There have been exceptions to the Federal Reserve's policy of keeping the fed funds rate between 2.0 percent and 5.0 percent, which helps ensure a healthy economy. To combat out-of-control inflation, the country's benchmark rate has been raised substantially above that range at times. It has also dropped below 2% in order to boost economic growth.

Examining the Fed's modifications to the fed funds rate reveals how the central bank has dealt with inflation and recessions in the past.

Key takeaways

- In reaction to double-digit inflation, the highest fed funds rate was 20% in 1980.

- In 2008, the federal funds rate was zero, and in March 2020, it was zero again in response to the coronavirus epidemic.

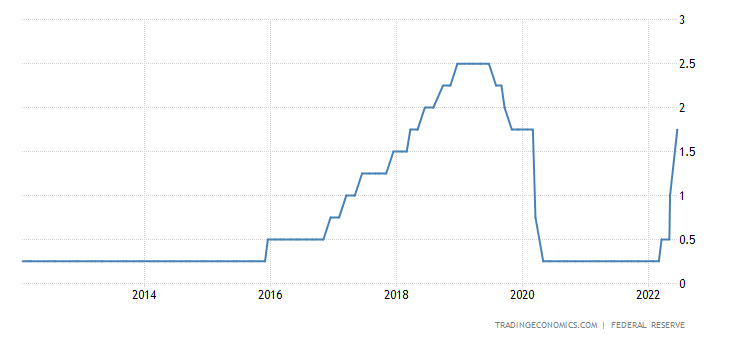

- In May 2022, the FOMC indicated that it will keep raising interest rates in response to rising inflation.

Lowest fed funds rate

The federal funds rate is practically 0 at its all-time low. The Federal Reserve has lowered the interest rate twice, to a range of 0.0 percent to 0.25 percent. The first time was in 2008, amid the financial crisis, and the Fed didn't start raising rates again until December 2015.

The second occurrence was in March 2020, when the worldwide health crisis erupted. In March 2022, however, the Fed began raising interest rates in an effort to combat excessive inflation.

Before 2008, the lowest fed funds rate was in the range of 0.75 percent to 1.0 percent, set in 2003 to counteract the 2001 recession. At the time, there were concerns that the economy was heading into deflation.

Deflation happens when prices continue to decline, causing purchasers to postpone purchases while they wait for further lower prices.

Highest fed funds rate

To battle double-digit inflation, the fed funds rate reached a peak of 20% in 1980.

When President Richard Nixon decoupled the currency from the gold standard in March 1973, inflation began to soar. In December 1974, inflation jumped from 4.7 percent to 12.3 percent. The Federal Reserve raised the fed funds rate from 7% in March to 11% in August.

Through April 1975, inflation remained in the double digits. In March 1975, the Fed raised the benchmark rate to 16%, deepening the 1973-1975 recession. It then changed course, bringing the rate down to 5.25 percent by April 1975.

These abrupt shifts were part of a monetary policy of "stop-go." They weren't long enough to bring down inflation or boost growth. To stay abreast of the Fed's interest rate hikes, perplexed businesses kept prices high, which exacerbated inflation. Fed officials discovered that maintaining inflation expectations was an important part of controlling inflation.

In 1979, Federal Reserve Chairman Paul Volcker put an end to the Fed's stop-go strategy. Instead, he hiked rates and left them there in order to bring inflation to a halt. The 1980 recession resulted from this, but it effectively eliminated double-digit inflation, which hasn't been a concern since.

Fed funds rate history

The graphs below illustrate the changes in the target fed funds rate since 1971.

After its sessions, the Federal Open Market Committee (FOMC) did not declare its target interest rate until October 1979. Through its open market operations, the Fed changed the rate. As a result, banks were obliged to predict what the rates would be. The Fed attempted to combat inflation without regulating inflation expectations.

In 1979, the Federal Reserve began targeting the money supply to combat inflation. As a result, the fed funds rate changed a lot between 1979 and 1982. The Fed then reverted to targeting the fed funds rate in 1982.

For the first time in February 1994, the FOMC explicitly declared its policy modifications. Since then, it has made it plain what it wants the interest rate to be. This policy regulates inflation expectations and reduces disruptions caused by Fed surprises.

These are the fed funds target rates, as well as the events that precipitated the modifications on the occasions where they did. The Federal Reserve usually announces a rate range for its key interest rate. The top end of the range is shown in the tables below, while the low end is a quarter point lower. In addition, each year includes:

- The gross domestic product (GDP)

- The unemployment rate

- The inflation rate

The Federal Reserve hiked rates by half a percentage point on May 4, bringing the federal funds rate target range to 0.75 percent to 1 percent. To battle inflation, the Board of Governors stated that they plan to keep raising rates throughout the year.

