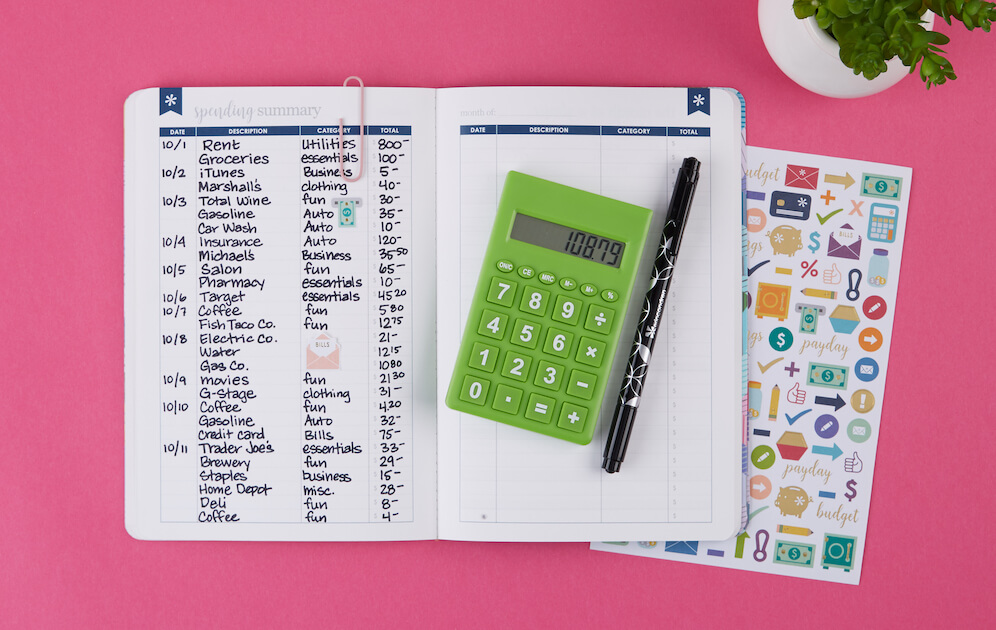

It's once again that time! It's the end of another month, and you're still baffled why you haven't made any progress toward your monthly financial goals. Perhaps you overspent on a home renovation or failed to account for a last-minute charge, but the budget has been blown again. Many traditional money management systems require you to keep a spreadsheet or input your expenditures into an app, but this isn't for everyone. If that describes you, a budget binder or other paper and pen solution could be the key to unlocking your financial success. What exactly is a budget binder? A budget binder makes using a zero-based budgeting method more obvious. You can see your financial goals at once and make adjustments as needed. Consider a budget binder to be a day planner for your finances. It can be tailored to your pay schedule, monthly or weekly bills, and spending habits. A budget binder is unique in that it is designed to assist YOU and YOUR budget. Along with a budget calendar, it's also an excellent way to arrange your finances. You can collect bills in real-time as they arrive, either online or by mail carrier. A budget binder also provides space to preserve any receipts you might need in the future and cash envelopes, and sinking funds. It's easier and faster to have all your financial documents in one location. What may a budgeting binder be used for? There are so many things that you can achieve with a budget binder, but here are a couple that we'll go over: Setting and tracking objectives Written down goals are a lot easier to stick with. When you write down your goals, you're more likely to achieve them than if you merely keep track of them in your head. You may dedicate an entire area to financial goals with a budget binder. Consider long-term goals like a down payment on a home or a new car. Christmas spending or replenishing a sinking fund, such as for house maintenance, are examples of short-term saving goals. You can keep an automated savings tracker spreadsheet to understand how to budget for the year and what has to be deducted from each paycheck to make it happen. Like those used for debt repayment, there are also trackers that you can colour or doodle to make it more enjoyable. It's an enjoyable and straightforward method to track your progress toward your objectives. Paycheck monitoring If you're someone who splits their wages between numerous bills, then creating a wiggle space between your paychecks can be tricky. You may keep track of upcoming expenses and assign the appropriate amount while still meeting your financial objectives with paycheck monitoring. A budget binder will help you keep track of your financial flow from payday to paycheck to avoid overspending before it happens. It's easy to blow money we think we have on frivolous items, so it's critical to give every dollar a purpose, which you can do with salary tracking. Tracking your debt repayment Regardless of the amount, paying off debt is a primary financial goal for many of us on our money management path. For some, the quantity may be more due to various life routes we have chosen, while for others, it may be due to multiple events. While credit card debt, student loans, and vehicle finance are the most frequent types of debt, others have medical debts or personal loans. With your binder, you can conveniently track your debt and debt payoff, regardless of the type of debt you have. Budget binders contain sections dedicated to debt repayment, including colour-in sheets to track your progress and a payout ledger. Paying off debt is fulfilling once you've decided on a debt repayment strategy. Having an entire section dedicated to seeing how far you've gone may be just what you need to keep going. Tracking expenses Choosing to track your expenditures is one of the most essential steps toward getting your finances in order. We typically have an "idea" of how much money we'd like to spend in each category, but we're not sure. Without recording your expenses, it's difficult to know if you're overspending or underspending in any category. We also forget to account for any fees we incur, monthly expenses that may arise, and previous subscriptions that we failed to cancel. Tracking your costs might also help you save money in these areas. You can not only write out your monthly budget in a budget binder, but you can also write out spending categories and keep track of how much you spend on each one. This is a fantastic approach to see if your spending is consistent with your values and goals. It's also the first step toward determining how much you're really spending in each area and whether you need to make any cuts. Our most significant flaws might sometimes be unpredictable spending areas like food, but your binder quickly rectifies this. Purposes of Planning Nothing sabotages my budget like forgetting costs. I entirely forgot when my auto registration was due, for example. Because my car is newer and more expensive, the few hundred dollars I didn't budget hurt a lot. I could have planned better and avoided being taken off guard if I had used a budget binder. A budget binder can be used to keep track of annual or quarterly spending so that you can prepare for any upcoming occurrences. You may plan out your meals and keep track of what you need to buy in the shop. You can also maintain track of vital financial records and login information so that someone can simply take over household money in the event of an emergency. Even if it were impossible, consider how easier it would be for your family. How to Organize Your Budget To make a budget binder, you don't need much. The true beauty of it is that you can make it as ornate or as plain as you desire. You're making something that you'll be able to stick to! You may find that you require the following items: A Binder The best binder for the job would be a three-ring binder with a transparent cover. You can either use an insert or design one yourself to customize the front. Because it will pass through a lot, I recommend at least a two-inch binder. Colourful pens I enjoy using different coloured pens to write different parts of my budget. It's a simple way to keep my categories distinct and know how much money I have when I go out. Paper clips and white-out You're bound to make a few errors, so having a white-out on hand is essential. Paper clips should also be kept on hand so that you may attach any to your tracker documents or receipts. Dividers in plastic pockets Dividers would be a simple method to divide different sections of your binder. You can also use pocket dividers to add any recipes or invoices you need to keep on hand to your tracker. Envelopes Envelopes simplify saving money for upcoming purchases, ambitions, or sinking funds. You can either invest in cute envelopes or buy some cheap ones from the dollar store. You might also use electronic cash envelopes! So, that’s how you make a budget binder. We hope this helped you!

How To Make a Budget Binder