High-risk vehicle protection is a sort of accident coverage covering circumstances where the safety net provider sees a more prominent than normal probability of a case or when the apparent sum that may be paid out in claims is higher than typical. Continuous explanations behind high-risk protection incorporate various mishaps, infractions, and driving-impaired infringement (DUIs). At different times, you can be viewed as high-risk because of your installment history, age, or vehicle's worth, use, or elements. For instance, rates will increase assuming you have alterations to your vehicle or will involve the vehicle for hustling. It's ideal to call your insurance agent to examine what happens when you've been denied vehicle protection, or high-risk vehicle protection is suitable for another explanation. Albeit some high-risk safety net providers can cover the vast majority of these conditions, some will show improvement over others. Here is our rundown of the vehicle insurance agency that is awesome for inclusion in various high-risk conditions. Beneath, you'll track down additional subtleties on our picks for the ideal choices for high-risk drivers:

Best High-Risk Auto Insurance Companies of 2022

- Best Overall: Bristol West

- Next in line, Best Overall: GEICO

- Best for DUI and Reckless Driving: State Farm

- Best for Lowering Costs: Progressive

- Best for Modified Vehicles and Track Use: Hagerty

- Best for Reconditioned Vehicles: Kemper Auto

- Best for Basic Coverage: The General

Best High-Risk Auto Insurance Companies

- Bristol West

- GEICO

- State Farm

- Moderate

- Hagerty

- Kemper Auto

- The General

Step-by-step instructions to Get High-Risk Auto Insurance

- Bristol West:

What We Like

- Expert for high-risk vehicle protection

- Can offer rideshare inclusion

What We Don't Like

- More restricted limits than certain contenders

- Not accessible in AK, MA, NC, NJ, NY, WY

- GEICO

What We Like

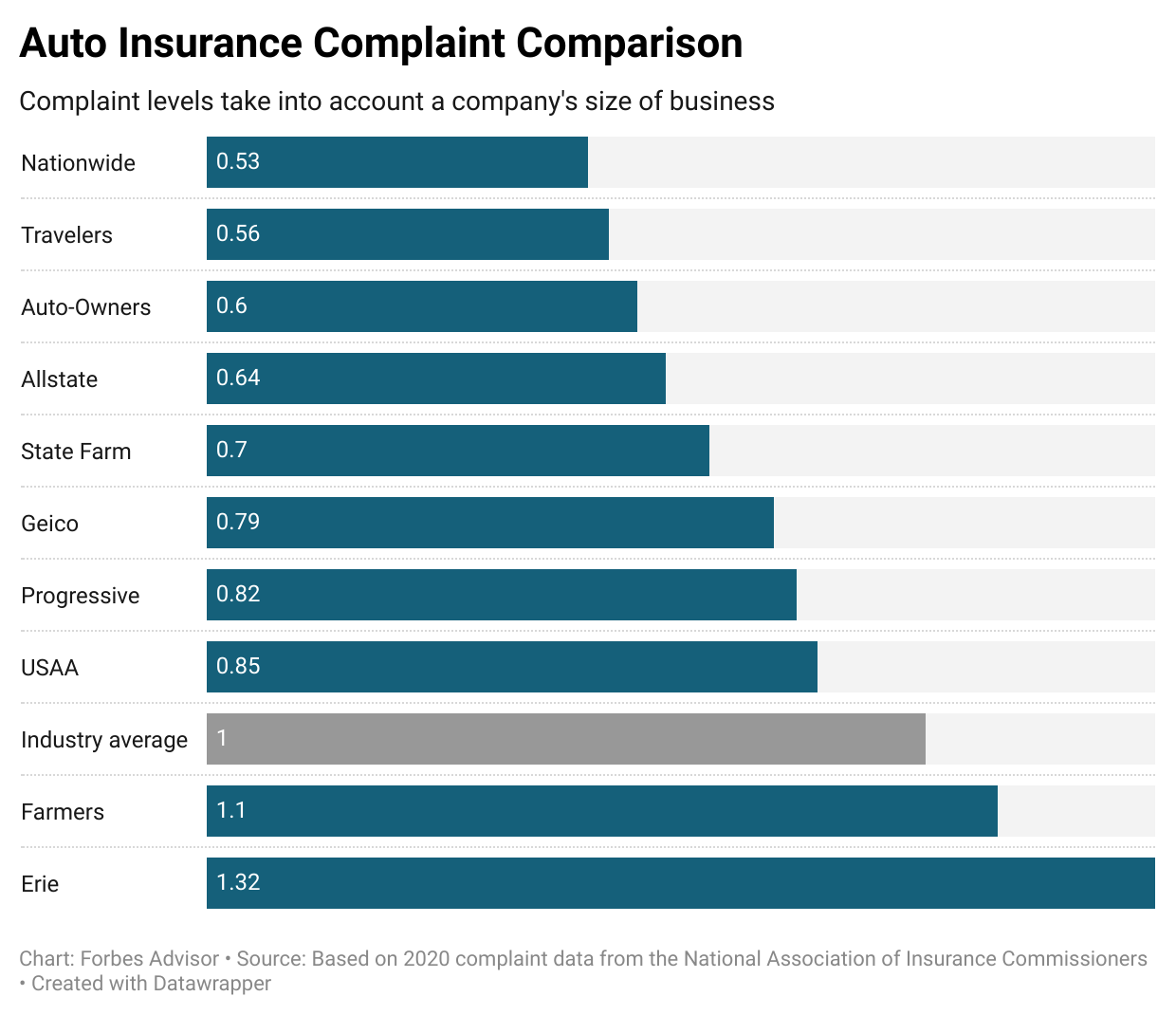

- Great client care rankings for cases and consumer loyalty

- Low degrees of client protests

- Simple web-based statements with great valuing

- Safe driver limits through GPS beacon

- Can give SR-22 or FR-44 structures (the last option for Florida and Virginia)

- Mechanical breakdown inclusion

What We Don't Like

- No hole protection

- The safe driving DriveEasy program is not accessible in all states

- State Farm

What We Like

- Fair valuing for DUI and wild driving versus contenders

- High consumer loyalty rankings for cases and administration

- Low protest levels

- Customized administration through nearby specialists

- Different chances to save money on protection costs for safe driving propensities or safe vehicle highlights

What We Don't Like

- Consumer loyalty rankings fluctuate from the highest level to average, contingent upon the area.

- Clients rate the advanced insight less than ideal.

- If you display safe driving propensities, it can require as long as a half year to see limits from the Drive Safe and Save program.

- Moderate

What We Like

- Moderate can offer an SR-22

- Previewing the safe driver program saves clients a normal of $146 every year.

- Different statements are accessible online to assist you with tracking down the best cost.

- Offers rideshare protection and hole protection

- Reducing deductibles at regular intervals, you don't have a case.

What We Don't Like

- Moderate rates change contingent upon how you buy your vehicle protection (specialist, representative, or on the web)

- Rideshare inclusion just accessible in restricted states

- Conflicting client support and claims fulfillment rankings

- Hagerty

What We Like

- Hagerty Drivers Club for individuals gives limits and emergency aides.

- Expert in gatherer vehicles, including supercars, exotics, and imports

- Can guarantee vehicles for course use, changed vehicles, and pack vehicles

- Spare parts inclusion

- Reliable, worth inclusion, which pays your vehicle's full guaranteed esteem in a complete misfortune

What We Don't Like

- Inclusion choices may not be accessible in all states.

- Not so much for ordinary use vehicles

- Kemper Auto

What We Like

- Protection for rescued vehicles

- Mishap absolution, infringement, and deductible waivers

- Inclusion of trip-interference costs

- Emergency aides

- SR-22 accessible

What We Don't Like

- A rising number of protests in 2018, 2019, and 2020

- Substitution cost, hole inclusion, and different elements may not be accessible to high-take a chance with clients.

- Online assets are restricted, and the online statement isn't easy to understand

- You want to address a specialist to ensure you get the right inclusion.

- The General

What We Like

- Can guarantee individuals with terrible credit or other insurability issues, such as having been uninsured

- Quick internet-based statements and strategy the board with an application

- Nearby specialists to assist your strategy.

What We Don't Like

- The General Agency might put you with one of two different backup plans who have elevated degrees of protests.

- Low greatest inclusion limits

- Hardly any inclusion advantages or choices

Think about Providers

- Provider: Bristol West

- Provider: GEICO

- Provider: State Farm

- Provider: Moderate

- Provider: Hagerty Insurance

- Provider: Kemper Auto Insurance

- Provider: The General

What Is High-Risk Auto Insurance?

High-risk collision protection alludes to any approach an insurance agency sees as having the capacity to convey higher-than-normal payouts because of cases. One of the apparatuses for deciding vehicle protection rates is risk characterization factors, like driving history. Insurance agencies base charges on how likely they figure it will be to need to pay claims and, in doing so, the amount they hope to need to pay out. You could require high-risk vehicle protection if you or your vehicle are viewed as a high gamble. For instance, vehicles with high money-related worth or changes can be considered high-risk because the payout in a case would probably be higher than one for a standard vehicle. Most frequently, however, individuals go to high-take a chance with vehicle protection due to their driving history. This rundown shows the typical expense influence on insurance payments in 2021 for high-risk drivers with the accompanying normal violations:- DUI: $971

- To blame mishap: $569

- Speeding: $353

- Messaging while at the same time driving: $321

Who Is a High-Risk Driver?