These are the fed funds target rates, as well as the events that precipitated the modifications on the occasions where they did. The Federal Reserve usually announces a rate range for its key interest rate. The top end of the range is shown in the tables below, while the low end is a quarter-point lower. In addition, each year includes:

- The gross domestic product (GDP)

- The unemployment rate

- The inflation rate

Fed Chair Arthur Burns (January 1970 - March 1978)

In 1971, the gross domestic product (GDP) was 3.3 percent, the unemployment rate was 6.0 percent, and inflation was 4.4 percent.

| Date |

Fed Funds Rate |

Event |

| Jan. 12 |

4.25% |

Expansion |

| Feb. 9 |

3.75% |

No notable event |

| March 9 |

5.0% |

Inflation at 4.7% year-over-year |

| July 27 |

5.5% |

Nixon shock; weakened gold standard; tariffs |

| Aug. 24 |

5.75% |

Wage-price controls |

| Oct. 19 |

5.25% |

The Fed lowered rates to boost growth |

| Nov. 16 |

5.0% |

No notable event |

In 1972, the GDP was 5.3 percent. Inflation was 3.2 percent, and unemployment was 5.2 percent.

| Date |

Fed Funds Rate |

Event |

| March 21 |

5.5% |

Nixon devalued the dollar, creating inflation |

| Dec. 19 |

5.75% |

Fed raised rates to combat 3.4% YoY inflation |

The GDP was 5.6% in 1973, unemployment was 4.9%, and inflation was 6.2%.

| Date |

Fed Funds Rate |

Event |

| Jan. 19 |

6.0% |

Stagflation |

| Feb. 23 |

6.5% |

No notable event |

| March 20 |

7.0% |

No notable event |

| April 17 |

7.25% |

Inflation at 5.1% |

| May 15 |

7.5% |

Inflation at 5.5% |

| June 19 |

8.5% |

Inflation at 6.0% |

| July 17 |

10.25% |

Recession |

| Aug. 21 |

11.0% |

OPEC embargo worsened inflation in October |

In 1974, the gross domestic product (GDP) was -0.5 percent, unemployment was 7.2 percent, and inflation was 11.0 percent.

| Date |

Fed Funds Rate |

Event |

| Feb. 20 |

9.0% |

Recession |

| March 19 |

10.0% |

Embargo ended in March |

| April 16 |

11.0% |

Fed raised rates to stop inflation |

| July 16 |

13.0% |

Inflation at 11.5%; Ford replaced Nixon in August |

| Nov. 19 |

9.25% |

Recession combined with 12.2% YoY inflation |

| Dec. 17 |

8.0% |

The Fed lowered rates to end the recession |

In 1975, the gross domestic product (GDP) was -0.2%, unemployment was 8.2%, and inflation was 9.1%.

| Date |

Fed Funds Rate |

Event |

| Jan. 21 |

7.0% |

No notable event |

| Feb. 19 |

6.0% |

The economy contracted 4.8% in Q1 with inflation at 11.2% |

| March 21 |

5.5% |

Recession ended |

| April 15 |

5.25% |

Inflation at 10.2%, Unemployment at 9% |

| June 17 |

6.25% |

Inflation at 9.4% |

| Sept. 16 |

6.5% |

Inflation fell to 7.9% |

In 1976, the gross domestic product (GDP) was 5.4 percent, unemployment was 7.8 percent, and inflation was 5.8 percent.

| Date |

Fed Funds Rate |

Event |

| Jan. 20 |

4.75% |

Rate lowered from October through January |

| May 18 |

5.5% |

Raised in April and May |

| Oct. 19 |

5.0% |

The official end of gold standard |

| Nov. 16 |

4.75% |

Lowered from July–November |

In 1977, the gross domestic product (GDP) was 4.6 percent, unemployment was 6.4 percent, and inflation was 6.5 percent.

| Date |

Fed Funds Rate |

Event |

| Aug. 16 |

6.0% |

Inflation rose to 7% in April |

| Sept. 20 |

6.25% |

Inflation at 6.6% |

| Oct. 18 |

6.5% |

Raised again in September and October |

Fed Chair William Miller (March 1978 - August 1979)

In 1978, the gross domestic product (GDP) was 5.5 percent, unemployment was 6.0 percent, and inflation was 7.6 percent.

