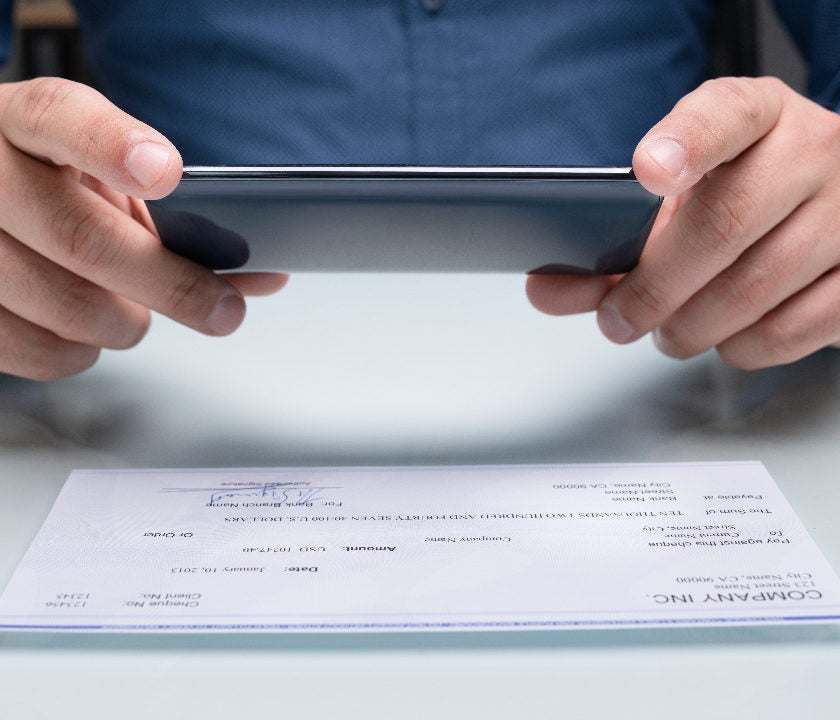

Using this convenient banking feature, you can make deposits quickly.

Banks frequently offer their customers a variety of features designed to make banking easier as technology advances. Mobile banking, digital wallet payments, peer-to-peer payments, and other services are available from many banks. Customers can deposit checks through the bank's app without leaving their homes, which is a popular feature.

Learn more about how to deposit money into your bank account using a mobile check deposit.

What Is a Mobile Deposit and How Does It Work?

A mobile deposit is a method of depositing a check without having to visit the bank physically. It's simple to take a picture of the check with a mobile device with a camera, such as a smartphone or a tablet, and then upload it through the bank's mobile app. The majority of mobile deposits are cleared within a few days.

How to Deposit a Check on Your Phone

Depending on the financial institution, the methods for depositing a check may differ slightly. However, the steps below are frequently used.

Download the App for Mobile Banking

To begin, double-check that your bank or credit union provides a mobile check deposit. If it does, the website will usually include a link to download the bank's mobile app. Install the app on a mobile device that has a camera—most Android, iPhone, and Windows phones are supported. Begin by visiting your bank's website to ensure that you receive a legitimate app rather than a fake one.

Approve Your Check

Include any bank endorsements that are required. Although a signature in the payee section at the top of the back of the check may suffice, your bank may insist on a restrictive endorsement that clearly states your intent.

Note: "For mobile deposit only to my [name of financial institution] account," for example, is an example of such an endorsement.

Some checks already have the mobile deposit language on the back of the check, next to a checkbox; you may not need to write it out if you check the box. If you fail to endorse, your money may be delayed, and you need to endorse and re-deposit it.

Please fill in the required fields

During a mobile check deposit, you may be asked to provide some information about the check, depending on your bank's app. This could include the check's amount as well as the account where you want to deposit the funds.

Take Photographs

The app should walk you through the process of photographing the check with your phone. You'll need separate front and back photos and your endorsement.

Tip: When the camera is positioned directly over the check, some banking apps will take a photo automatically. Make sure all four corners of the check are within the app's frame to ensure crisp images.

Check your deposit and send it in

The app will most likely read the numbers printed in magnetic ink on the bottom of the check and prompt you to confirm that they have been recorded correctly. If everything appears to be in order, submit your request.

Await confirmation

Please don't throw away the check right after depositing it because the bank might not have accepted it yet. Many banks advise keeping the check for a certain amount of time, while others advise shredding it as soon as it clears. To find out what your bank recommends, go to its website.

You'll usually get an email confirming receipt after submitting your deposit, and you might get another one informing you that it was accepted. Check to see if the deposit is reflected in your account balance.

Please make a small mark on your check with a date until it has fully cleared to remind yourself that it has been deposited.

When Be Will Funds From Mobile Deposit Available?

After you deposit your check, you'll probably have to wait until the next business day to get access to all of your funds. Banks will sometimes make a portion of the funds available the same day but put the rest on hold until later.

Restrictions on Mobile Check Deposit

Most banks impose limits on deposits made with a mobile device in order to reduce fraud. Learn more about the restrictions that are frequently imposed on mobile deposits.

Deposit Limits for Mobile Devices

There is usually a daily or monthly maximum deposit limit and a limit on the number of checks you can deposit. The amount you can deposit varies by bank, but you can usually deposit several thousand dollars monthly.

Your deposit limits are usually visible within the app. After you select an account and enter the desired deposit amount, the Wells Fargo mobile app, for example, displays your mobile deposit limit. If your account has been open for several years with no problems, your limit may be increased.

Types of Deposits Allowed

Standard deposits, which are checks made payable to you directly rather than checks made payable to someone else but signed over to you, maybe your only option. If a check is payable to both you and someone else, you might be able to deposit it in your own account if both of you endorse it and the amount isn't too large.

Note that checks must be drawn on US banks and in US currency. Furthermore, money orders are not always accepted.

Security of Mobile Check Deposit

Mobile check deposits are generally safe; in some cases, they can prevent fraud. When you keep your check with you and deposit it quickly, it becomes much more difficult for a criminal to steal it.

Your account information should be safe because reputable banks and credit unions use industry-standard encryption in their apps. Also, make sure that no images or other data are saved on your mobile device.

However, you should avoid using public Wi-Fi for any sensitive data or anything that requires your bank password. If you don't want to share sensitive information, use a secure wired or wireless connection—or your mobile phone's data connection.

Most Commonly Asked Questions (FAQs)

After a mobile deposit, what do you do with a check?

After you've made your deposit, write "deposited" on the front of the check and keep it until you hear from the bank that your deposit has cleared. Once the check has cleared, destroy it to avoid any issues with someone attempting to deposit it a second time.

What is the procedure for canceling a mobile check deposit?

It's possible that you'll be able to cancel a mobile deposit, but it all depends on your bank's policies. You may only have a small window to request a cancellation because the deposit is usually accepted the next business day.