Saving water and energy is good for the environment and can lead to decreased utility bills. However, big improvements like drought-resistant planting and solar panels may be pricey. So, how can you create long-term improvements without breaking the bank? A PACE loan might be a potential finance alternative. PACE financing makes it simple to qualify for relatively low-interest long-term loans, but there are advantages and disadvantages to this approach.

Details of PACE Programs

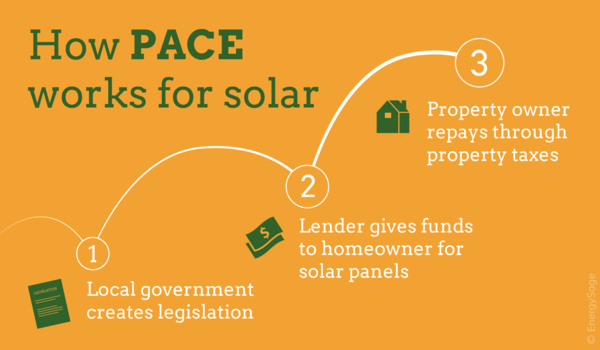

PACE (Property Assessed Sustainable Energy) is a method of borrowing money for clean energy projects. Property owners pay back the loaned monies in addition to their property taxes. If the assessment has not been paid off by the time a property is sold, it remains with the property rather than the original borrower. PACE financing is approved mostly on the basis of the equity in the property being renovated, which acts as collateral to secure the loan. The credit score of the homeowner is less important. PACE funding cannot exceed 15% of the property's value. Furthermore, the overall loan-to-value ratio of the PACE assessment plus any outstanding amounts on property-related debts shall not exceed 97 percent. PACE funding was available for residential properties only in California, Florida, and Missouri as of September 2020; PACE-enabling legislation is active in 37 states plus D.C., and PACE programs are operational in 24 states plus D.C. PACE financing programs go under a variety of names. They include CaliforniaFIRST, FortiFi, HERO, and Ygrene in California, for example. PACE financing may be utilized to replace a roof in all three states, in addition to energy-saving projects. It may be used to help safeguard your home against hurricanes in Florida. It may be used to increase water efficiency in California, including the installation of low-flow plumbing and drip irrigation. PACE money is not technically a loan because it is repaid as an assessment through your property taxes. The loan is established as a lien on the property, which usually takes precedence over the mortgage lender's.Evaluating PACE Financing

While PACE financing offers many benefits, it is not the ideal solution for everyone. That is why it is equally critical to be informed of the drawbacks of accepting PACE financing.Advantages

- Approval is frequently easy.

- There is no need for a down payment.

- The assessment is attached to the property.

- The terms are adaptable.

- Payments of interest may be tax deductible.

Disadvantages

- Some contractors promote PACE borrowing in order to benefit themselves.

- Payments may be required in lump sums once or twice a year.

- The interest rate is greater than on regular loans.

- Because of the assessment, selling the property may be more difficult.

- The assessment is attached to the house, increasing the likelihood of foreclosure.

Advantages of PACE Funding

These programs offer various tempting characteristics for borrowers.- Easy to qualify: PACE eligibility is quite straightforward. The approval standards appear to be more flexible when compared to home equity loans, which are popular options for costly home modifications. With PACE, your FICO credit score is less significant, but current or recent flaws in your credit reports might cause complications. You must also pay all property taxes on time.

- 100% financing: PACE allows you to fund the whole cost of a project with no down payment required. As a consequence, you may get started fast without having to save up for projects or transfer funds. Larger loans, of course, imply greater interest rates and larger payments.

- Can be transferred to the next owner: If you sell a home after completing modifications, you are not required to repay the loan. The debt is tied to the property, so the next owner can transfer and pay it off. Depending on whether or not you are the buyer, this might be a positive thing. Not all purchasers are interested in the additional cost of these upgrades.

- Time to repay: Significant enhancements might be costly. PACE loans can be repaid over a long period of time (10-20 years, for example). As a consequence, payments can be reduced to a minimum. However, like with any loan, the longer you wait to return, the more interest you'll have to pay throughout the term of the loan.

- Potential tax credits: PACE money may make qualifying for environmental tax credits easier. Before making any choices, consult with your tax professional. When it comes to scheduling, PACE allows you to complete a project before tax benefits expire, and obtaining a large loan enables you to install everything in a single year (as opposed to stringing things out over several years to spread out the cash flows).

- Tax deduction for interest payments: The interest on PACE assessments should be deductible. However, because of the greater standard deduction imposed by the 2017 Tax Cuts and Jobs Act, a homeowner with a PACE assessment is less likely to itemize that deduction.

Disadvantages of PACE Financing

Before you use PACE funds for your project, become acquainted with some of the hazards.Conflicts of Interest

PACE programs are frequently promoted by building firms. Most service providers are truthful, and it is ultimately up to consumers to make informed selections, but a tiny proportion of contractors may make false claims in order to land high-paying assignments. Contractors may obtain additional referral fees from a lender if they arrange project finance in addition to being paid for the job they will execute, creating the possibility of conflicts of interest.Payment Shock

Even if you select a longer payback time, making payments might be difficult. While most individuals consider monthly payments, property assessments are sometimes paid just once or twice a year. When it comes time to make those inflated installments, you may be hit with an unexpected bill. You should be able to make PACE payments in monthly installments if your mortgage loan servicer pays your property taxes through an escrow or impounds account.Interest Costs

It is quite simple to qualify for PACE financing. However, interest rates might be higher than those on a home equity loan or line of credit, especially if you have strong credit. Whether or not you can find a better bargain depends on a variety of criteria, but PACE financing is not always inexpensive.Costs and Benefits

Not all PACE-funded upgrades will result in energy or water cost reductions that surpass the borrowed amount, and some may not provide significant savings at all. You should extensively investigate the suggested enhancements to see if they will eventually benefit you.Risk of Foreclosure and First-Lien Status

Because your house secures PACE borrowing, you may lose your home in foreclosure if you do not make the payments. Furthermore, because the PACE lien is usually in the first position—that is, in front of your mortgage lender—you face foreclosure even if you make your normal mortgage payments on time. Furthermore, residences with a PACE debt are ineligible for Fannie Mae, Freddie Mac, or the Federal Home Loan Banks financing. This might make selling the home to someone whose mortgage was secured through a government financing program difficult.Looks can be deceiving.

The hazards listed above do not imply that PACE programs are ineffective. However, it is important to understand the benefits and drawbacks of these agreements before joining up. Unfortunately, because PACE programs are viewed as "safe," the hazards are frequently neglected.- Government-related? PACE financing is made accessible by local governments, and PACE initiatives are commonly conflated with government-offered programs. In the end, they're just loans like any other—they're an obligation that must be met, and there are repercussions for not doing so.

- For a good cause? It feels wonderful to do something nice for the environment, and PACE financing may help you pay for green improvements. However, there are other entities involved that may be more concerned with generating a profit than making a difference. According to critics, these loans are akin to subprime loans.

- Tax-deductible? Interest charges associated with your project may be deductible. However, tax regulations are complicated, and you should consult with a local tax professional to confirm your eligibility for deductions.