| Date |

Fed Funds Rate |

Event |

| Jan. 17 |

6.75% |

Inflation rose to 6.8% |

| April 19 |

7.0% |

No notable event |

| May 17 |

7.5% |

No notable event |

| June 21 |

7.75% |

No notable event |

| Aug. 16 |

8.0% |

Inflation rose to 7.8% |

| Sept. 20 |

8.5% |

No notable event |

| Oct. 18 |

9.0% |

Inflation at 8.9% |

| Nov. 21 |

9.75% |

No notable event |

| Dec. 20 |

10.0% |

Raised each month from April through December |

Fed Chair Paul Volcker (August 1979 - August 1987)

In 1979, the economy grew at 3.2 percent, unemployment was at 6.0 percent, and inflation was at 11.3 percent.

| Date |

Fed Funds Rate |

Event |

| April 17 |

10.25% |

Inflation at 10.5% |

| July 20 |

10.5% |

No notable event |

| Aug. 15 |

11.0% |

No notable event |

| Sept. 19 |

11.5% |

Inflation rose to 12.2% |

| Oct. 8 |

13.0% |

The Fed began targeting the money supply |

| Oct. 22 |

15.5% |

Conference call raised rates 2.5 points |

| Nov. 20 |

14.0% |

Inflation at 12.6% |

In 1980, the gross domestic product (GDP) was -0.3%, unemployment was 7.2 percent, and inflation was 13.5 percent.

| Date |

Fed Funds Rate |

Event |

| Feb. 15 |

15.0% |

A recession began in January, with Inflation at 14.2% |

| March 18 |

20.0% |

No notable event |

| May 15 |

11.5% |

Conference calls on April 29 and May 6 lowered rates |

| June 5 |

8.5% |

The recession ended in July |

| Aug. 7 |

10.0% |

The Fed raised rates; inflation at 12.9% |

| Sept. 16 |

11.0% |

No notable event |

| Oct. 13 |

12.0% |

No notable event |

| Nov. 21 |

18.0% |

Inflation eased to 12.6% |

| Dec. 5 |

20.0% |

Conference call |

| Dec. 29 |

18.0% |

Lowered two points |

In 1981, the gross domestic product (GDP) was 2.5 percent, unemployment was 8.5 percent, and inflation was 10.3 percent.

| Date |

Fed Funds Rate |

Event |

| Feb. 3 |

20.0% |

Reagan took office; Volcker raised rates again |

| April 28 |

16.0% |

Conference call lowered rates |

| May 18 |

20.0% |

A recession began in July |

| Nov. 17 |

13.0% |

Gradually lowered rates over six months |

| Dec. 22 |

12.0% |

Inflation at 8.9% |

In 1982, the gross domestic product (GDP) was -1.8 percent, unemployment was 10.8 percent, and inflation was 6.2 percent. The data comes from the Federal Reserve Bank of St. Louis' now-defunct target fed funds rate series, which ran from 1982 to 2007.---

| Date |

Fed Funds Rate |

Event |

| March 30 |

15.0% |

Gradually raised rates three points over four months |

| July 15 |

13.0% |

Conference call; gradually lowered rates |

| Aug. 24 |

9.5% |

Gradually lowered rates |

| Nov. 16 |

9.5% |

Recession ended |

| Dec. 21 |

8.5% |

Inflation at 3.8% |

The GDP was 4.6% in 1983, unemployment was 8.3%, and inflation was 3.2%.

| Date |

Fed Funds Rate |

Event |

| May 24 |

8.63% |

Gradually raised rates over five months |

| Aug. 23 |

9.75% |

Raised from May to August |

| Oct. 4 |

9.38% |

Lowered from August to October |

The GDP was 7.2% in 1984, unemployment was 7.3%, and inflation was 4.3%.

| Date |

Fed Funds Rate |

Event |

| March 29 |

10.5% |

Raised rates again |

| July 17 |

11.0%. |

No notable event |

| Aug. 21 |

11.5% |

Raised from March to August |

| Oct. 2 |

11% |

Began lowering again |

| Nov. 7 |

10% |

No notable event |

| Dec. 18 |

8.75% |

Lowered from September to December |

The GDP was 4.2% in 1985, unemployment was 7.0%, and inflation was 3.6%.

| Date |

Fed Funds Rate |

Event |

| March 26 |

8.38% |

Raised from February to mid-March |

| May 20 |

7.75% |

Began lowering again |

| Aug. 20 |

7.75% |

Raised again |

| Dec. 17 |

8.0% |

Lowered again |

The GDP was 3.5% in 1986, unemployment was 6.6%, and inflation was 1.9%.

