Love it or hate it, if you would like to be financially successful, you would like to budget your money. Getting your finances so as and building wealth takes planning, and your budget can assist you in doing exactly that. For several people, budgeting is not any fun. It means limits or lack of or maybe punishment. I prefer the word "plan" to "budget" because it does not imply restriction. However, having a budget that is split down into categories in some way is critical to your financial success. Have you heard the phrase "failing to plan is planning to fail"? If you do not plan, you cannot win. The process of budgeting doesn't need to be complicated. There are several advantages of budgeting. You only got to create a system that works for you. And this suggests the proper budget methods and budget categories. During this blog post, you'll learn all about budgeting and how you'll win at it! Part 1: Finding the proper budget method for you Part 2: Budget categories to use Part 3: the way to stick with your budget

Part 1: Finding the proper budget method for you

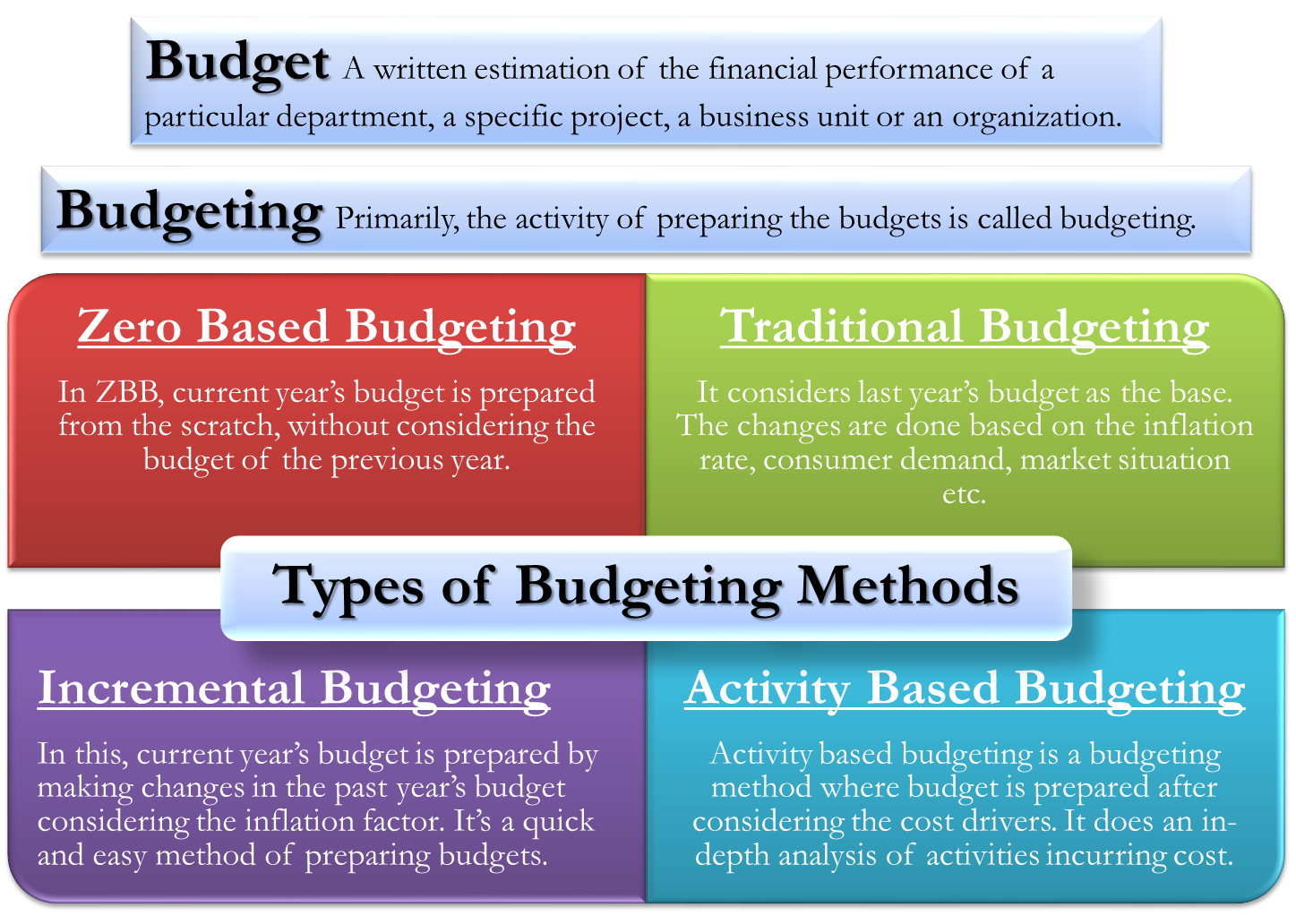

There are several solid reasons to budget. It helps keep your spending in restraint, tracks your expenses, and teaches you to regulate your money — and not have it control you! It's the first step toward assisting you in accumulating wealth. Having a budget helps you enjoy life without worrying about how you'll pay for it later. Because "later" rarely comes. Paying for things within the present rather than the long term allows you to enjoy yourself and live the life you would like. I was ready to save $100,000 in only three years by making a budget and sticking to it. Imagine what you'll accomplish with touch planning. People will often allow their emotions to cloud their judgment when it involves planning their finances, but if you check out your money objectively for what it is, a tool, then it's easier to form your plans! Once you opt for your priorities, your budget should reflect them. So how does one make a budget? There is a spread of the way during which you'll budget and make budget categories. Trust me, albeit you currently hate budgeting, there is a style out there for you! The tactic you select is entirely up to you; the foremost important part is picking a method that works for your life. You'll prefer to budget weekly on a biweekly budgeting basis or monthly. You'll like one among these methods or a hybrid of a few of them. The most essential thing is to discover out what works best for you, as not everyone's brain processes information in the same way. The most important thing is to only roll in the hay. If one doesn't work, try a special one. As a result, here are four other budgeting approaches you might attempt.Budget Method 1: Budgeting with the envelope or cash system

