Definition and Example of a Mezzanine Loan

A mezzanine credit is a support that mixes obligation and equity.1 Lender gives subject advances (less senior than customary advances), and they possibly get value interests too. Mezzanine advances commonly have moderately exorbitant financing costs and flexible reimbursement terms.

When a business needs assets for a huge undertaking, traditional banks might be reluctant to give all the cash required. Innovative supporting methodologies like mezzanine credits could fill the hole.

How Mezzanine Loans Work

Mezzanine credits are half and half of both obligation and value. Contingent upon the particulars of the understanding and how the situation transpires, the course of action can give a value interest to loan specialists.

For the most part, Mezzanine loan specialists work with organizations with fruitful histories. For instance, you could utilize a mezzanine credit to get a current business or extend tasks for a business that is as of now beneficial.

Interest and Repayment

Mezzanine credits frequently accompany greater expenses than customary getting. Financing costs in the twofold digits are normal, or banks might request value openness to enhance revenue pay.

Contingent upon the provisions of an understanding, borrowers might have a few choices for reimbursement. If income isn't accessible — or, on the other hand, if the business needs to reinvest rather than pay interest — organizations can underwrite interest charges, known as an "installment in kind."

Subjected Loans

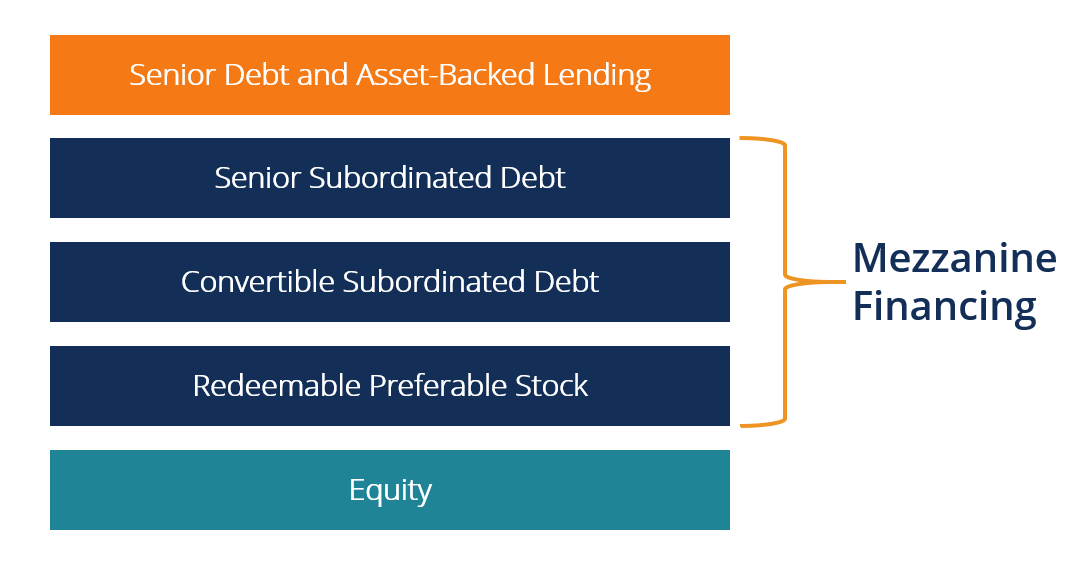

Mezzanine obligation commonly has a lower need than senior obligations when borrowers fail.

If a business falls flat, it might have to offer resources like structures and hardware to produce money and pay off obligations. On the off chance that there's insufficient cash to pay everyone, those banks fall in line.

Banks and senior bondholders are ordinarily close to the front of the line, allowing them an excellent opportunity of getting installment in a liquidation. (Their inclinations additionally might be gotten by security.)

Mezzanine advances are ordinarily farther back in need, even though they are above the normal value.

Upsides and downsides of Mezzanine Loans for Borrowers

Like each getting, mezzanine advances accompany advantages and downsides for borrowers.

- Admittance to capital

- Limit value weakening

- Deductible interest installments

- Various reimbursement choices

- Benefits capital design

- Monetary outcomes

- Hazard of value misfortune

- Imparted control to loan specialists

- Experts Explained

Admittance to capital: Borrowers get the cash they need to buy or extend.

Limit value weakening: Instead of exchanging a significant measure of value for capital, borrowers can limit their value weakening while at the same time getting more than traditional banks need to lend.

Deductible interest installments: Interest installments might be deductible to the business.

Numerous reimbursement choices: Borrowers might pay revenue accused of money, add them to the advance equilibrium, or give the value like instruments to the bank.

Benefits capital design: Mezzanine support frequently shows up as value on the accounting report, empowering borrowers to show lower obligation levels and, all the more effectively, meet all requirements for different sorts of financing. Cons Explained

Economic outcomes: Leverage (getting cash with the desire to acquire back more than you acquired) is consistently dangerous. Borrowers might confront critical obligations and different results if circumstances don't pan out according to plan.

Chance of value misfortune: If borrowers default on advances, they might need to give value interests to lenders.

Imparted control to moneylenders: Mezzanine banks might set explicit standards that borrowers should keep up with. For instance, banks could determine limits on monetary proportions or make other demands.

Upsides and downsides of Mezzanine Loans for Lenders

Borrowers aren't the ones in particular who face advantages and downsides from mezzanine credits. This kind of loaning structure has upsides and downsides for moneylenders too.

- Interest pay

- Value and cooperation

- Chance of default

- Low status

- Stars Explained

Premium pay: Mezzanine support has somewhat exorbitant financing costs to repay loan specialists for the high degree of chance.

Value and cooperation: Lenders might get value, permitting them to partake in a business's prosperity. For instance, warrants might be important for the moneylender's pay, or banks might get value when borrowers default.

Hazard of default: Lenders generally risk losing cash to default, particularly with the mezzanine obligation.

Low position: These credits probably won't be gotten by any insurance. For instance, there probably won't be liens on property, gear, or other organization assets.5 When the business pays senior indebted individuals, it might drain any suitable assets before the mezzanine loan specialists get installment.

Key Takeaways

- A mezzanine credit is a support that mixes obligation and value.

- Moneylenders give subject credits (less senior than conventional advances), and they possibly get value interests also.

- Mezzanine advances normally have moderately exorbitant financing costs and flexible reimbursement terms.

- Mezzanine obligation normally has a lower need than senior obligations when borrowers fail.

- Contingent upon the states of the credit, banks might have the option to set states of business tasks or get an offer in value if the borrower defaults.