| Date |

Fed Funds Rate |

Event |

| April 18 |

7.31% |

Continued lowering rates |

| Aug. 21 |

5.88% |

Lowered until August |

| Dec. 16 |

5.88% |

Began raising rates again |

Fed Chair Alan Greenspan (August 1987-January 2006)

The GDP was 3.5% in 1987, unemployment was 5.7%, and inflation was 3.6%.

| Date |

Fed Funds Rate |

Event |

| May 19 |

6.5% |

Continued raising rates to fight inflation |

| Sept. 22 |

7.25% |

No notable event |

| Nov. 4 |

6.81% |

Lowered after Black Monday stock market crash |

The GDP was 4.2% in 1988, unemployment was 5.3%, and inflation was 4.1%.

| Date |

Fed Funds Rate |

Event |

| Feb. 10 |

6.25% |

Continued lowering |

| March 29 |

6.5% |

Began raising to fight inflation |

| Aug. 16 |

8.13% |

No notable event |

| Dec. 14 |

8.38% |

No notable event |

The GDP was 3.7% in 1989, unemployment was 5.4%, and inflation was 4.8%.

| Date |

Fed Funds Rate |

Event |

| Dec. 19 |

8.5% |

S&L crisis; The Fed lowered rates to calm markets |

The GDP was 1.9% in 1990, unemployment was 6.3%, and inflation was 5.4%.

| Date |

Fed Funds Rate |

Event |

| July 13 |

8.25% |

The recession began in July |

| Oct. 29 |

7.75% |

Continued lowering rates to boost the economy despite inflation |

| Nov. 14 |

7.5% |

No notable event |

| Dec. 7 |

7.25% |

Conference call |

| Dec. 18 |

7.25% |

The economy contracted 3.6% in Q4 |

The GDP was -0.1% in 1991, unemployment was 7.3%, and inflation was 4.2%.

| Date |

Fed Funds Rate |

Event |

| Jan. 9 |

6.75% |

Economy contracted by 1.9% |

| Feb. 1 |

6.25% |

No notable event |

| March 8 |

6.0% |

Recession ended |

| April 30 |

5.75% |

Conference call |

| Aug. 6 |

5.5% |

No notable event |

| Sept. 13 |

5.25% |

Conference call |

| Oct. 31 |

5.0% |

Conference call |

| Nov. 6 |

4.75% |

Fed continued lowering rates to fight unemployment |

| Dec. 6 |

4.5% |

No notable event |

| Dec. 20 |

4.0% |

No notable event |

The GDP was 3.5% in 1992, unemployment was 7.4%, and inflation was 3.0%.

| Date |

Fed Funds Rate |

Event |

| April 9 |

3.75% |

The Fed lowered rates to fight unemployment |

| July 2 |

3.25% |

No notable event |

| Sept. 4 |

3.0% |

No notable event |

In 1993, the GDP was 2.8%, unemployment was 6.5%, and inflation was 3.0%. President Clinton took office in 1993. The Fed made no changes.

The GDP was 4.0% in 1994, unemployment was 5.5%, and inflation was 2.6%.

| Date |

Fed Funds Rate |

Event |

| Feb. 4 |

3.25% |

Fed raised rates to keep the economy healthy |

| March 22 |

3.5% |

No notable event |

| April 18 |

3.75% |

Conference call |

| May 17 |

4.25% |

No notable event |

| Aug. 16 |

4.75% |

No notable event |

| Nov. 15 |

5.5% |

Raised rates |

The GDP was 2.7% in 1995, unemployment was 5.6%, and inflation was 2.8%.

| Date |

Fed Funds Rate |

Event |

| Feb. 1 |

6.0% |

Raised rates |

| July 6 |

5.75% |

Lowered rates |

| Dec. 19 |

5.5% |

No notable event |

The GDP was 3.8% in 1996, unemployment was 5.4%, and inflation was 3.0%.

| Date |

Fed Funds Rate |

Event |

| Jan. 31 |

5.25% |

Kept rates low despite inflation |

The GDP was 4.4% in 1997, unemployment was 4.7%, and inflation was 2.3%.

| Date |

Fed Funds Rate |

Event |

| March 25 |

5.5% |

Raised rates despite low inflation |

The GDP was 4.5% in 1998, unemployment was 4.4%, and inflation was 1.6%.

