American Funds is one of the biggest mutual fund companies in the world with over 90 years of experience. Some of their oldest mutual funds with a track record of success are the greatest American funds to hold. Their lengthy history, wide range of funds, and lower-than-average expenditure ratios all contribute to their popularity.

Learn more about the top five long-term investment funds and American Funds.

Main points

- One of the biggest investment management organizations in the world, American Funds manages more than $2 trillion in assets.

- For long-term investors, these five American funds may be the best choice. They provide low expenditure ratios and sustained high returns.

- Fees apply to these broker-sold funds unless they are a component of a 401(k), in which case there are none.

- These five top American funds frequently have front-load fees of between 5.00% and 5.75%, which are tolerable if you're investing for the long term.

How Do American Funds Work?

With more than $2 trillion in assets under management, Capital Group, one of the biggest investment management companies in the world, is the parent company of American Funds.

It provides a good selection of stock and bond funds with a range of objectives.

Their funds' distinctive qualities include diversification; a multi-manager structure; "high-conviction" investments; a foundation in fundamental research; continuity and consistency in their approach; and the presence of these characteristics.

The Best American Funds for Long-Term Investors: The Top 5

The following are some of the best characteristics of American funds:

- They are primarily administered by teams.

- Their expense ratios are below average.

- For periods of 10 to 15 years or longer, they frequently yield returns that are above average.

- Due to this, long-term investors should consider mutual funds from the American Funds family of companies. Here are some of the top American funds to think about in light of this.

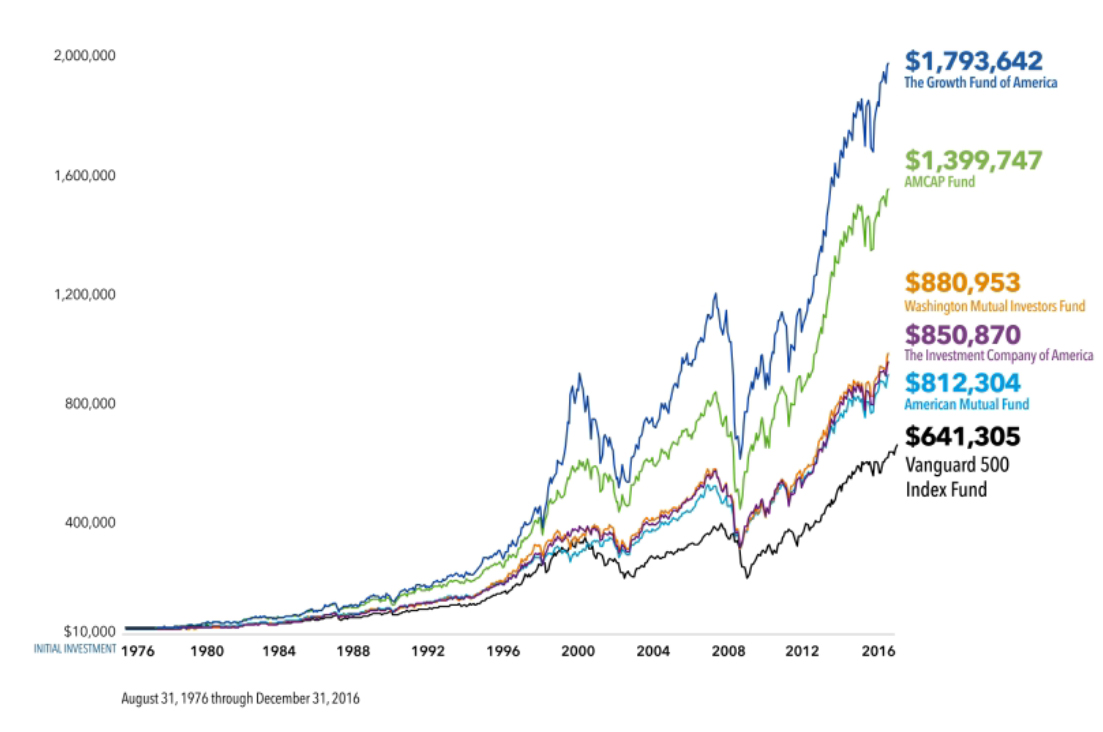

American Funds Growth Fund of America: AGTHX

As implied by its name, AGTHX generally invests in large-cap growth firms, such as Alphabet (GOOG) and Amazon (AMZN) (GOOG). Depending on how well international stocks perform in comparison to U.S. stocks, AGTHX frequently owns up to 10% of foreign stocks, which could be advantageous or disadvantageous.

However, AGTHX typically outperforms category averages over the long term, particularly for periods of up to 15 years or more.decent quality and characteristics of an index fund, AGTHX will probably vary around average during the short run.

ANCFX, a Fundamental Investor of American Funds

This portfolio makes investments in a mix of large-cap growth and value stocks. Holdings like Microsoft (MSFT) and Meta (FB), formerly Facebook, will be provided. The fund looks for undervalued prospects and prioritizes growth over income. Although ANCFX's performance varies, it is still among the best among American Funds. Over a ten-year period, the average annualized return is greater than 12%.

American Funds SMALLCAP World SMCWX

Since SMCWX is a world stock fund, it will invest in both domestic and international stocks. In actuality, the two make up almost exactly half of the fund's asset mix. Small-cap stocks carry a higher level of market risk than large-cap equities, but their long-term gains can be higher as well. This is another area where SMCWX concentrates its holdings. One of American Funds' methods that requires the greatest investigation is this one. It employs more than 100 analysts and portfolio managers.

AEPGX is an abbreviation for American Funds EuroPacific Growth

American Funds offers only a small number of foreign stock funds, including this one. It is among their greatest as well. AEPGX primarily invests in large-cap stocks outside of the United States. The managers look for possibilities that might exist in markets that are well-positioned to gain from innovation, economic expansion, rising demand, and advantageous business climates.

Asia, developing markets, and Europe are the main regions for exposure. Another American fund that rarely outperforms its class is AEPGX, but it routinely offers above-average returns, particularly over the long run.

Washington Mutual Investors' Fund of American Funds: AWSHX

This is a large-blend fund, similar to ANCFX. It delivers consistently over time. U.S. stocks make up a major portion of AWSHX's holdings. The fund's objectives are to generate income and offer a chance for principal growth. The managers look for two things: solid balance sheets and regular dividend payments. Because of this discipline, AWSHX has outperformed the S&P 500 throughout each downturn of 15% or more since the fund's inception. Up to 10% of AWSHX's assets may be allocated to businesses based outside of the United States.

The conclusion

Unless they are in a 401(k) plan, mutual funds in the American Funds family are broker-sold and frequently come with fees. All five of the aforementioned American funds are front-loaded funds, which implies that investors must pay a fee when purchasing shares, often between 5.00 percent and 5.75 percent.

Other share classes that American Funds offers might not charge a load.

These funds may still be appealing to some investors after costs, especially for long-term holding periods.

Questions and Answers (FAQs)

How much in dividends and capital gains will American funds pay out?

Information on every distribution for American Funds is available on the year-end distributions website. These consist of capital gains, dividends, and capital returns. You may also look into historical distributions to find out more about distributions from earlier years.

What American funds are available as ETFs?

Despite not releasing ETF products as quickly as rival mutual fund providers Vanguard and Fidelity, American Funds is experimenting with ETFs. Capital Group declared its intention to launch actively managed ETFs in early 2022. The material is being provided without taking into account any specific investor's investing goals, risk tolerance, or financial situation. Therefore, it might not be appropriate for all investors. Future outcomes cannot be predicted based on past performance. Risks associated with investing include the potential loss of an investment.