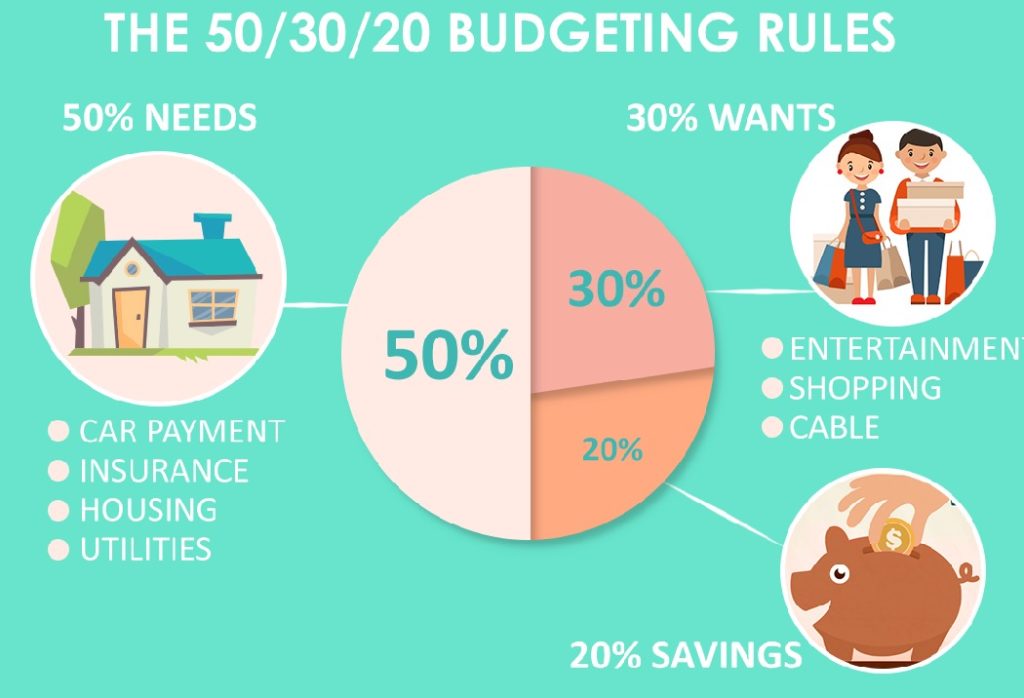

You are not alone if you think, "how much money should I save each month." A monthly savings goal is a terrific concept because saving money is crucial for your long-term financial well-being. Although increasing your monthly contributions can be challenging, it can significantly impact your financial future. You are more likely to stick to a savings plan if you set a monthly savings goal. Even if you don't meet your monthly savings goal, saving a portion of your monthly salary for a rainy day is a good idea. Let's take a deeper look to see how much money you should be saving each month. Why should you make saving a priority? Working toward a greater salary and putting money down for the future is beneficial. Your savings every month can help you build a more financially stable life for your future self. The future feels far away for many of us because of which we put off saving. It's all too easy to get caught up in the moment and spend all of your money. Aside from enjoying our youth, many of us are fighting to make ends meet every month. A large percentage of Americans, 78%, live paycheck to paycheck. Because of these societal pressures, many persons aged 18 to 29 do not have any retirement savings. They do not set aside any money each month. Your savings will provide you with more options in the future. Additionally, give you peace of mind as you travel through life. Because you are not connected to a source of income, you have more choice in your decisions when you save. You'll have the opportunity to save for the most important things to you. So, how much money should you save every month? So, how much should you set aside each month? Depending on your objectives, the quantity of money you should save each month will vary greatly. Consider your personal and financial objectives. Consider your life goals before deciding on your savings goals. Think about the logistics of significant expenditures like a luxury vacation or a car. Consider long-term timescales for your major financial goals, such as purchasing your first house or retiring. It's exciting to consider savings objectives like a luxury vacation or a worry-free retirement. However, breaking down these long-term goals into monthly savings might be tricky. For example, if you want to retire early, you may need to set aside 50% of your monthly salary. If you plan to retire in your 70s, you won't need to set such a high savings goal. Regardless of the statistics on savings by age, the monthly savings target you establish is essentially a personal choice. When making your savings plan, remember to include your individual life plans. With that in mind, setting aside 20% of your monthly salary is an excellent place to start. Most experts recommend putting aside at least 20% of your monthly income. According to the 50-30-20 budgeting strategy, which states that you should spend 50% of your money on necessities, 20% on savings, and 30% on discretionary goods. So, after taxes, you're taking away $1000; you should ideally be setting aside $200 every month. You could put $200 into numerous separate savings accounts. For example, you could put your retirement assets into a 401(k) or Roth IRA. Alternatively, put some of the money into a high-yield savings account until you're ready to use it on your next vacation. Make an emergency fund. When you ask yourself, "How much money should I save each month," one of the most critical items to consider is an emergency fund. Building an emergency fund is vital in addition to your other savings goals. An emergency fund, in fact, maybe the greatest location to begin your savings. You prepare for the inevitable surprises that life throws your way with an emergency fund. Suppose you have a medical emergency or an unexpected car repair. In that case, you'll be able to cover the charges without going into debt. You'll have more peace of mind and be able to concentrate on the problem at hand rather than the finances. How to save more money Once you calculate how much money you should save each month and set your savings goals, you might need to change your habits to meet those goals. Let's take a closer look at some of how you can save more money each month!

- Evaluate your priorities

- Consider your priorities.

- Make an effort to save money.

- Increase your earnings

- Participate in a savings challenge