| Date |

Fed Funds Rate |

Date |

| Sept. 29 |

5.25% |

Lowered rates to fight the LTCM crisis |

| Oct. 15 |

5.0% |

No notable event |

| Nov. 17 |

4.75% |

No notable event |

The GDP was 4.8% in 1999, unemployment was 4.0%, and inflation was 2.2%.

| Date |

Fed Funds Rate |

Event |

| June 30 |

5.0% |

Raised rates because the economy was doing well |

| Aug. 24 |

5.25% |

No notable event |

| Nov. 16 |

5.5% |

No notable event |

The GDP was 4.1% in 2000, unemployment was 3.9%, and inflation was 3.4%.

| Date |

Fed Funds Rate |

Event |

| Feb. 2 |

5.75% |

No notable event |

| March 21 |

6.0% |

No notable event |

| May 16 |

6.5% |

Raised rates despite a stock market drop |

The GDP was 1.0% in 2001, unemployment was 5.7%, and inflation was 2.8%.

| Date |

Fed Funds Rate |

Event |

| Jan. 3 |

6.0% |

No notable event |

| Jan. 31 |

5.5% |

Bush took office |

| March 20 |

5.0% |

Recession |

| April 18 |

4.5% |

No notable event |

| May 15 |

4.0% |

No notable event |

| June 27 |

3.75% |

EGTRRA tax rebate enacted |

| Aug. 21 |

3.5% |

No notable event |

| Sept. 11 |

3.0% |

9/11 attacks |

| Oct. 2 |

2.5% |

Afghanistan War |

| Nov. 6 |

2.0% |

Recession ended |

| Dec. 11 |

1.75% |

No notable event |

The GDP was 1.7% in 2002, unemployment was 6.0%, and inflation was 1.6%. The following tables have data taken from The Federal Reserve.

| Date |

Fed Funds Rate |

Event |

| Nov. 6 |

1.25% |

The Fed lowered rates to fight sluggish growth |

In 2003, the GDP was 2.8 percent. Inflation was 2.3 percent, and unemployment was 5.7 percent.

| Date |

Fed Funds Rate |

Event |

| June 25 |

1.00% |

JGTRRA tax cuts enacted to spur growth |

In 2004, the economy grew at a rate of 3.9 percent, unemployment was at 5.4 percent, and inflation was at 2.7 percent.

| Date |

Fed Funds Rate |

Event |

| June 30 |

1.03% |

Low rates pushed interest-only loans |

| Aug. 10 |

1.5% |

No notable event |

| Sept. 21 |

1.75% |

No notable event |

| Nov. 10 |

2.0% |

No notable event |

| Dec. 14 |

2.25% |

No notable event |

The GDP was 3.5 percent in 2005, with unemployment at 4.9 percent and inflation at 3.4 percent.

| Date |

Fed Funds Rate |

Event |

| Feb. 2 |

2.5% |

No notable event |

| March 22 |

2.75% |

No notable event |

| May 3 |

3.0% |

No notable event |

| June 30 |

3.25% |

No notable event |

| Aug. 9 |

3.5% |

No notable event |

| Sept. 20 |

3.75% |

No notable event |

| Nov. 1 |

4.0% |

No notable event |

| Dec. 13 |

4.25% |

No notable event |

Fed Chair Ben Bernanke (February 2006 - January 2014)

In 2006, the economy grew at a rate of 2.8 percent, unemployment was at 4.4 percent, and inflation was at 3.2 percent.

| Date |

Fed Funds Rate |

Event |

| Jan. 31 |

4.5% |

Raised to cool housing market bubble |

| March 28 |

4.75% |

Higher rates caused more mortgage defaults |

| May 10 |

5.0% |

No notable event |

| June 29 |

5.25% |

No notable event |

GDP was 2.0%, unemployment was 5.0 percent, and inflation was 2.8 percent in 2007.

| Date |

Fed Funds Rate |

Event |

| Sept. 18 |

4.75% |

Home sales fell |

| Oct. 31 |

4.5% |

No notable event |

| Dec. 11 |

4.25% |

LIBOR rose; stock market peaked; recession began |

In 2008, the GDP increased by 0.1 percent, unemployment increased by 7.3 percent, and inflation increased by 3.8 percent. The target funds rate became a range on Dec. 16, 2008, as shown in the tables by the upper limit.

| Date |

Fed Funds Rate |

Event |

| Jan. 22 |

3.5% |

No notable event |

| Jan. 30 |

3.0% |

No notable event |

| March 18 |

2.25% |

Bear Stearns bailout |

| April 30 |

2.0% |

No notable event |

| Oct. 8 |

1.5% |

Lehman failed; bank bailout approved |

| Nov. 29 |

1.0% |

AIG bailout |

| Dec. 16 |

0.25% |

Effectively zero |

Between 2008 and 2015, the Fed kept the rate at zero. In June 2009, the recession came to an end.

