Options for the Strangle Investors can profit from using the strangle options strategy by using the correct assessment of whether a share's price is most likely to change significantly or stay within a narrow price range. Investors can make money when a stock's price moves significantly with a long strangle, and they can make money when the price of the stock stays within a certain range with a short strangle. Let's examine strangles' operations so that you can decide if they are appropriate for your investment strategy.

The meaning of a strangle

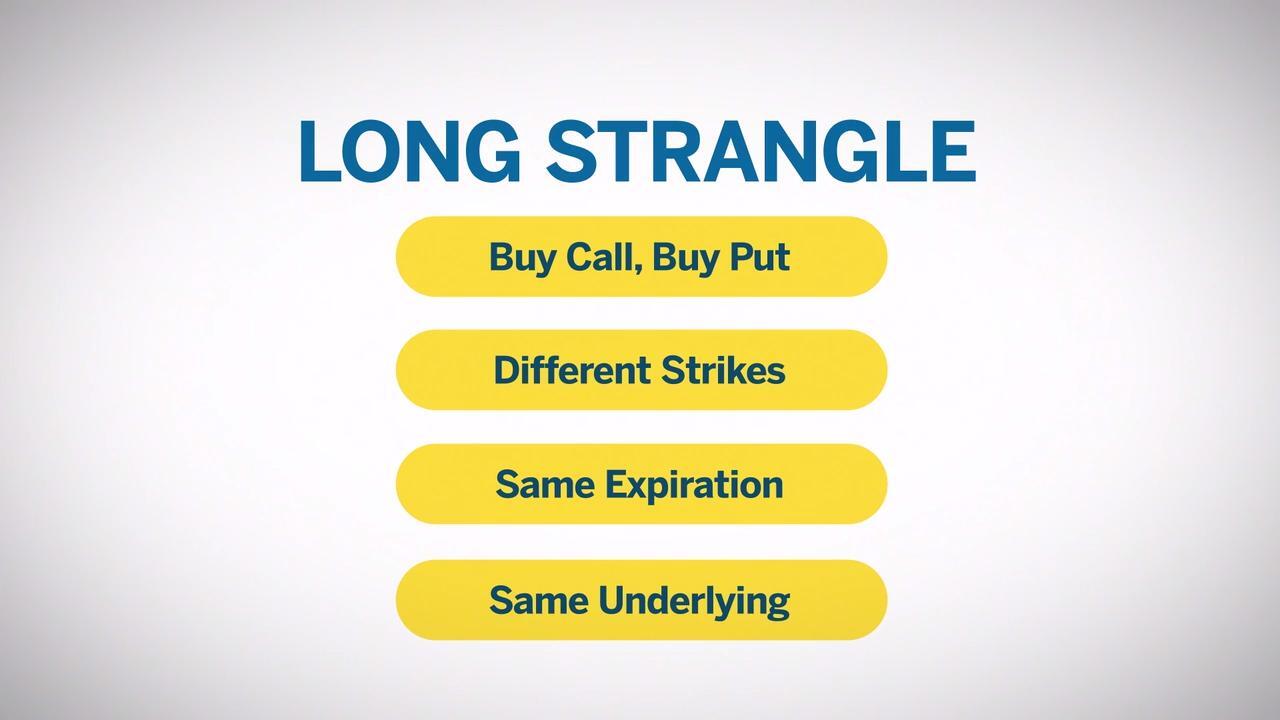

Using options to speculate on whether or not a stock's price will change significantly is known as a strangle. Buying or selling a call option with a strike price higher than the stock's current price, as well as a put option with a strike price lower than the current price, is how a strangle is executed. The majority of options contracts include 100 shares of the underlying stock; take note.How a Strangle Functions

Strangles allow investors to profit from their educated guesses about whether a stock's price will change, regardless of which way it moves. Strangles give investors, like other options strategies, the opportunity to increase the income from their holdings, leverage their portfolios, and profit from situations where they would not be able to do so by simply owning shares in a company. A long strangle is an investment in volatility. The potential gains from a long strangle are higher the more erratic and frequent price changes in stock are. Investors can profit from short strangles when a stock's price is steady. Warning: Some strangles subject investors to theoretically limitless risk, similar to many options strategies. Because there is theoretically no cap on how high a stock's price can rise, a short strangle carries unlimited risk.Types of Strangles

