Even in today's digital environment, checks are nevertheless widely used while less popular than they previously were. Paper checks are an efficient and low-cost method of money transfer, but you probably don't write checks every day (or have never done so). Writing a check is simple, and this lesson will show you how. Proceed through each step at a time, or use the example above as a template to generate the checks you need. You'll move from the top to the bottom of check-in, this example, which should assist you in avoiding missing any stages. You can complete the procedures in whatever order you like if the final product has no missing information.

01 Example

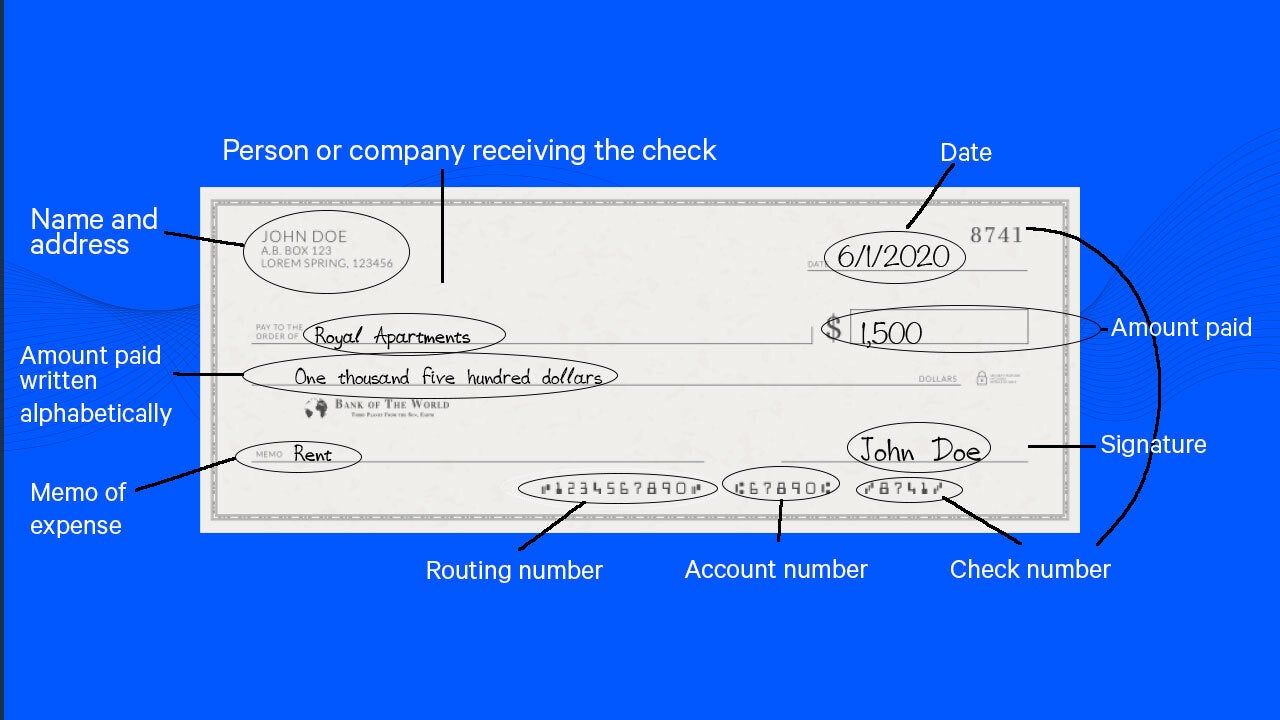

Here's a rundown of the ideal check.- Current date: Put this in the upper right-hand corner. You'll use today's date most of the time, which helps you and the recipient preserve accurate records. You can also postdate the check. However, this does not always work as expected.

- Payee: Fill in the name of the person or organization you're paying on the line that says "Pay to the order of." If you're unsure what to write, you may need to ask, "Who do I make the check out to?"

- Amount in numeric form: Fill in your payment amount in the small box on the right. Start writing as far to the left as you can. To avoid fraud, the "8" should certainly be up against the left-hand margin of the dollar box if your transactions are for $8.15. See examples of how to enter the amount.

