A trading notebook enables traders to keep tabs on their transactions and ideas all day long. It's an excellent tool because an exhaustive journal contains information that is not included in your brokerage statement.

It covers the state of the economy and whether you were preoccupied or committed errors. Additionally, you may use it to jot down any new trading ideas that come to mind throughout the day.

Although day traders don't have the time to spend their entire day ranting on paper, all traders should keep a trading log. It could be unproductive and result in missed deals to keep a trading notebook while trading when the action is taking place.

There is, however, a simple alternative that doesn't require any handwriting and keeps a record of the exact market conditions you faced on a given day.

Main points

- Every day traders should keep a trading journal.

- Use screenshots of your daily trading chart with typed commentary in place of a handwritten notebook to record what happened and why.

- If you save these screenshots in monthly files on your PC, you can look back at your trading history and make changes.

The Simple Way

One image can convey a thousand words. Take a screenshot of the trading day and add some textual notes to it rather than writing about the market, errors, what went well, and new strategy ideas.

Most traders draw lines and mark indicator levels on their charts throughout the day to help them identify the trend and locate potential target or reversal points.

The chart displays the precise trading conditions. Intraday assessments can reveal your perspective on the market for that particular day in a way that words in a trading journal could never do justice.

Using an image as your trade log is simple, but it must contain specific details to be helpful when you go back and review it.

Adding Marks to Your Charts

Your charts will be valuable for future reference if you follow these simple instructions for marking them up.

If necessary, give a background on what was happening before you started trading by including an hour or two of price activity before you start trading. Price movement from the previous day is not required to be included. This can aid in your ability to decide which time frames to use when trading.

On the chart, indicate your start time with a vertical line or text remark. It tells you if you started trading early or late and gives you information about why you might have missed trade signals earlier in the day.

Note the dates and times of significant economic events for which you will be stepping aside. Make a note once again that you weren't trading due to news when that time comes.

Make text notes regarding trends and market circumstances you notice throughout the day. Make a note of any mistakes you make. Make a note of any trades you miss.

If they don't distract you, keep as many trendlines and illustrations on your chart as you can. They will assist in demonstrating to your future self how you perceive the market at any given period in real time.

With a vertical line or text note, indicate the time you cease trading for the day

List the number of transactions you executed, the number of wins, the total profit from the winners, the number of losers, the total loss from the losers, and the final outcome. Avoid utilizing money because it varies depending on the size of the position.

Instead, use ticks or points for futures, pips for currency, and cents for equities. To trade the ES Futures contract, for instance, write "4 wins, 8 points; 4 losers, 4 points = net +4 points" rather than "4 winners, $400; 4 losers, $200 = net + $200."

Take a screenshot of your chart at the conclusion of the trading day and put it into a photo editor. It must contain the details mentioned above. Take two or three pictures and save them separately if you can't fit everything on one chart.

Keep them in a trade folder saved to an easily accessible area on your computer or in the cloud, and name each day's files with the date. To make the files easier to search, create subfolders for each year and month.

Going over your journal

Go back and review your actions at the conclusion of each week and month to identify any trends, common issues, and areas of strength. These observations might show you where to play to your strengths and where you need to improve.

It is more efficient to take screenshots of information than it is to just write it down in a journal. You can record information directly on your charts or in a paper trading log if you choose to do so. Be thorough in this practice to ensure that every trade you make is documented.

Questions and Answers (FAQs)

How can a trading notebook be created?

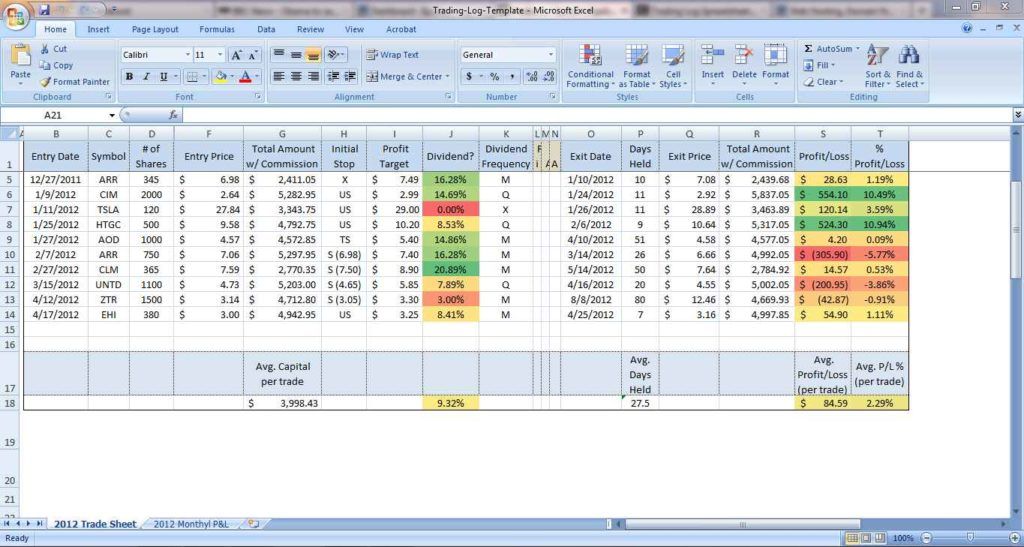

You have a variety of options for setting up and maintaining your trade journal. It will be easier to use an electronic journaling method if you wish to incorporate screenshots. You can use a spreadsheet program, a cloud-based document service like Google Docs, or a note-taking app on your smartphone.

Since you may insert cell equations that quickly compute your profit or loss, spreadsheet software can be especially useful. You can use services that are made to support traders in maintaining effective journals, such as Tradervue.

What information must be recorded in a trade journal?

Your trading notebook should, at the very least, record your daily profit or loss as well as any observations on the general market environment. You ought to try to include a lot more. Any ideas you have regarding the rationale behind a trade, its success, or failure will be useful to reflect upon afterward.

You can better replicate trades to change your strategy if you know the specifics of your entry and exit spots. In general, the more information you give, the more you will understand which trade strategies work and which do not.