Key Takeaways:

No one can legally remove correct information from your credit reports.

If collection activity on your credit reports is wrong, there's a proper process you'll use to dispute it.

In many cases, paying off debts in collections can assist you to know far away from your credit reports early.

With no action taken, collection activity on your credit reports will “fall off” on its own after seven years have passed.

When you default on any sort of debt obligation, like Mastercard debt or a private loan, the first creditor will attempt to collect on the debt for a short time. Eventually, though, your creditor may come to some extent where they sell your debt to a set agency. At that time, the extra negative information is reported to the three credit bureaus, which may do considerable damage to your credit score.

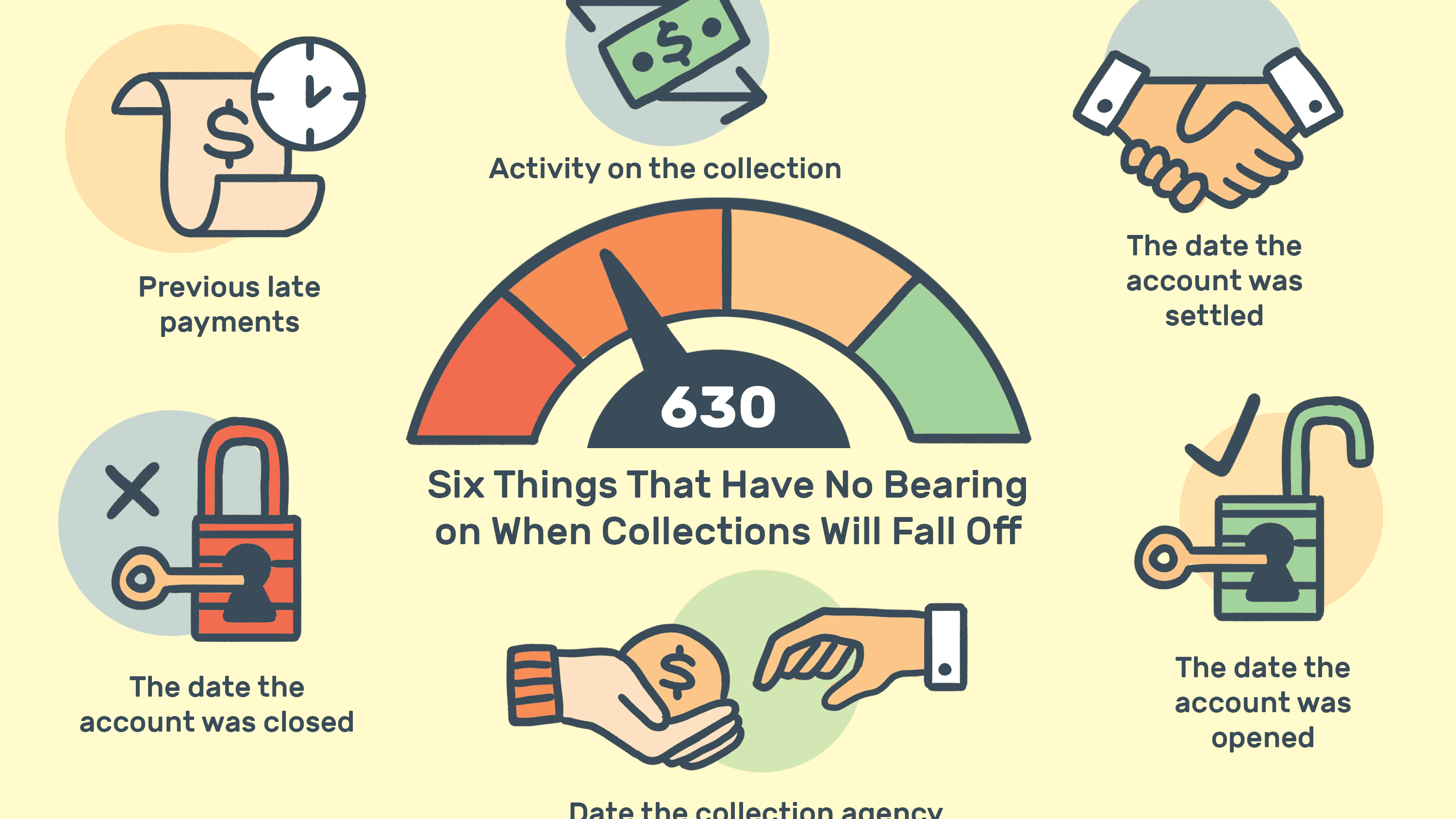

Collections stay on your credit report for seven years from the purpose the account first went delinquent, at which point this information will automatically “fall off” your report. However, you'll want to possess collections far away from your credit report sooner instead of later — particularly if you’re hoping to enhance your credit score in the short term. As a side note, you’ll also want to possess collections activity far away from your credit reports if you think some or all of the knowledge is wrong.

But, how does one remove collections from your credit report? There are several ways this will happen, although the step you ought to take depends on your situation.

Steps to get rid of Collections from Your Credit Report

If you’re wondering the way to get collections off your credit report, you’ll likely get to take a minimum of a couple of the steps below:

Step 1: Check Your Credit Reports

Step 2: Dispute misinformation

Step 3: invite a Goodwill Deletion

Step 4: Write a “Pay for Delete” Letter

Step 5: Wait it Out

Step 1: Check Your Credit Reports

Whether you only think you've got collections on your credit report, otherwise you know for a fact you are doing, you've got to start out the method with the complete knowledge of what you’re handling. To seek out the precise details of the collections activity you’re facing, and you've got to start out by checking your credit reports with all three credit bureaus — Equifax, Experian, and TransUnion.

This a part of the method is straightforward and free because of a government-backed website that gives free credit reports — AnnualCreditReport.com. Anyone can head to the present website and receive a free check of their credit reports at any time. While free reports usually are only available once every 12 months from each of the credit bureaus, you'll currently access all three of your reports weekly, thanks to the COVID-19 pandemic.

Note that your credit reports will list all of your credit accounts, also as your payment activity and the way much you owe. Any collections on your credit report also will list the quantity you owe plus any additional interest and charges that have accrued. You'll also see who currently owns your debt in collections and their contact information.