This cash-based budgeting system is straightforward. Subtract your expenses from your income, then put the quantity of every expense into its envelope. These envelopes are your categories. Using cash can also make it easier to stay within your budget. According to studies, you spend 15-20% less on average when you pay with cash. But you don't need to use cash for all of your expenses when using the envelope system. You can keep the cash for your big bills in virtual envelopes that you track through a budget worksheet or an app. Then, put actual cash for your more minor expenses or day-to-day transactions in physical envelopes. For categories where you frequently overpay, the cash envelope technique works well. Clothing, food, eating out, entertainment, children's expenses, and so on don't make it overly complicated, or it'll be hard to follow and stick with. Learn more about getting started with the cash envelope method, and make sure to see our reviews of the most uncomplicated cash envelope wallets.Budget Method 2: Budgeting using percentage breakouts

Another approach to budgeting is to divide your household income into percentages and then plan your spending and savings appropriately. The foremost typical percentage breakdown is 50/30/20. This suggests that: Not 50% of your income goes toward your needs and essentials (things like housing, transportation, food, etc.) Not 30% of your income goes on wants and non-essentials (travel, getting your hair done, shopping, etc.) At least 20% of your salary should be set aside for savings and debt repayment. Please keep in mind that these percentages are estimates. Remember this is often YOUR budget and may prefer to spend less on one category to place more in another, like savings or debt repayment. So, for instance, you'll select a 35/30/35 breakout, a 35/35/40 breakout, or maybe a 25/25/50 breakout. The goal is to set percentage breakouts that add up for you. Just be mindful of what proportion of your income you're spending on housing alone. A simple rule of thumb is to keep your housing costs but 30% of your income. Otherwise, you won't be able to devote the greatest amount of money to your other objectives, such as saving and investing or debt elimination. It's helpful to take care of a budget worksheet for this method. Employing a budget template or worksheet (get ours above!) is helpful to ascertain where your money goes. It can assist you in creating your budget easier from month to month. Other standard percentage methods include The 70-20-10 budget, the 30-30-30-10 budget, the 80-20 rule, and the 60-30-10 rule!Budget Method 3: The reverse budgeting approach

