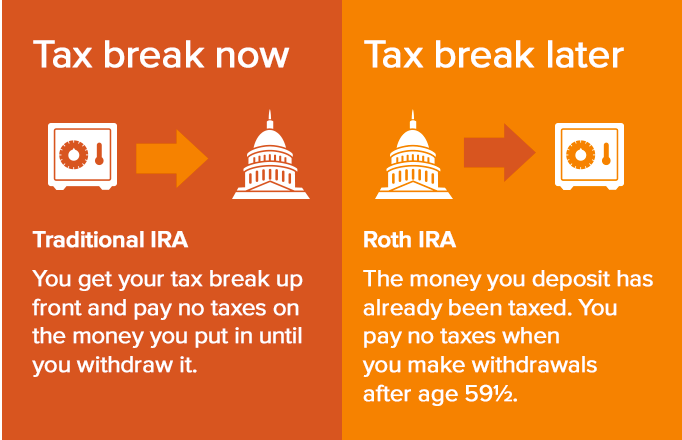

Roth IRAs are tax-advantaged individual retirement accounts that allow investors to save for retirement with after-tax dollars and avoid paying further taxes. You can contribute up to $6,000 per year to a Roth IRA (plus an extra $1,000 if you're 50 or older), and the funds can be invested in any stocks or bonds supported by the institution where you start the account. Although there is no limit to the number of Roth IRAs you can have, the yearly contribution maximum remains the same. Depending on your position, there may be some positive reasons to open several Roths, as well as some possible obstacles.

Important Points to Remember

- You can open as many Roth IRA accounts as you desire, but the yearly contribution limit still applies.

- It may be easier to pursue multiple investment strategies or appoint different beneficiaries to each Roth IRA if you open multiple Roth IRAs.

- However, keeping track of many accounts' contributions can be difficult, and contribution errors might result in IRS fines.

- You are permitted to have as many Roth IRAs as you choose.

- You can open as many Roth IRAs as you like throughout your lifetime.

The Drawbacks of Having Multiple Roth IRAs

The biggest disadvantage of several Roth IRAs is that they might get confusing. In an email to The Balance, Steve Burkett, a Certified Financial Planner with Palisade Investments, said, "From the IRS' standpoint, you only have one Roth IRA, no matter how many different IRA custodians you have money with." "Having more than one Roth IRA custodian makes little sense, and it could lead to tracking and contribution problems." Even if it's an accident, you could be penalized for breaking the Roth IRA 5-year limit if you don't maintain close track of which monies you contributed to which accounts at when dates. According to the law, you can only make qualifying distributions of investment earnings (which aren't taxed or penalized) if the cost basis for the earnings has been in the account for at least five years. Furthermore, if you opt to have many accounts to apply alternative investment methods, you risk mistakenly overweighting one approach by contributing to the incorrect account. If you have several retirement accounts and want to merge them into a single Roth IRA, you can do so by rolling over the funds. You may be subject to tax consequences if you roll over a traditional IRA or another non-Roth account.When Having Multiple Roth IRAs Makes Sense

There may be times when it makes sense to open many accounts if you can stay organized and keep your contributions under the annual limit. "Using multiple custodians could be a reason to utilize numerous custodians if different custodians offer you different investment ideas," Burkett said. This is especially true for custodians who provide specialized services. You could, for example, form two different Roth IRAs, one actively managed by an investment adviser and the other solely holding Vanguard funds. Another incentive to open numerous Roth IRAs is to distinguish between the funds you'll leave to different beneficiaries. "Multiple Roth IRAs make sense in circumstances where you wish to divide the beneficiaries of those accounts," Certified Financial Planner Brandon Opre explained via email to The Balance. Roth IRAs are normally converted to inherited IRAs before transferring to the beneficiary unless the account holder's spouse is the beneficiary. If you wish to leave your savings to numerous beneficiaries, one method to make it easier is to open a new account for each. "You might select one Roth IRA to go directly to a charity, [and] the others can go to family members or anyone," said Opre. "It makes processing go more smoothly, and the investment custodian doesn't have to worry about fractionalizing the investments."Other Typical Roth IRA Errors

Making mistakes with Roth IRA contributions or investing can be costly in the long run (by diminishing investment gains) and in the near run (by incurring IRS penalties). Here are a few more common Roth IRA blunders to avoid. Investing Options That Are Tax-Advantaged or Low-Yield A Roth IRA allows you to grow your money without paying taxes. You won't get the most money if you invest your Roth in tax-advantaged municipal bonds or low-return securities. Let's imagine you want to diversify your portfolio by purchasing a high-growth stock and a 3%-yielding bond, with one in your Roth IRA and the other in a separate account. You won't have to pay taxes on the 3% yield if you buy the bond in a Roth. If you buy the Roth equity and it rises 500%, you won't have to pay taxes on the bigger gain.Withdrawals without conditions

You can only distribute investment earnings (not cost basis) from your account if you meet certain criteria. The cost basis must first have been invested for at least five years. You must also meet at least one of a variety of requirements, including- You must be at least 59 and 12 years old.

- Identify yourself as disabled.

- Use up to $10,000 of the funds to help you buy your first home.

- You must pay an additional 10% tax if you withdraw investment earnings that aren't qualified to be withdrawn.

Contributions in Excess

A Roth IRA's yearly contribution limit is $6,000 ($7,000 if you're 50 or older), which applies to all of your contributions if you open several accounts. The IRS assesses a 6% penalty each year if you contribute more than the annual maximum, even if it's by mistake.You're not contributing to your spouse's IRA.

Even if only one of you generated taxable income, you and your spouse can contribute to each other's Roth IRAs if you're married and file jointly. A married filing jointly couple's total contribution is double that of a single individual: $12,000, plus $1,000 for each person over 50. You can contribute to Roth IRAs in both of your names if your combined tax return indicates that you had at least that much in taxable compensation.Most Commonly Asked Questions

- When were Roth IRAs first introduced?

- What happens to the money in a Roth IRA as it grows?