Once you've got accessed your collection information and, therefore, the other details on your credit reports, you'll compare the knowledge to your own records to see for accuracy.

Step 2: Dispute misinformation

If you discover any incorrect data on your credit reports, you’ll get to dispute it with the credit bureaus and, therefore, the company reporting the info. this is often true whether we are talking about misinformation regarding your accounts in collections, but it also applies to the other information you discover.

According to the buyer's Financial Protection Bureau (CFPB), you'll start the method by disputing the incorrect data with both parties in writing. Explain what you think is wrong about the knowledge, and check out to incorporate any documentation you've got that confirms your dispute. In your letter to the credit bureaus and, therefore, the company reporting the false information, you’ll want to include:

- Your full contact information

- Copies of your credit report with the wrong information highlighted

- A comprehensive explanation of why the knowledge is wrong

- A formal request to possess the knowledge updated, corrected, or far away from your credit report

The CFPB also has several sample letters on its website and contact information for every of the three credit bureaus. Note that you simply can get the address for the corporate reporting any misinformation directly from your credit reports.

After your dispute has been submitted and received, the credit bureaus each have 30 days to research your claim. If collections activity on your credit reports is false, they're going to remove the wrong information from your reports. If the info is correct, however, the gathering activity will remain on your credit reports with no change in the least.

Step 3: invite a Goodwill Deletion.

If you recognize for a fact the gathering activity on your credit reports is correct, there’s no reason to spend time disputing it. In fact, federal law dictates that nobody can legally remove accurate information from your credit reports for any reason.

Instead of spending some time trying to urge correct information wiped away, you'll ask the gathering agency to form a “Goodwill Deletion.”

Note that this strategy only works if you’re wondering the way to get paid collections off your credit report. If you continue to owe the cash, there’s no chance the gathering agency will do anything to form your situation more manageable.

If you've got settled the debt with the gathering agency, reach out with written correspondence that explains the circumstances that led to collections, why you'd just like the information faraway from your credit reports, and the way your situation has changed.

There’s no guarantee the gathering agency will do anything on your behalf, but it never hurts to ask. Suppose the gathering agency does indeed remove the gathering reporting from your credit reports. In that case, you'll still see the late payment activity that led up to collections, which is harmful to your credit score. However, having collection activity far away from your credit report while also showing a positive payment history going forward can assist you in getting on the proper track.