As the name implies, reverse budgeting is the polar opposite of typical budgeting approaches, in which you remove your monthly spending from your monthly income. In this budgeting method, you specialize in one goal, like paying off a particular amount of debt or saving a particular amount of cash monthly and paying your bills. Then, as long as you reach your monthly goal and pay your bills on time, you may do whatever you want with your leftover money.Budget Method 4: Zero-based budgeting

Zero-based budgeting is another type of budget. A zero-based budget is one for which every dollar is planned. This is often the tactic that Dave Ramsey advocates using. So, rather than having $X amount leftover at the top of the month, you've got $0 left (on paper anyway). Once you plan out your budget, you account for everything you'll consider within the budget so that every dollar features a job. You won't have zero dollars at the top of the month because you've accounted for various budget savings funds. This method is effective because it causes you to be intentional with every dollar so that what's "left" doesn't disappear monthly.Budgeting employing a spreadsheet vs. an app

Spreadsheets or apps? Which do you have to use? the solution is to use what works best for you and makes it easy for you to stay up together with your budget. Some people love spreadsheets — they do not need to worry about bank security or what's happening with their personal information. And employing a budget worksheet allows them to urge really on the brink of their numbers. I love budgeting with a spreadsheet but are you worried about having the ability to access it when you are not home? Google Drive is a free service that allows you to easily upload your budget spreadsheet for convenient access on your mobile devices. On the other hand, apps can make it simple to budget, especially if you connect your bank accounts to them, so your transactions are often tracked automatically. Lately, most apps have extreme levels of security. But sometimes, there are often delays in transaction updates. And apps aren't always as intuitive when it involves categorizing transactions, requiring you to spend a while setting things up. That aside, for the foremost part, all you'll need to try to do once things are found out is check infrequently. This may help you ensure that your transactions are adequately documented and that you receive alerts to keep you on pace with your financial goals Whether you select a budget worksheet or an app, your budget will reflect any of the above budgeting methods. Please make sure to see our example of a budget.Part 2: Budget categories to use

You would like to know where your money goes monthly to plan successfully. Only then can you create an idea to assist you in controlling your spending. This is where budget categories typically come into play. Your monthly budget will be divided into four categories:Budget category #1: Money for your future self, emergency fund, and debt

Have you ever heard the expression "pay yourself first"? This could be a uniform part of any plan you create. Before you pay any bills or do any shopping, some of your earnings should be diverted into your pension plan for your future self, and your emergency savings account for some time. No ifs, no maybe's. Just roll in the hay. Time goes by so quickly, and planning for the longer-term version of you'll make sure that you'll enjoy your retirement and not need to depend upon the govt or your children to require care for you. Having an emergency fund also will provide you with a buffer within the event of a period in order that you'll believe in your emergency savings rather than a MasterCard or other debt. You can also include money to pay off any debt you've got during this category or add it as a sub-category (e.g., your MasterCard debt, car loan, student loans, etc.) because it's essential that you pay off your debt as soon as you'll so you'll specialize in building wealth.Budget category #2: Your essentials and wishes

Next would be your essentials and wishes — the items you would like to measure your life. This doesn't include money for shopping or getting your nails done — those aren't essentials. This includes expenses such as housing (mortgage or rent), transportation, and food.Budget category #3: Your other money and life goals

This would include money you're saving outside of your pension plan, like your midterm savings and investments for subsequent 10 to fifteen years, business savings, saving for a home purchase, college savings, and so on. I recommend creating separate accounts to save lots for each of your different goals. I've even set up automated deposits for particular goals, which has helped me keep track of my money!Budget category #4: Everything else

This is where your splurge money would fall into . the cash you'd spend shopping or but a list item, eating out, traveling, entertaining yourself, and whatever else it's that you would typically do to enjoy your life. Proportions of each budget category For each of the categories mentioned above, below may be a general guideline of how your money is often allocated:- Money for your future self, your emergency fund, and debt repayment: a minimum of 20%

- Your essentials and wishes (e.g., shelter, food, transportation, insurance): not quite 50%

- Your other money and life goals: 15%

- >Everything else: 15%