Fed Chair Janet Yellen (February 2014 - February 2018)

GDP was 2.3 percent in 2015, with unemployment at 5.0 percent and inflation at 0.1 percent.

| Date |

Fed Funds Rate |

Event |

| Dec. 17 |

0.50% |

Growth stabilized; Fed began raising rates |

In 2016, the GDP increased by 1.7 percent, unemployment increased by 4.7 percent, and inflation increased by 1.3 percent.

| Date |

Fed Funds Rate |

Event |

| Dec. 15 |

0.75% |

Fed maintained a steady increase in rates |

In 2017, the GDP increased by 2.3 percent, unemployment increased by 4.1 percent, and inflation increased by 2.1 percent.

| Date |

Fed Funds Rate |

Event |

| March 16 |

1.00% |

Continued raising rates |

| June 15 |

1.25% |

No notable event |

| Dec. 14 |

1.5% |

No notable event |

Fed Chair Jerome Powell (Since February 2018)

In 2018, GDP increased by 2.9 percent, unemployment increased by 3.9 percent, and inflation increased by 2.4 percent.

| Date |

Fed Funds Rate |

Event |

| March 22 |

1.75% |

No notable event |

| June 14 |

2.00% |

No notable event |

| Sept. 27 |

2.25% |

No notable event |

| Dec. 20 |

2.50% |

Fed promised to stop raising rates |

In 2019, the GDP increased by 2.3 percent, unemployment increased by 3.5 percent, and inflation increased by 1.9 percent.

| Date |

Fed Funds Rate |

Event |

| Aug. 1 |

2.25% |

Lowered rates despite growth |

| Sept. 19 |

2.00% |

Fed was concerned about slowing growth |

| Oct. 31 |

1.75% |

Slow global growth and muted inflation |

GDP was down 3.4 percent in 2020, inflation was 1.2 percent, and unemployment was 6.7 percent.

| Date |

Fed Funds Rate |

Event |

| March 3 |

1.25% |

Coronavirus pandemic |

| April 29 |

0.25% |

Effectively zero |

| June 10 |

0.25% |

Effectively zero |

| July 29 |

0.25% |

Effectively zero |

| Sept. 16 |

0.25% |

Effectively zero |

| Nov. 5 |

0.25% |

Effectively zero |

| Dec. 16 |

0.25% |

Effectively zero |

In 2021, GDP climbed by 6.9%, the highest one-year gain since 1984; on the other hand, inflation increased by 7%, the highest increase since 1982.

| Target Federal Funds Rates for 2021 |

| Date |

Fed Funds Rate |

Event |

| Jan. 27 |

0.25% |

Effectively zero |

| March 17 |

0.25% |

Effectively zero |

| April 28 |

0.25% |

Effectively zero |

| June 16 |

0.25% |

Effectively zero |

| July 28 |

0.25% |

Effectively zero |

| Sept. 22 |

0.25% |

Effectively zero |

| Nov. 4 |

0.25% |

Effectively zero |

| Dec. 15 |

0.25% |

Effectively zero |

Inflation remained high in the first quarter of 2022. In February, year-over-year inflation was 7.9%.

| Target Federal Funds Rates for 2022 |

| Date |

Fed Funds Rate |

Event |

| Jan. 26 |

0.25% |

Effectively Zero |

| March 16 |

0.5% |

Inflation trumped concerns over the Russian invasion of Ukraine |

| May 4 |

1% |

The Russian invasion of Ukraine continues as China brings back COVID-19 lockdowns |

This data comes from the Federal Reserve as it announces the Federal Open Market Committee's monetary policy stance (eight times a year).

Frequently Asked Questions (FAQs)

When will the Fed raise interest rates?

The Federal Reserve usually announces its interest rate plans before they are implemented. Analysts can use the dot plot to see where members stand on interest rate changes. The Federal Reserve also publishes meeting minutes and members speak to the public and Congress on a regular basis.

What happens when the Fed raises interest rates?

Interest rates are influenced by the Federal Reserve, and the consequences are felt throughout the interest rate environment. It means that anything involving interest rates will be influenced. If the Fed raises interest rates, you will pay more on credit cards and mortgages, but you'll get more interest on your savings and bonds.