Step 4: Write a “Pay for Delete” Letter

According to Lexington Law, another strategy involves writing a “Pay for Delete” letter, which they assert is “a negotiating tool to possess negative information far away from your report in exchange for payment.”

With this sort of letter, you’re agreeing to pay the balance you owe in exchange for having the knowledge far away from all three of your credit reports. After all, you’re using your agreement to pay as a bargaining tool to urge collections activity off your reports. Thereupon in mind, you’ll want to send this letter before you pay off the debt in collections.

Your letter doesn’t get to be complicated. It just must include:

- Your full contact information

- Account numbers for your account in collections

- The amount you currently owe

An explanation that you’re willing to pay this amount in exchange for having the gathering far away from your credit reports

If the gathering agency responds positively, you ought to keep all the correspondence as proof of the agreement. If they reject your request or ignore your letter completely, you’ll need to try another strategy to possess the gathering information far away from your credit reports.

Step 5: Wait it Out

You can also prefer to wait until the gathering activity falls off your credit report on its own. This takes place seven years from the date your account first became delinquent, so you'll be waiting quite a while if your financial problems were pretty recent.

Although waiting it out could seem just like the long and drawn-out option, confine in mind that the impact of collection activity on your credit report will lessen over time. Also, note that steps you're taking in the meantime, like keeping your credit utilization low and making all monthly payments on time, can help improve your score also.

Collections Removed? What Happens Next

Once collections activity is far away from your credit reports, either through actions you're taking or the passage of your time, your credit score has the potential to enhance fairly quickly. this is often mainly thanks to the very fact that your payment history makes up 35% of your FICO score. When negative information regarding your payment history (such as collections) stops having the facility to wreck your credit score, you'll directly see a reasonably big boost to your credit.

However, you shouldn’t let your guard down, nor do you have to become complacent about your credit. While collections activity could also be gone from your report, late payments, high balances, and other credit mishaps can still hurt your credit score moving forward.

To keep your credit score in the best shape, you should always strive to pay your bills early or on time. Also, confirm you retain your credit utilization at a minimum or below 10% of your available credit for the simplest results. At the utmost, you ought to keep your credit balances at 30% of your available credit or less, or $3,000 in debt at the foremost for each $10,000 you've got in available credit. Also, refrain from opening or closing too many accounts since either action can negatively impact your credit.

The Bottom Line

Having one among your debts in collections is often incredibly stressful, and that’s very true once you see the impact on your credit score. However, it’s good to understand that collections can’t harm your credit forever, and they’ll eventually fall off your reports on their own if you can’t have the knowledge removed.

If collection accounts on your credit report are making your life difficult, however, your best bet is deciding what steps to require to form it all getaway. Most of the time, this is often getting to involve biting the bullet and indeed returning the cash you owe.

FAQ

How long does it deem a paid collection to return off your credit reports?

Collection activity will stay on your credit report for seven years. However, the timeline begins on the date the first debt became delinquent — not when the debt was sold to a set agency.

How long does bankruptcy stay on your credit reports?

According to the buyer Financial Protection Bureau (CFPB), bankruptcy can stay on your credit reports for up to 10 years.

Can a credit repair agency help get collections far away from my credit report?

A credit repair agency like Lexington Law or Credit Saint can assist you with affect collections on your credit report, misinformation on your reports, debt collections, and more. However, credit repair agencies can't do anything for you that you simply can't do yourself.

What are my rights if debt collectors won't stop calling me?

The Fair Debt Collection Practices Act (FDCPA) makes it illegal for debt collectors and collection agencies to use "abusive, unfair, or deceptive practices once they collect debts," consistent with the CFPB. This law doesn't cover business debts, but other debts like MasterCard debt, auto loans, medical bills, student loans, mortgage debt, and other household debts are.

Can debt collectors garnish my wages?

Collection agencies could also be ready to garnish your wages to pay back your debts, but they need to sue you in court first. Debt collectors also can invite a writ to require money from your checking account to repay your debts. Consistent with the CFPB, you ought never to ignore a lawsuit for this reason. If you ignore a lawsuit, you will not have the prospect of fighting against the collector's efforts.