Short strangles and long strangles is the two different types of strangles.Short Strangles

Short strangles enable investors to profit when a stock's price does not change significantly. When using the short strangle strategy, investors sell put options with strike prices below the current share price and call options with strike prices above the share price. The investor makes money if the stock price remains within the range of the option strike prices. The investor could lose money if it fluctuates outside of that range. When the difference between the two strike prices is smaller, profits are typically higher. Sell a call at $55 and a put at $45, for instance, to set up a short strangle on XYZ. If the price stays in that range, you will keep the premium from selling the options. You will lose if the price drops to less than $45. (100 x [$45 – market value]) – (call price + put price) You will lose if the cost exceeds $55: (100 times the market value less $55] - (call price plus put price)Long Strangles

When a stock's price experiences a significant rise or fall, a long strangle enables investors to profit without having to guess which way the change will go. This strategy is used by investors who buy call options with strike prices above the market price and put options with strike prices below the market price. The investment in the options is lost if the share price stays between the two strike prices. The option to purchase shares below market value can be exercised if the stock price increases above the call's price. They may purchase shares at market value and exercise the put to sell them for a profit if the price falls below the strike price of the put option. For instance, you could purchase a call with a strike price of $55 and a put with a strike price of $45 in order to set up a long strangle on the stock XYZ, which is currently trading at $50. Your profit if the price increases are: (100 times the market value less $55] - (call price plus put price) Your profit if the price drops are as follows: (100 x [$45 – market value]) – (call price + put price) You will forfeit the amount you paid to purchase the options if the price stays between $45 and $55.Collars vs. strangulation

Both collars and strangles are options trading strategies that incorporate volatility as well as the buying and selling of options. Strangles is made to allow investors to make money off of forecasts of volatility. The underlying shares in the options contracts an investor is buying and selling do not have to be their own in order for them to use a strangle. In that they involve volatility, collars are comparable. They are made for investors who have stock in a company and want to protect themselves from volatility, though. Collars limit the potential gains from significant price increases in exchange for limiting the potential losses from significant price declines. Despite their apparent similarity, the two approaches are applied in very different circumstances.Benefits and Drawbacks of a Strangle

Pros

- Earn money whether the stock price goes up or down.

- Short strangles generate revenue.

- It is not necessary for investors to own stock in the underlying business.

Cons

- Losses that could go on forever

- Complexity may make the tactic challenging to implement.

Pros Explanation

Gain regardless of whether the stock price increases or decreases: With a strangle, you can make money by predicting whether a stock's price will change significantly or stay within a narrow band, regardless of its direction. Selling short strangles allows investors to profit from the premium payments as long as they are successful in their prediction that stock prices won't change significantly. It's not necessary for investors to hold stock in the underlying company: Some options strategies, such as covered calls, demand that the investor own the shares that are the subject of the options. Investors who do not own the underlying shares can trade strangles.Cons Described

Potentially limitless losses: Because the price of a share is theoretically unlimited, losses from a short strangle may be limitless. The tactic may be challenging to implement due to complexity: Options trading strategies can be difficult, especially when there are several linked options. Due to this, some investors may find it to be unsuitable.How It Affects Individual Investors

Strangles are sophisticated options strategies, but they are approachable enough that experienced individual investors ought to be able to use them. Strangles give you a way to profit from your conviction that you can accurately predict whether a stock's price will fluctuate significantly or remain stable. Other investing strategies are likely a better fit for you if you lack confidence in your capacity to forecast price volatility in a stock.Main Points

- Strangles allow you to make money by predicting whether a share's price will change, regardless of the change's direction.

- When you think a stock's price will change significantly, you use long strangles, and when you think it will remain stable, you use short strangles.

- The risk involved in short strangles is essentially limitless.