Futures contracts on commodities are agreements to buy or sell a raw material at a certain date in the future at a certain price. These dates and prices are specified in advance. The monetary terms of the contract are predetermined. It outlines the date and time that the buyer will receive the asset from the seller. Additionally, it determines the price. There are certain contracts that permit a cash settlement rather than an item delivery.

Commodities can be broken down into three primary categories: food, energy, and metals. Meat, wheat, and sugar all consistently rank among the most sought-after food futures. Oil and gasoline make up the majority of energy futures. Gold, silver, and copper are examples of metals that can be traded using futures.

Futures contracts are used by purchasers of food, energy, and metal to determine the price of the commodity that they are going to purchase. This decreases the likelihood that they will need to raise their prices. Futures provide the sellers of these commodities with the assurance that they will be paid the price that was previously agreed upon. They eliminate the possibility of a price decrease.

The costs of commodities are subject to weekly or even daily fluctuations. Even contract prices are subject to change. Because of this factor, the prices of meat, gasoline, and gold are subject to significant swings.

Key Takeaways

- Futures contracts on commodities are agreements that specify the price, volume, and closing date of a transaction.

- Food, metals, and energy are the three primary classifications that commodities are placed into.

- The transaction is made more secure due to the fact that futures contracts are sold on an exchange.

How They Carry It Out

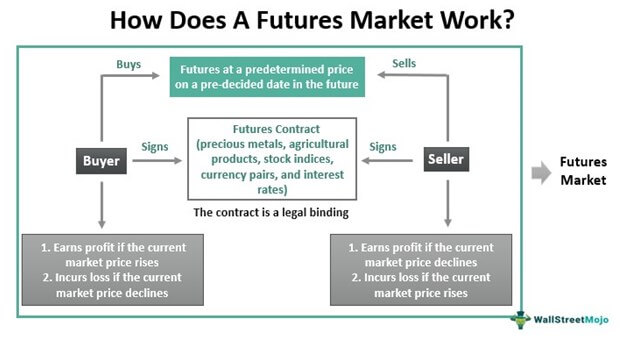

The buyer of the futures contract stands to gain financial benefit from an increase in the price of the underlying commodity. He buys the product at the lower price that was agreed upon, and he is now able to sell it at the higher price that is currently being offered on the market. If there is a drop in price, it is profitable for the futures seller. He can purchase the commodity at the lower market price currently available and then sell it to the futures buyer at the higher price that has been agreed upon.

Few people would engage in the trading of commodities if they were also required to deliver the product. Instead, they can satisfy the terms of the contract by providing evidence that the product is currently stored at the facility. They also have the option of providing another contract at the current market price or paying the difference in cash.

Exchanges for Various Commodities

On a commodities futures exchange, futures contracts are traded in the marketplace. The Chicago Mercantile Exchange, the Chicago Board of Trade, and the New York Mercantile Exchange are some examples of these markets. The CME Group currently owns each and every one of these. They are subject to regulation by the Commodity Futures Trading Commission. Registration with the CFTC is mandatory for both buyers and sellers.

The role played by the exchange in ensuring a more secure trade is an important one.

Note: The clearinghouse of the exchange is where the contracts are settled. In a strict sense, the clearinghouse is responsible for the buying and selling of all contracts.

The fungibility provided by the exchanges makes it much simpler to buy and sell different types of contracts. That indicates that they can be used in place of one another. However, they need to be for the same commodity and have the same requirements for quantity and quality. They need to be for the same delivery month as well as the same location.

The ability to "offset" contracts is made possible by fungibility. That is the point at which they will buy the contracts, after which they will sell them. It gives them the option to pay off the contract or get out of it before the date that was originally agreed upon. Because of this, futures contracts are considered to be derivatives.

The Influence That Futures Contracts Have on the Economy

Futures contracts are a tool that businesses can use to lock in a guaranteed price for essential commodities like oil. Farmers rely on them to ensure that they will receive a certain price for their livestock or grain. They are able to buy or sell the goods at a predetermined price thanks to the futures contracts. They intend to fulfill the terms of the contract by transferring possession of the goods. Additionally, the agreement gives them the ability to calculate any associated costs or revenues. They alleviate a considerable amount of risk for themselves as a result of the contracts.

Hedge funds can increase their leverage in the commodities market through the use of futures contracts. They have absolutely no intention of trading in any kind of commodity. They plan, as an alternative, to purchase an offsetting contract at a price that will result in a profit for them. They are, in a sense, speculating on the future price of the commodity in question. The evaluation and forecasting of prices for various raw materials are the means by which commodities futures influence the economy. These values are determined by traders as well as analysts.

Pros

- When it is time to harvest or sell the commodity, these contracts guarantee that the producer will receive a predetermined price for their wares.

- The decrease in price does not result in a financial loss for the manufacturer. He is paid the price that was agreed upon.

- In the event that prices fall, producers have the ability to mitigate their risk.

- Better production plans could be made by either producers or companies.

Cons

- In the event that prices go up, manufacturers stand to lose out on potentially significant profits. The prices on the contract are set in stone.

- The trading of these contracts is fraught with peril. The prices of commodities on a global scale are highly unpredictable.