- Amount in words: To avoid fraud and misinterpretation, write out the amount in words. This is the proper amount of your payment. If that amount differs from the amount you submitted in numeric form in the previous step, the amount you wrote in words will legally be the amount of your check. Use all capital letters, which are more challenging to change.

- Signature: Sign the check legibly on the bottom-right corner line. Still, use the name and signature like the one on file with your bank. This is essential because a check will not be valid until signed.

- Memo (or "For") line: Include a note if desired. This is an optional step that has no bearing on how banks handle your check. The note line is an excellent spot to include a reminder of why you made the check. It could also record information that your payee will need to execute your payment (or find your account if anything gets misplaced). For example, when paying the IRS, you may write your Social Security Number on this line or an account number for utility payments.

- You might pay your bills online and even have your bank send you a monthly cheque. You will not be required to write a check, pay for postage, or mail it.

- Get a debit card instead and use it to make transactions. You will pay electronically from the same account. There will be no need to use up checks (which will have to be re-ordered), and you will have an online database of your transaction that includes the name of the payee, payment date, and amount.

- Set up recurring payments for things like power bills and insurance premiums. This type of payment is typically gratuitous, making your life easy.

- Ensure that you always have enough money to cover the cost.

Record the Payment in your Check Register

Keep a check register and keep track of every check you write. This will enable you to: To avoid bouncing checks, keep track of your spending.- Know where your money is going. Your bank statement might only show a check number and amount, with no indication of who wrote the check.

- Detect identity theft and fraud in your bank account.

- The account number

- The day you wrote the cheque

- A description of the transaction or the person to whom you made the check

- What the payment was for

- See a graphic of the different check elements for more information on where to obtain this information.

Tips for Writing a Check

When you write a check, be sure that it is utilized as intended—to pay the amount you meant to the person or organization you intended. Thieves can modify checks that are lost or stolen. Checks have various chances of becoming lost after leaving your hands, making it difficult for criminals to cause you problems. Whether you lose money permanently or not, you'll have to spend time and effort cleaning up the damage left by fraud.Security Tips

To limit the likelihood of fraud affecting your account, implement the following steps.- Make it permanent: When writing a check, use a pen. If you write with a pencil, anyone with an eraser can change the amount of your check and the payee's name.

- No blank checks: Sign a check only after filling in the payee's name and amount. Bring a pen if you're not sure who to make the check payable to or how much anything costs—significantly, it's less risky than giving someone unfettered access to your bank account.

- Keep checks from growing: When entering the monetary amount, print it so that scammers cannot add to it. Start at the far left border of the area and draw a line that follows the last digit. If your check is $8.15, move the "8" as far to the left as feasible. Then, put a line from the right side of the "5" to the end of the space, or write the numbers in a way that makes adding them difficult. Someone may add numbers to your cheque if you leave a space, making $98.15 or $8,159.

- Carbon copies: Use checkbooks with carbon copies if you want a paper record of every check you write. Those checkbooks include a thin sheet with a copy of each check you write. As a result, you'll be able to immediately determine where your money went and what you wrote on each check.

- Consistent signature: Many people cannot sign legibly, and some even sign checks and credit card slips with amusing drawings. However, constantly utilizing the same signature assists you and your bank detect fraud. If a signature is not the same, it will be simple to show that you are not responsible for the costs.

- No "Cash": Make your check payable to cash instead. This is just as dangerous as carrying a signed blank check or a pile of cash. 3 If you need cash, use an ATM, purchase a stick of gum and earn cash back with your debit card, or acquire cash from a teller.

- Write fewer checks: Checks aren't particularly dangerous, but there are safer ways to pay for items. There is no paper to be lost or stolen when you make electronic payments. Because most checks are converted to electronic payments, utilizing checks does not avoid technology. Electronic payments are often easier to track because they already have a timestamp and the payee's name in a searchable format. For recurrent payments, use technologies like online bill payment, and for everyday purchasing, use a credit or debit card.