High-risk drivers incorporate individuals whose driving history shows possibly more serious dangers than normal. Some high-risk driver profiles include:- New drivers and, for certain safety net providers, youthful drivers

- Those without earlier protection

- Individuals who have had at least one fender bender

- Drivers who have been sentenced for DUI or driving while intoxicated (DWI)

- Drivers with numerous criminal traffic offenses

- Somebody who a state has expected to record an SR-22

- Individuals who have a suboptimal record as a consumer

- Individuals with altered or high-esteem cars

Instructions for getting High-Risk Auto Insurance

The most effective way to get high-risk vehicle protection is to look for statements with one or two insurance agencies before pursuing a choice. When you have statements, inform protection experts about your circumstance. Specialists can likewise propose ways of bringing down the expense of your protection and give you a thought of how long you will stay in high-risk classification. In contrast to normal vehicle protection circumstances, when you have a high-risk profile, it is more critical to call specialists for every insurance agency you are considering to examine choices.Tips On Lowering the Cost of High-Risk Car Insurance

Contingent upon the reasons you are viewed as a high-risk driver, you can adopt an assortment of strategies to reduce the expense of your vehicle protection. On the off chance that you are a high gamble because of your vehicle's worth: Consider introducing post-retail hostile to robbery gadgets that your insurance agency will give limits for. Before picking a gadget, ask your insurance agency which one yields the best limits. If you are purchasing another vehicle, check the expense of the model's vehicle protection before you buy it. Past your gamble factors, the expense of vehicle protection relies upon the vehicle's gamble profile. Vehicles with more costly parts, higher motor limits, or those at more gamble for robbery, particularly in your ZIP code region, will add to your protection cost. Vehicles with well-being elements might bring down the expense of your protection. On the off chance you are a high gamble after numerous mishaps, shop around for rates with various safety net providers each restoration term. A few guarantors utilize the most recent five years of driving history to decide the rate; others utilize the most recent three years. It is also significant that not all safety net providers similarly punish a to blame mishap. Check on the off chance that your insurance agency will give you limits: You can bring down your expense by taking guarded driving courses or signing up for a protected driver program that tracks information about your driving propensities, for instance. If you are a high gamble because of a low FICO rating: Try to go to lengths to get your FICO rating in the groove again. You don't have to take care of all your Visas to develop your FICO rating further; you can make enhancements by covering your bill before it is past due or bringing down the normal card balance. If you are a high gamble as far as FICO rating because of an exceptional situation, similar to a separation, clinical emergency, transitory joblessness, or passing in the family, let your insurance agent know. Some will make exemptions, and this could set aside some cash. On the off chance that you are high gamble since you're a senior: Some organizations think that drivers over age 65 higher gamble. Think about taking guarded driving courses, investigating guarantors with better rates, or gathering plans for seniors. Look into protection rates through enrollment affiliations and your boss: Sometimes, these participation plans will be more tolerant because you are partnered with a gathering. Keep awake to date with what elements influence your insurability, and make enhancements at every possible opportunity. By focusing on the subtleties, asking your insurance agency when you can anticipate that your rate should go down, and finding organizations that will give you the most limits, you could further develop your superior as soon as possible.Imagine a scenario in which You Can't Find Insurance.

Assuming you attempt to get statements and can't find protection because of your high-risk grouping, ask the insurance agency that denies inclusion for what valid reason they are doing so. This will assist you with finding out about the ideal way to find inclusion somewhere else. On the off chance that it is because of past cases, you can request a letter of case insight, so you will have every one of the subtleties you want to get statements elsewhere. You can also contact your state protection official's office to assist you with tracking down protection, assuming you are inconvenienced. States have frameworks to ensure that accident coverage is accessible to the people who can't acquire it in the confidential market. As a feature of this, you could be relegated by your state to a "doled out risk plan" at a confidential safety net provider instead of picking your guarantor, or you could attempt an administration-run protection program.The Method In Which We Choose Our Best High Risk Insurance Company For 2022

To choose the best high-risk vehicle insurance agency, we assessed which safety net providers can offer inclusion in every high-risk situation, including:- Protecting high-risk drivers or specialty vehicles

- Giving better rates for poor to awful credit

- Offering an SR-22