- Even when demand and supply are held constant at the same level, the prices of commodities are still subject to the influence of global events, the emotions of traders, and market speculation.

- It is best to entrust this type of investment to professionals.

A Guide to Investing

Commodity futures can be invested in through various vehicles, but commodity funds offer the highest level of security. Both commodity exchange-traded funds and commodity mutual funds can fall into this category. These funds take into account the extensive range of futures contracts for commodities that are active at any given time.

The buying and selling of options and futures contracts on commodities is a highly complex and high-risk activity. The prices of commodities are notoriously unstable. There are many instances of fraudulent behavior on the market. You run the risk of losing more than the money that you initially invested if you aren't absolutely certain of what you're doing.

Read up on commodities profiles and day trading in commodities futures before you put money into the market. In addition, you should look over the Guide to Fraudulent Activity and the Education Center that the CTFC provides.

The Influence That They Have on Costs

Because they are traded on a public exchange, futures contracts for commodities provide an accurate estimate of the cost of raw materials. They also make projections regarding the commodity's value in the coming years. The values are decided upon by traders and the analysts that they employ. They devote each and every waking hour of the day to researching the specific commodity. The events of each day are immediately incorporated into the forecasts. For instance, if Iran makes a threat to close the Strait of Hormuz, there will be a significant shift in the prices of various commodities.

Why are oil prices at such an all-time high? Oil prices are affected by a number of factors, including the depreciation of the dollar as well as the activities of commodity traders.

Sometimes the emotions of traders or the market are more reflected in commodity futures than the relationship between supply and demand. Speculators drive up prices in the hopes of making a profit in the event that a crisis occurs, and they correctly anticipate that there will be a shortage. When other traders notice that the price of a commodity is rapidly increasing, they start a bidding war in an attempt to secure more of the commodity. Because of this, the price goes up even further. However, the fundamentals of supply and demand have not changed in any significant way. When the crisis is over, prices will fall like a stone and return to their normal levels.

In addition, the currency of trade for commodities is the United States dollar. There is a connection that works in the opposite direction between the dollar and commodities. The price of commodities goes down whenever there is an increase in the value of the dollar. This is due to the fact that merchants can purchase the same quantity of commodities for a lower price.

Examples

There are a lot of different ways in which trading futures on commodities can influence prices. Here are some specific examples of when that occurred in the oil industry, the metals industry, and the food industry.

Oil

Traders consider all of the available information regarding oil supply and demand, in addition to taking into account geopolitical factors. This has an impact on the price of oil. It is precisely these presumptions that underlie oil prices that have such a significant impact on the economy. The price of oil has an effect on every product and service that is produced in the United States. For instance, the price of oil has a direct impact on the price of gasoline due to the fact that the price of crude accounts for 54% of the total cost of gasoline. If the price of crude oil goes up, then the price at the pump will also go up.

Note: In 2020, oil prices fell into negative territory.

To combat the spread of the coronavirus pandemic, governments around the world started imposing travel restrictions and closing businesses in January of 2020. Demand for oil fell. The amount of oil that was consumed in the first quarter of 2020 was 5.6 percentage points lower than what it had been in the same time period in 2019.

Competition between Russia and OPEC made the supply glut an even greater problem, to begin with. Russia made the announcement on March 6 that it would raise production beginning in April. OPEC declared that it would increase oil production in order to preserve its market share. The prices were reduced even further. OPEC and Russia reached an agreement on April 12, 2020, to reduce output in order to prop up prices.

About a week later, when traders were trying to roll forward expiring futures contracts (in order to avoid taking physical delivery of oil), they drove the price of a barrel of oil down to a low of -40.32 dollars, which made the situation even worse. Nevertheless, this historical oddity only lasted for a brief period of time. The price quickly moved back into the black, and by the beginning of June, it was trading somewhere around $40.00.

Metals

The price of gold reached a new all-time high of $1,895 per ounce on September 5, 2011.

Traders drove up the price of gold as a result of their concerns about the ongoing economic uncertainty. Gold is frequently invested during times of unrest because many individuals consider it to be a haven of sorts.

The price of gold reflects the state of the American economy. A rise in gold investments, which leads to an increase in the price of gold as a direct result, may be an indication that the economy is performing poorly. On the other hand, a fall in the price of gold might be interpreted as a sign of some positive developments for the economy.

Food

During the time of the economic crisis, commodity traders were responsible for driving up food prices. The cost of food experienced a 4.0 percent increase in 2007 and a 5.5 percent increase in 2008. The result was unrest in countries with a lower level of development. These food riots may have even been a contributing factor in the uprisings that occurred during the Arab Spring.

Questions That Are Typically Asked (FAQs)

What kind of investments can be made in water commodities?

Although it may be challenging to make a direct investment in water as a commodity, this does not imply that there are no opportunities for investment in the water sector. Water exchange-traded funds make it simple for investors to monitor the performance of businesses involved in the provision of potable water. These businesses consist of utilities, water purification facilities, and companies that construct water pipelines.

What is the definition of soft commodities?

Agricultural commodities are also sometimes referred to as "soft commodities." A couple of examples of soft commodities include coffee and sugar. These are in contrast to "hard commodities," which are things that are extracted from the ground, such as gold and silver.